Region:Asia

Author(s):Shubham

Product Code:KRAB1179

Pages:83

Published On:October 2025

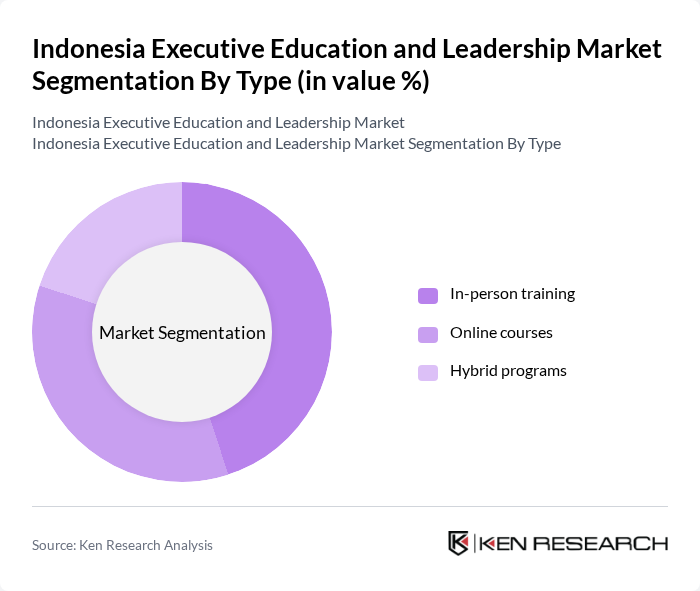

By Type:The market is segmented into three main types: In-person training, Online courses, and Hybrid programs. In-person training remains popular due to its interactive nature, while online courses have gained traction for their flexibility. Hybrid programs combine the best of both worlds, catering to diverse learning preferences.

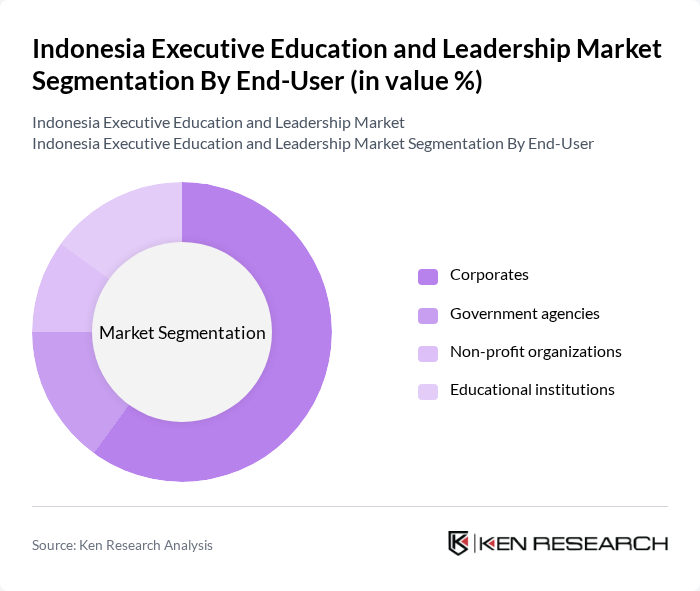

By End-User:The end-user segmentation includes Corporates, Government agencies, Non-profit organizations, and Educational institutions. Corporates are the largest segment, driven by the need for leadership development and employee training programs.

The Indonesia Executive Education and Leadership Market is characterized by a dynamic mix of regional and international players. Leading participants such as Universitas Indonesia, Prasetiya Mulya Business School, BINUS Business School, IPMI International Business School, Universitas Gadjah Mada, Institut Teknologi Bandung, Atma Jaya Catholic University of Indonesia, Swiss German University, Universitas Pelita Harapan, Universitas Kristen Satya Wacana, Universitas Airlangga, Universitas Diponegoro, Universitas Sebelas Maret, Ruangguru, Cakap, Quipper contribute to innovation, geographic expansion, and service delivery in this space.

The future of the executive education and leadership market in Indonesia appears promising, driven by technological advancements and a growing emphasis on skill development. As organizations increasingly recognize the importance of leadership in achieving strategic goals, the demand for tailored educational programs is expected to rise. Furthermore, the integration of technology in learning environments will facilitate more engaging and effective training experiences, positioning Indonesia as a regional leader in executive education in future.

| Segment | Sub-Segments |

|---|---|

| By Type | In-person training Online courses Hybrid programs |

| By End-User | Corporates Government agencies Non-profit organizations Educational institutions |

| By Industry | Finance Technology Healthcare Manufacturing Public Sector |

| By Program Duration | Short-term (less than 3 months) Medium-term (3 to 6 months) Long-term (more than 6 months) |

| By Delivery Mode | Classroom-based Virtual instructor-led Self-paced online Blended learning |

| By Certification Type | Professional certifications Executive diplomas Custom certifications Micro-credentials |

| By Policy Support | Government subsidies Tax incentives for corporate training Grants for educational institutions Public-private partnership programs |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Executive Education Programs | 100 | HR Managers, Training Coordinators |

| Leadership Development Workshops | 60 | Program Participants, Facilitators |

| Online Executive Courses | 50 | eLearning Managers, Course Designers |

| Industry-Specific Leadership Training | 40 | Industry Experts, Training Consultants |

| Alumni Feedback on Executive Programs | 45 | Program Alumni, Corporate Leaders |

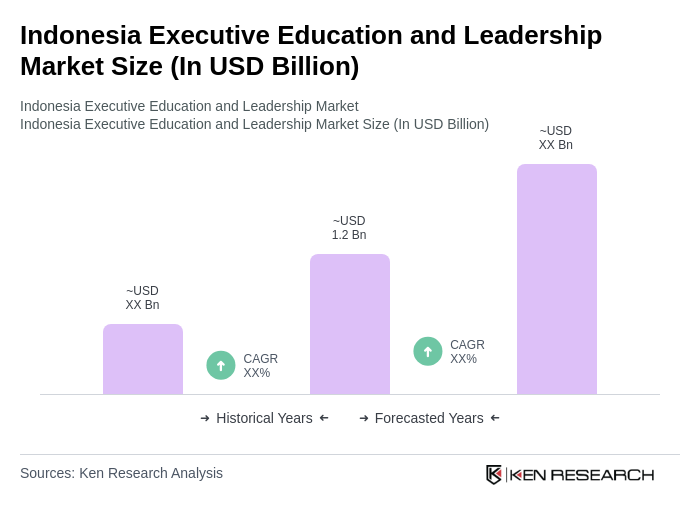

The Indonesia Executive Education and Leadership Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the increasing demand for skilled leadership and the rise of digital learning platforms in the country.