Region:Europe

Author(s):Shubham

Product Code:KRAB5656

Pages:88

Published On:October 2025

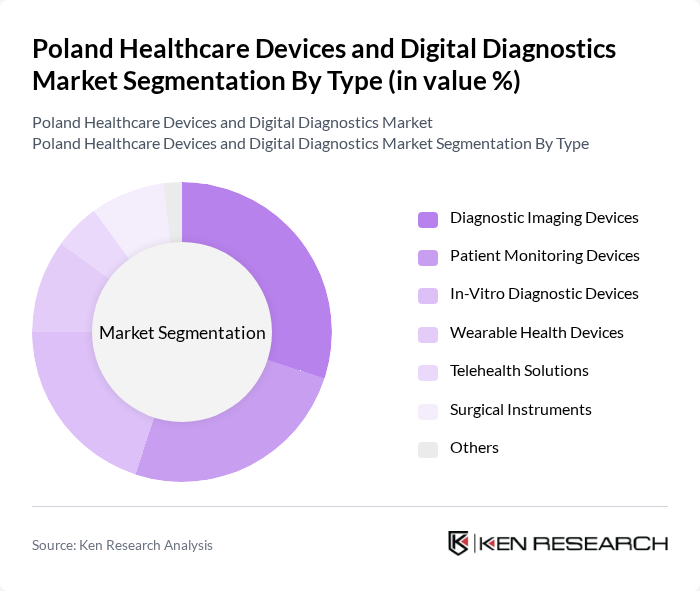

By Type:The market is segmented into various types of healthcare devices and digital diagnostics solutions. The primary subsegments include Diagnostic Imaging Devices, Patient Monitoring Devices, In-Vitro Diagnostic Devices, Wearable Health Devices, Telehealth Solutions, Surgical Instruments, and Others. Each of these subsegments plays a crucial role in enhancing patient care and improving healthcare outcomes.

The Diagnostic Imaging Devices segment is currently dominating the market due to the increasing adoption of advanced imaging technologies such as MRI, CT scans, and ultrasound. These devices are essential for accurate diagnosis and treatment planning, leading to a higher demand from hospitals and clinics. The growing emphasis on early disease detection and the need for precise imaging in various medical fields further bolster this segment's growth. Additionally, technological advancements and the introduction of portable imaging devices are enhancing accessibility and convenience for healthcare providers.

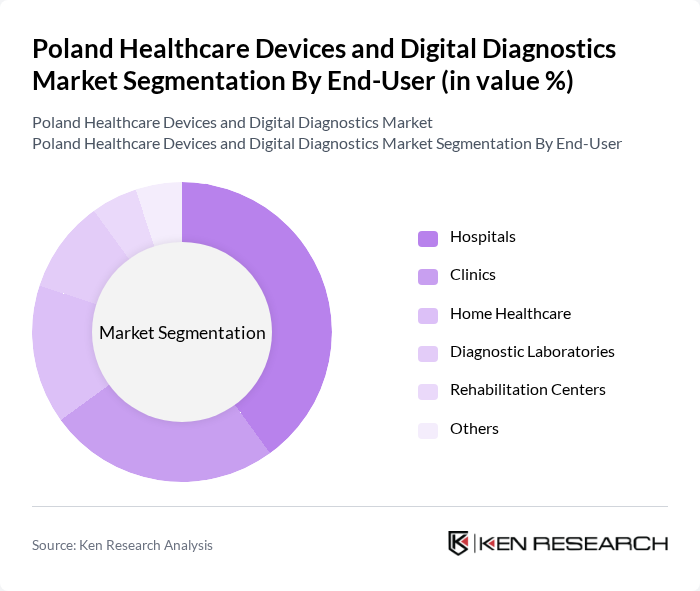

By End-User:The market is segmented by end-users, which include Hospitals, Clinics, Home Healthcare, Diagnostic Laboratories, Rehabilitation Centers, and Others. Each end-user category has distinct needs and preferences, influencing the types of healthcare devices and digital diagnostics solutions they utilize.

Hospitals are the leading end-user segment, accounting for a significant share of the market. This dominance is attributed to the high volume of patients requiring diagnostic and therapeutic services, as well as the need for advanced medical equipment to support complex procedures. Hospitals invest heavily in state-of-the-art healthcare devices to enhance patient care, improve operational efficiency, and comply with regulatory standards. The increasing number of hospitals and healthcare facilities in urban areas further drives the demand for healthcare devices.

The Poland Healthcare Devices and Digital Diagnostics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Philips Healthcare, Siemens Healthineers, GE Healthcare, Medtronic, Roche Diagnostics, Abbott Laboratories, Johnson & Johnson, Becton, Dickinson and Company, Siemens AG, Canon Medical Systems, Mindray Medical International, Stryker Corporation, Thermo Fisher Scientific, Hologic, Inc., Fujifilm Holdings Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Poland healthcare devices and digital diagnostics market appears promising, driven by technological advancements and increasing healthcare demands. The integration of AI and machine learning into diagnostics is expected to enhance accuracy and efficiency, while the expansion of telemedicine services will improve access to care. Additionally, the focus on preventive healthcare measures will likely lead to increased investments in wearable health monitoring devices, further transforming the healthcare landscape in Poland.

| Segment | Sub-Segments |

|---|---|

| By Type | Diagnostic Imaging Devices Patient Monitoring Devices In-Vitro Diagnostic Devices Wearable Health Devices Telehealth Solutions Surgical Instruments Others |

| By End-User | Hospitals Clinics Home Healthcare Diagnostic Laboratories Rehabilitation Centers Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Pharmacies Others |

| By Application | Chronic Disease Management Emergency Care Preventive Healthcare Rehabilitation Others |

| By Technology | Digital Imaging Mobile Health Technologies Cloud-Based Solutions AI and Machine Learning Applications Others |

| By Price Range | Low-End Devices Mid-Range Devices High-End Devices |

| By Regulatory Compliance | CE Marking ISO Certification FDA Approval Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Device Manufacturers | 100 | Product Managers, R&D Directors |

| Digital Diagnostics Providers | 80 | Business Development Managers, Technology Officers |

| Healthcare Professionals | 150 | Doctors, Nurses, Lab Technicians |

| Regulatory Bodies | 50 | Policy Makers, Compliance Officers |

| Patients Using Digital Diagnostics | 120 | General Public, Patient Advocacy Group Members |

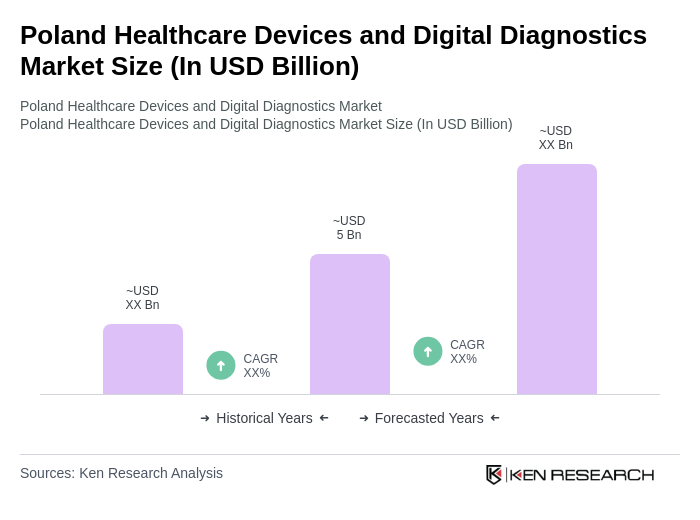

The Poland Healthcare Devices and Digital Diagnostics Market is valued at approximately USD 5 billion, reflecting a significant growth driven by technological innovations, an aging population, and the rising demand for advanced healthcare solutions.