Region:Asia

Author(s):Rebecca

Product Code:KRAB5298

Pages:80

Published On:October 2025

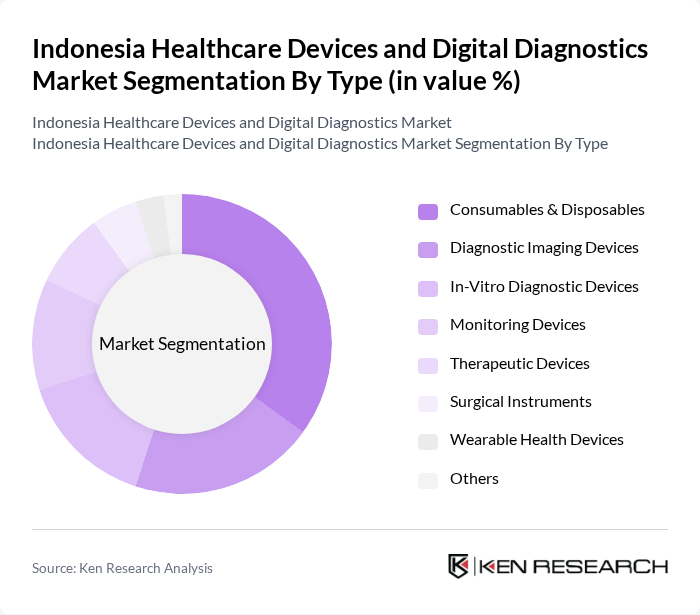

By Type:The market is segmented into various types of healthcare devices, including diagnostic imaging devices, in-vitro diagnostic devices, monitoring devices, therapeutic devices, surgical instruments, wearable health devices, consumables & disposables, and others. Among these, consumables & disposables hold the largest market share, driven by high recurring usage in hospitals, clinics, and home healthcare settings. Single-use syringes, surgical gloves, catheters, and dressing materials dominate volume consumption, while diagnostic imaging and monitoring devices follow due to their critical role in disease detection and management. The increasing adoption of advanced imaging technologies, such as MRI and CT scans, is particularly notable in urban healthcare facilities .

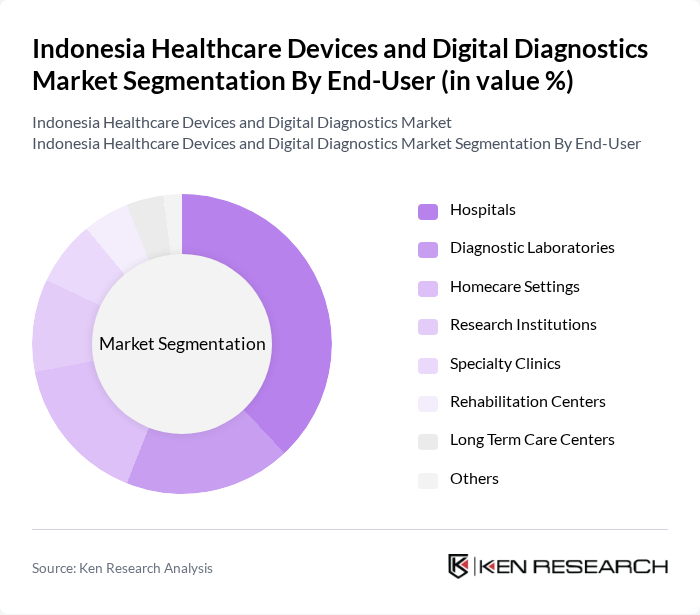

By End-User:The end-user segmentation includes hospitals, diagnostic laboratories, homecare settings, research institutions, specialty clinics, rehabilitation centers, long-term care centers, and others. Hospitals remain the dominant end-user segment, supported by the increasing number of healthcare facilities and the rising demand for advanced medical technologies. The expansion of the national health insurance scheme (JKN), which covers over 90% of the population, and the trend toward integrated healthcare services further bolster the growth of this segment. Homecare settings are also experiencing rapid growth, reflecting the shift toward decentralized patient care and remote monitoring .

The Indonesia Healthcare Devices and Digital Diagnostics Market is characterized by a dynamic mix of regional and international players. Leading participants such as PT. Kalbe Farma Tbk, PT. Kimia Farma Tbk, PT. Indofarma Tbk, PT. Prodia Widyahusada Tbk, PT. Medikaloka Hermina Tbk, PT. Siloam International Hospitals Tbk, PT. Mitra Keluarga Karyasehat Tbk, PT. Enseval Putera Megatrading Tbk, PT. Duta Intidaya Tbk, PT. Itama Ranoraya Tbk, PT. Tempo Scan Pacific Tbk, Medtronic Indonesia, Siemens Healthineers Indonesia, GE Healthcare Indonesia, Philips Indonesia contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Indonesian healthcare devices and digital diagnostics market appears promising, driven by ongoing government investments and a growing emphasis on digital health solutions. The integration of artificial intelligence in diagnostics is expected to enhance accuracy and efficiency, while the expansion of e-health services will improve access to healthcare. Additionally, partnerships with international firms are likely to foster innovation and knowledge transfer, further strengthening the market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Diagnostic Imaging Devices In-Vitro Diagnostic Devices Monitoring Devices Therapeutic Devices Surgical Instruments Wearable Health Devices Consumables & Disposables Others |

| By End-User | Hospitals Diagnostic Laboratories Homecare Settings Research Institutions Specialty Clinics Rehabilitation Centers Long Term Care Centers Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Pharmacies Third Party Distributor Others |

| By Application | Cardiovascular Diabetes Management Cancer Diagnostics Infectious Diseases Therapeutics Others |

| By Component | Hardware Software Services |

| By Price Range | Low-End Devices Mid-Range Devices High-End Devices |

| By Technology | Digital Diagnostics Traditional Diagnostics Telehealth Solutions Portable Devices Tabletop Devices Standalone Devices Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Device Manufacturers | 60 | Product Managers, R&D Directors |

| Digital Diagnostics Providers | 50 | Business Development Managers, Technology Officers |

| Hospital Administrators | 70 | Chief Medical Officers, Procurement Managers |

| Healthcare Professionals | 90 | Doctors, Nurses, Technicians |

| Patients Using Digital Diagnostics | 40 | General Public, Health App Users |

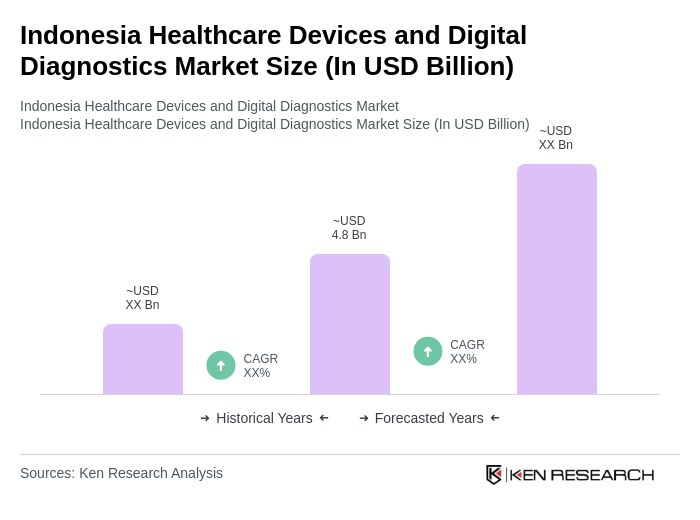

The Indonesia Healthcare Devices and Digital Diagnostics Market is valued at approximately USD 4.8 billion, driven by increased healthcare infrastructure spending, the expansion of national health insurance, and rising demand for advanced diagnostic and monitoring devices.