Region:Europe

Author(s):Geetanshi

Product Code:KRAB5245

Pages:94

Published On:October 2025

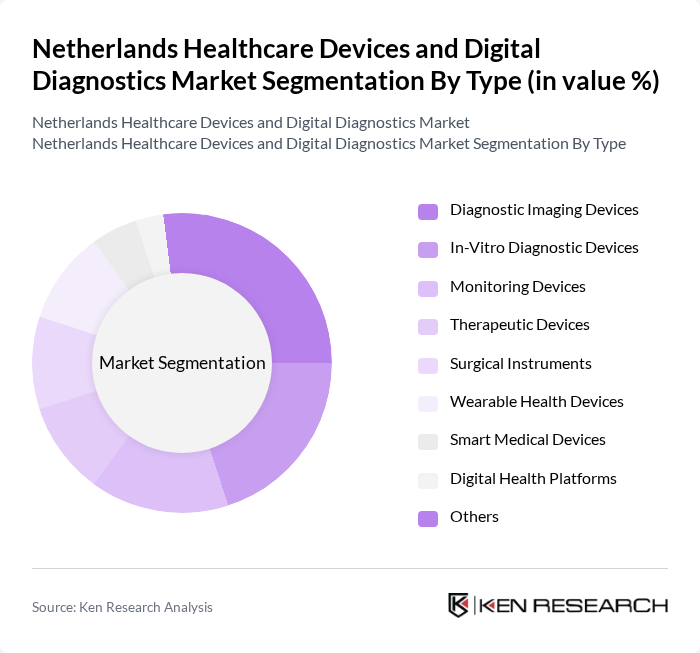

By Type:The market is segmented into Diagnostic Imaging Devices, In-Vitro Diagnostic Devices, Monitoring Devices, Therapeutic Devices, Surgical Instruments, Wearable Health Devices, Smart Medical Devices, Digital Health Platforms, and Others. Diagnostic Imaging Devices and Wearable Health Devices are among the fastest-growing segments, driven by increased adoption of AI-enabled imaging and remote patient monitoring solutions. In-Vitro Diagnostic Devices are also expanding rapidly due to rising demand for point-of-care and home testing. Monitoring Devices, Therapeutic Devices, and Smart Medical Devices are benefiting from ongoing digital transformation and the shift toward personalized medicine .

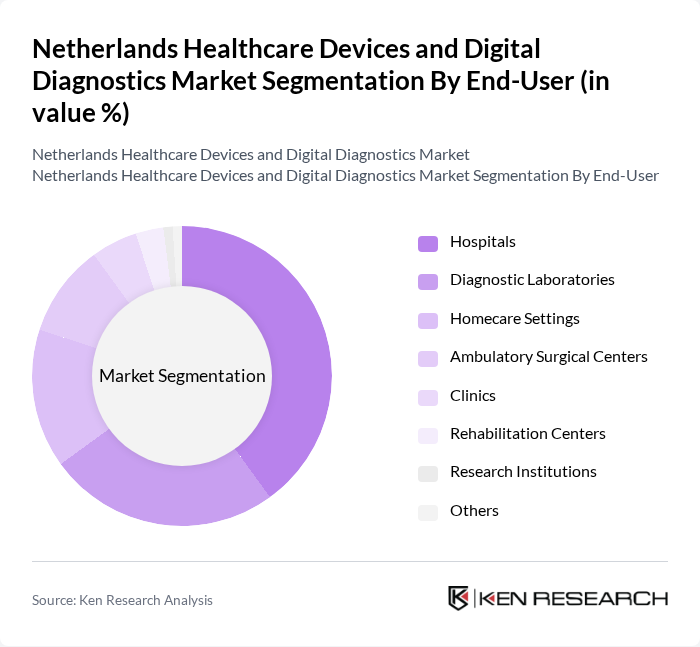

By End-User:The end-user segmentation includes Hospitals, Diagnostic Laboratories, Homecare Settings, Ambulatory Surgical Centers, Clinics, Rehabilitation Centers, Research Institutions, and Others. Hospitals and Diagnostic Laboratories account for the largest share, reflecting their central role in deploying advanced diagnostic and therapeutic technologies. Homecare Settings and Ambulatory Surgical Centers are rapidly expanding due to the adoption of remote monitoring, telemedicine, and minimally invasive procedures. Rehabilitation Centers and Research Institutions are increasingly utilizing digital diagnostics and smart devices to support patient recovery and clinical innovation .

The Netherlands Healthcare Devices and Digital Diagnostics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Philips Healthcare (Koninklijke Philips N.V.), Siemens Healthineers, GE Healthcare, Roche Diagnostics, Abbott Laboratories, Medtronic, B. Braun Melsungen AG, Johnson & Johnson, Thermo Fisher Scientific, Canon Medical Systems, Hitachi Medical Corporation, Mindray Medical International Limited, Hologic, Inc., Stryker Corporation, Fujifilm Holdings Corporation, OMRON Corporation, Garmin Ltd., Polar Electro, Everist Health, UltraLinq Healthcare Solutions, Sotera Health Company, Fitbit (now part of Google), Intel Corporation, Mediq B.V., Becton, Dickinson and Company (BD) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Netherlands healthcare devices and digital diagnostics market appears promising, driven by technological advancements and a shift towards patient-centric care. In future, the integration of AI and machine learning in diagnostics is expected to enhance efficiency and accuracy, while the expansion of telehealth services will improve access to care. Additionally, the focus on preventive healthcare solutions will likely reshape service delivery, fostering a more proactive approach to health management across the nation.

| Segment | Sub-Segments |

|---|---|

| By Type | Diagnostic Imaging Devices In-Vitro Diagnostic Devices Monitoring Devices Therapeutic Devices Surgical Instruments Wearable Health Devices Smart Medical Devices Digital Health Platforms Others |

| By End-User | Hospitals Diagnostic Laboratories Homecare Settings Ambulatory Surgical Centers Clinics Rehabilitation Centers Research Institutions Others |

| By Application | Cardiovascular Applications Neurological Applications Respiratory Applications Diabetes Management Cancer Diagnostics Sports and Fitness Monitoring Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Pharmacies Others |

| By Region | North Holland South Holland North Brabant Gelderland Utrecht Others |

| By Price Range | Low-End Devices Mid-Range Devices High-End Devices |

| By Technology | Wireless Health Technologies Mobile Health (mHealth) Technologies Cloud-Based Solutions AI-Driven Diagnostics Spring-Based Technologies Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Device Manufacturers | 60 | Product Managers, R&D Directors |

| Digital Diagnostics Providers | 50 | Business Development Managers, Technology Officers |

| Healthcare Professionals | 70 | Doctors, Nurses, Technicians |

| Regulatory Bodies | 40 | Policy Makers, Compliance Officers |

| Patients Using Digital Diagnostics | 45 | Patient Advocates, User Experience Researchers |

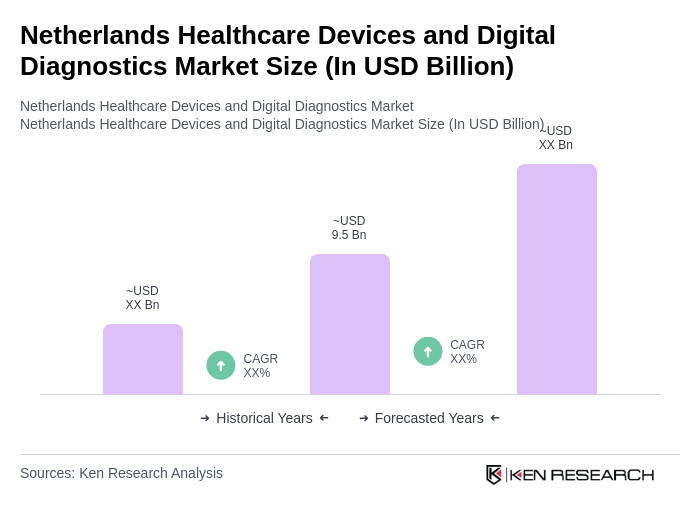

The Netherlands Healthcare Devices and Digital Diagnostics Market is valued at approximately USD 9.5 billion, reflecting growth across various segments, including diagnostic imaging equipment and wearable medical devices, driven by technological advancements and increased healthcare expenditure.