Region:Middle East

Author(s):Geetanshi

Product Code:KRAB1367

Pages:90

Published On:October 2025

By Type:The market is segmented into various types of educational offerings, including Executive MBA Programs, Leadership Development Workshops, Online Certification Courses, Coaching and Mentoring Services, Industry-Specific Training Programs, Customized Corporate Training, Public Sector Leadership Programs, Entrepreneurship and Innovation Programs, and Others. Among these, Executive MBA Programs and Leadership Development Workshops are particularly prominent, as they cater to the growing need for advanced managerial skills and strategic thinking in a rapidly evolving business environment.

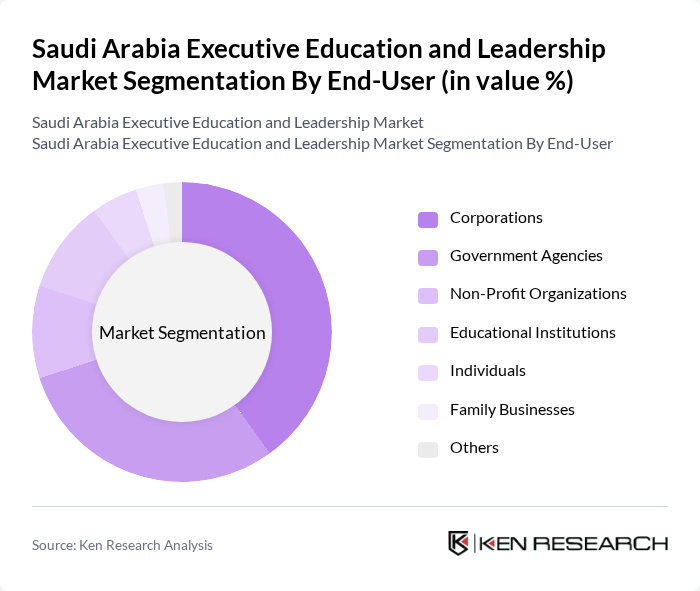

By End-User:The end-user segmentation includes Corporations, Government Agencies, Non-Profit Organizations, Educational Institutions, Individuals, Family Businesses, and Others. Corporations and Government Agencies are the leading segments, driven by the need for skilled leaders who can adapt to changing market dynamics and drive organizational success. The focus on leadership development within these sectors reflects a broader trend towards investing in human capital.

The Saudi Arabia Executive Education and Leadership Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Aramco Leadership Academy, King Saud University Executive Education, Prince Mohammad Bin Salman College (MBSC) of Business and Entrepreneurship, INSEAD Middle East Campus, London Business School Executive Education (Dubai Campus), HEC Paris in Qatar, Harvard Business School Executive Education, The Wharton School Executive Education, IMD Business School, Esade Business School, SDA Bocconi School of Management (Milan & Dubai), American University in Dubai Executive Education, Al Yamamah University Executive Education, Effat University Executive Education, Misk Foundation Leadership Programs contribute to innovation, geographic expansion, and service delivery in this space.

The future of the executive education market in Saudi Arabia appears promising, driven by ongoing government support and a growing recognition of the importance of leadership development. As organizations increasingly prioritize skills enhancement, the demand for tailored programs is expected to rise. Furthermore, the integration of technology in learning processes will likely facilitate more engaging and effective educational experiences, positioning the market for sustained growth and innovation in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Executive MBA Programs Leadership Development Workshops Online Certification Courses Coaching and Mentoring Services Industry-Specific Training Programs Customized Corporate Training Public Sector Leadership Programs Entrepreneurship and Innovation Programs Others |

| By End-User | Corporations Government Agencies Non-Profit Organizations Educational Institutions Individuals Family Businesses Others |

| By Delivery Mode | In-Person Training Online Learning Hybrid Learning On-Demand Learning Immersive/Experiential Learning Others |

| By Duration | Short-Term Programs (Less than 3 months) Medium-Term Programs (3 to 6 months) Long-Term Programs (More than 6 months) Modular/Stackable Programs Others |

| By Certification Type | Accredited Programs Non-Accredited Programs Professional Certifications Micro-Credentials Others |

| By Industry Focus | Finance and Banking Healthcare Technology Manufacturing Energy and Petrochemicals Public Sector/Government Retail and Consumer Goods Others |

| By Geographic Reach | Local Programs Regional Programs International Programs Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Executive Programs | 120 | HR Managers, Training Coordinators |

| Leadership Development Workshops | 100 | Program Directors, Executive Coaches |

| Industry-Specific Training Initiatives | 80 | Industry Experts, Corporate Trainers |

| Online Executive Education Platforms | 70 | Digital Learning Managers, Content Developers |

| Government-Funded Leadership Programs | 60 | Policy Makers, Educational Administrators |

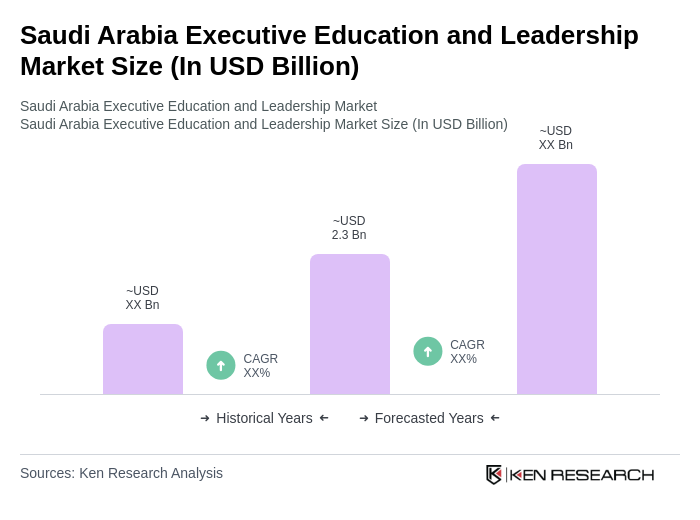

The Saudi Arabia Executive Education and Leadership Market is valued at approximately USD 2.3 billion, reflecting significant growth driven by the demand for skilled leadership and government initiatives aimed at enhancing workforce capabilities.