Region:North America

Author(s):Geetanshi

Product Code:KRAA5295

Pages:91

Published On:September 2025

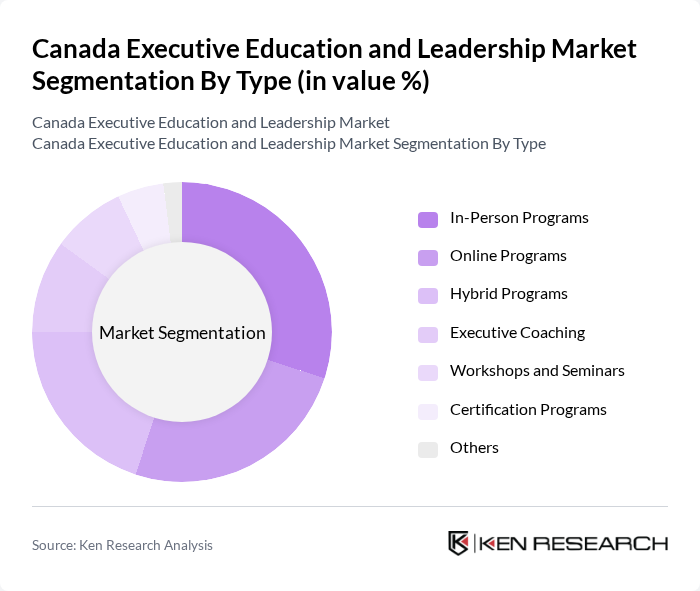

By Type:The market is segmented into various types of programs that cater to different learning preferences and organizational needs. The subsegments include In-Person Programs, Online Programs, Hybrid Programs, Executive Coaching, Workshops and Seminars, Certification Programs, and Others. Each of these subsegments plays a crucial role in addressing the diverse requirements of executives and organizations seeking to enhance their leadership capabilities.

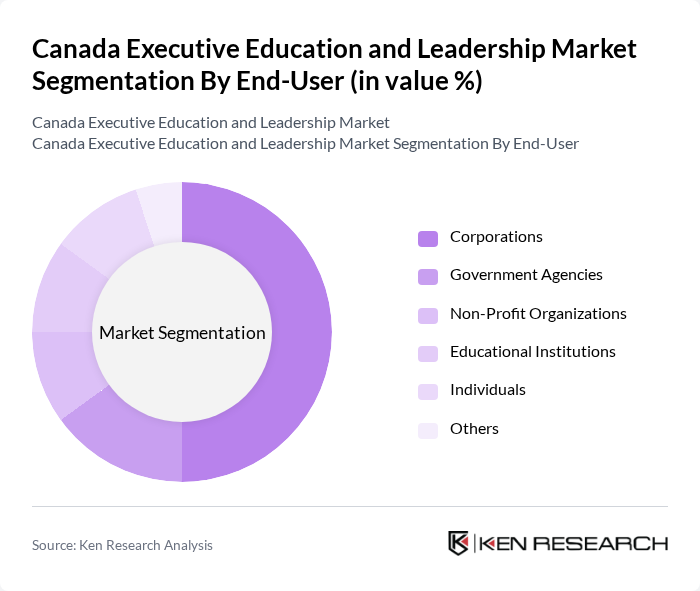

By End-User:The market is also segmented by end-users, which include Corporations, Government Agencies, Non-Profit Organizations, Educational Institutions, Individuals, and Others. This segmentation highlights the various sectors that actively seek executive education to improve leadership skills and organizational effectiveness.

The Canada Executive Education and Leadership Market is characterized by a dynamic mix of regional and international players. Leading participants such as Rotman School of Management, Ivey Business School, Sauder School of Business, Schulich School of Business, Queen's School of Business, HEC Montreal, McGill Executive Institute, University of Alberta Executive Education, University of Toronto School of Continuing Studies, UBC Sauder School of Business, Rotman Executive Programs, Executive Education at Western University, York University Executive Education, University of Calgary Executive Education, Athabasca University contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Canada Executive Education and Leadership Market appears promising, driven by the increasing emphasis on leadership development and the integration of technology in learning. As organizations adapt to evolving business landscapes, the demand for tailored leadership programs is expected to rise. Furthermore, the focus on diversity and inclusion training will likely shape program offerings, ensuring that educational institutions remain relevant and responsive to market needs while fostering a more inclusive workforce.

| Segment | Sub-Segments |

|---|---|

| By Type | In-Person Programs Online Programs Hybrid Programs Executive Coaching Workshops and Seminars Certification Programs Others |

| By End-User | Corporations Government Agencies Non-Profit Organizations Educational Institutions Individuals Others |

| By Delivery Mode | Online Learning Face-to-Face Learning Blended Learning Mobile Learning Others |

| By Duration | Short-Term Programs (Less than 1 Month) Medium-Term Programs (1-3 Months) Long-Term Programs (More than 3 Months) Others |

| By Industry Focus | Technology Healthcare Finance Manufacturing Retail Others |

| By Learning Objective | Leadership Development Strategic Thinking Change Management Team Building Others |

| By Price Range | Low-End Programs Mid-Range Programs High-End Programs Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Executive Education Programs | 150 | Program Directors, Corporate Trainers |

| Leadership Development Initiatives | 100 | HR Managers, Learning and Development Specialists |

| Online Executive Learning Platforms | 80 | Product Managers, Digital Learning Coordinators |

| Alumni Feedback on Executive Programs | 70 | Program Graduates, Career Coaches |

| Industry-Specific Leadership Training | 90 | Industry Experts, Training Consultants |

The Canada Executive Education and Leadership Market is valued at approximately USD 2.5 billion, reflecting a significant growth driven by the increasing demand for leadership skills in a competitive business environment.