Region:Middle East

Author(s):Rebecca

Product Code:KRAB4107

Pages:83

Published On:October 2025

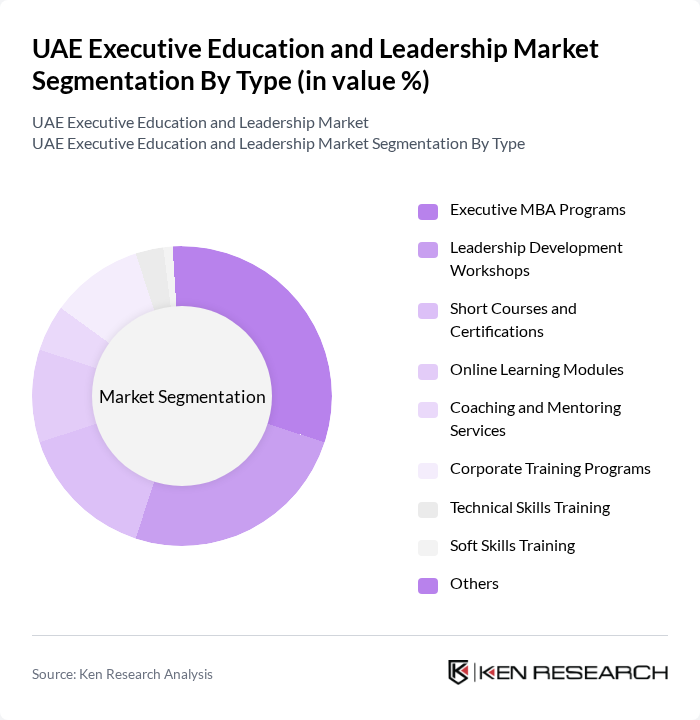

By Type:The market is segmented into various types of educational offerings, including Executive MBA Programs, Leadership Development Workshops, Short Courses and Certifications, Online Learning Modules, Coaching and Mentoring Services, Corporate Training Programs, Technical Skills Training, Soft Skills Training, and Others. Among these,Executive MBA ProgramsandLeadership Development Workshopsare particularly prominent due to their comprehensive curriculum, alignment with enterprise KPIs, and growing recognition of their value in enhancing managerial competencies .

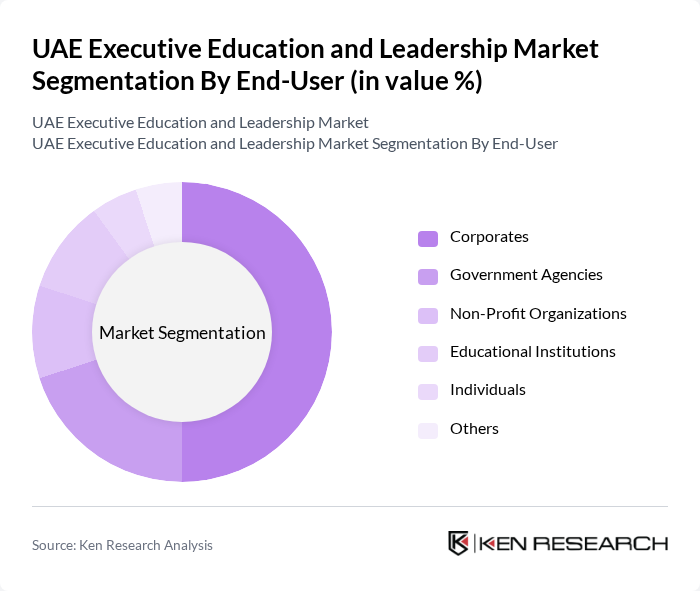

By End-User:The end-user segmentation includes Corporates, Government Agencies, Non-Profit Organizations, Educational Institutions, Individuals, and Others.Corporatesare the leading segment, driven by the need for continuous employee development, digital transformation, and the increasing focus on leadership skills to navigate complex business challenges in the UAE’s diversified economy .

The UAE Executive Education and Leadership Market is characterized by a dynamic mix of regional and international players. Leading participants such as INSEAD Middle East Campus (Abu Dhabi), Hult International Business School (Dubai), London Business School Dubai Centre, American University in Dubai (AUD), University of Dubai, ESCP Business School, University of Sharjah, Abu Dhabi University, Khalifa University, ESMT Berlin, The University of Manchester Middle East Centre (Dubai), SP Jain School of Global Management (Dubai), Zayed University, Mohammed Bin Rashid School of Government (MBRSG), Harvard Business School (Executive Education – UAE participants), Wharton School of the University of Pennsylvania (Executive Education – UAE participants), Stanford Graduate School of Business (Executive Education – UAE participants) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE executive education market appears promising, driven by a growing emphasis on leadership development and the integration of technology in learning. As organizations increasingly recognize the value of skilled leaders, demand for tailored programs is expected to rise. Additionally, the shift towards hybrid learning models will likely enhance accessibility, allowing more professionals to engage in executive education, thereby fostering a culture of continuous learning and adaptation in the workforce.

| Segment | Sub-Segments |

|---|---|

| By Type | Executive MBA Programs Leadership Development Workshops Short Courses and Certifications Online Learning Modules Coaching and Mentoring Services Corporate Training Programs Technical Skills Training Soft Skills Training Others |

| By End-User | Corporates Government Agencies Non-Profit Organizations Educational Institutions Individuals Others |

| By Delivery Mode | In-Person Training Online Learning Hybrid Learning On-the-Job Training On-Demand Learning Others |

| By Duration | Short Courses (1-3 days) Medium Courses (1-4 weeks) Long Courses (1-6 months) Others |

| By Certification Type | Professional Certifications Academic Degrees Micro-Credentials Accredited Certifications Non-Accredited Certifications Professional Development Certificates Others |

| By Industry Focus | Finance and Banking Healthcare Information Technology Hospitality Others |

| By Pricing Model | Fixed Pricing Subscription-Based Pay-Per-Use Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Training Programs | 120 | HR Managers, Training Coordinators |

| Executive MBA Participants | 90 | Alumni, Current Students |

| Leadership Development Initiatives | 70 | Program Directors, Organizational Development Managers |

| Sector-Specific Training Needs | 60 | Industry Experts, Sector Analysts |

| Government-Funded Education Programs | 50 | Policy Makers, Educational Administrators |

The UAE Executive Education and Leadership Market is valued at approximately USD 140 million, reflecting a growing demand for skilled leadership and government initiatives aimed at upskilling the workforce in a rapidly evolving business environment.