Region:Europe

Author(s):Rebecca

Product Code:KRAB3554

Pages:87

Published On:October 2025

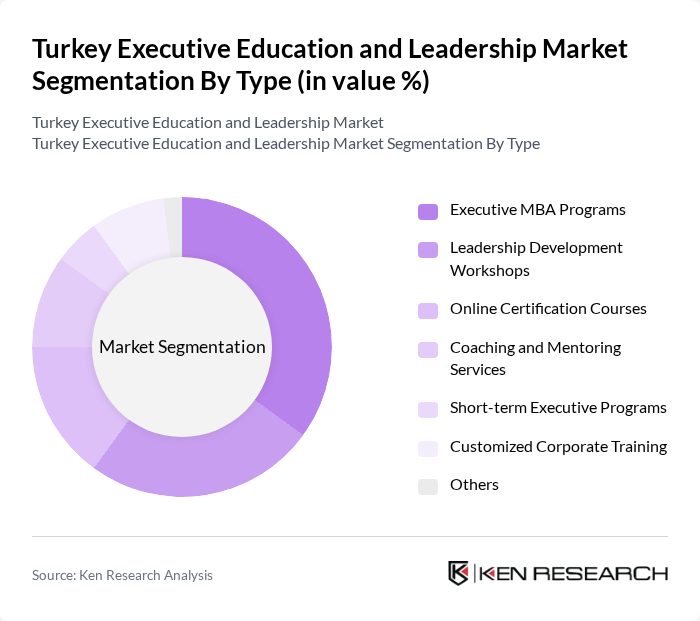

By Type:The market is segmented into various types of educational offerings, including Executive MBA Programs, Leadership Development Workshops, Online Certification Courses, Coaching and Mentoring Services, Short-term Executive Programs, Customized Corporate Training, and Others. Among these, Executive MBA Programs are particularly popular due to their comprehensive curriculum and the prestige associated with obtaining an MBA from a recognized institution. Leadership Development Workshops also see significant demand as organizations prioritize developing their leadership talent to navigate complex business challenges.

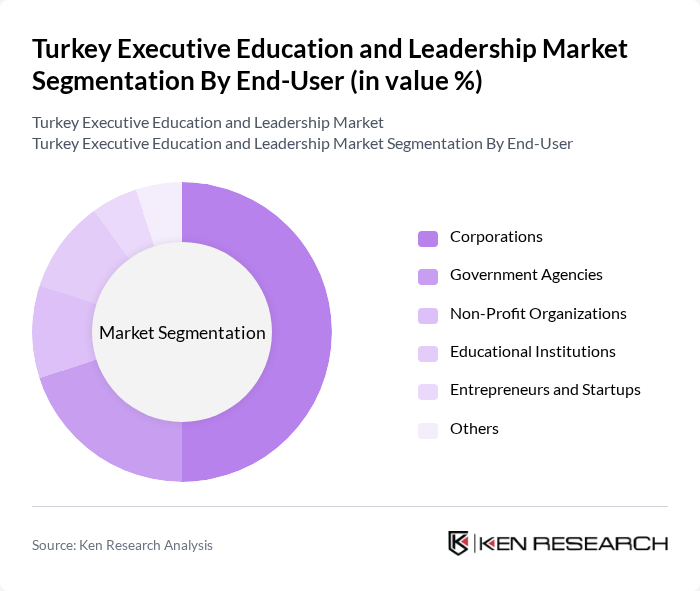

By End-User:The end-user segmentation includes Corporations, Government Agencies, Non-Profit Organizations, Educational Institutions, Entrepreneurs and Startups, and Others. Corporations are the leading end-users, as they invest heavily in executive education to enhance the skills of their workforce and maintain a competitive edge. Government agencies also play a significant role, as they seek to improve leadership capabilities within public service sectors.

The Turkey Executive Education and Leadership Market is characterized by a dynamic mix of regional and international players. Leading participants such as Sabanc? University, Bo?aziçi University, Istanbul Technical University, Koç University, Özye?in University, Bilkent University, Yeditepe University, Istanbul University, Hacettepe University, Anadolu University, Kadir Has University, Galatasaray University, ?stanbul Bilgi University, TED University, and Istanbul Sehir University contribute to innovation, geographic expansion, and service delivery in this space.

The future of the executive education market in Turkey appears promising, driven by the increasing integration of technology and a focus on soft skills development. As organizations recognize the importance of adaptive leadership in a globalized economy, there will be a shift towards experiential learning and coaching services. Furthermore, the expansion of hybrid learning models will cater to diverse learning preferences, enhancing accessibility and engagement for professionals seeking to advance their careers.

| Segment | Sub-Segments |

|---|---|

| By Type | Executive MBA Programs Leadership Development Workshops Online Certification Courses Coaching and Mentoring Services Short-term Executive Programs Customized Corporate Training Others |

| By End-User | Corporations Government Agencies Non-Profit Organizations Educational Institutions Entrepreneurs and Startups Others |

| By Delivery Mode | In-Person Training Online Learning Hybrid Learning On-Site Corporate Training Others |

| By Duration | Short Courses (1-3 days) Medium Courses (1-3 months) Long Courses (6 months and above) Others |

| By Certification Type | Accredited Programs Non-Accredited Programs Industry-Specific Certifications Others |

| By Target Audience | Senior Executives Mid-Level Managers Aspiring Leaders Others |

| By Price Range | Low-End Programs Mid-Range Programs High-End Programs Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Leadership Programs | 150 | HR Managers, Training Coordinators |

| Executive MBA Participants | 100 | Current Students, Alumni |

| Industry-Specific Workshops | 80 | Workshop Facilitators, Industry Experts |

| Online Leadership Courses | 120 | eLearning Managers, Course Designers |

| Government-Funded Training Initiatives | 70 | Policy Makers, Program Administrators |

The Turkey Executive Education and Leadership Market is valued at approximately USD 1.2 billion, reflecting a significant growth driven by the increasing demand for skilled leadership and the rise of digital learning platforms that enhance accessibility for professionals.