Region:Asia

Author(s):Rebecca

Product Code:KRAA1412

Pages:99

Published On:August 2025

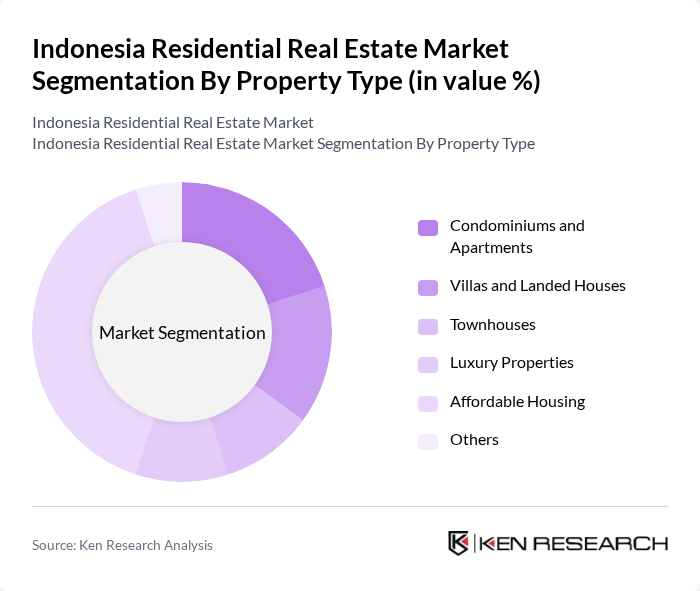

By Property Type:The property type segmentation includes condominiums and apartments, villas and landed houses, townhouses, luxury properties, affordable housing, and others. Affordable housing remains the most dominant segment, reflecting strong demand from the expanding middle class and robust government support for low-cost housing programs. Urbanization has intensified the need for affordable housing, making it a primary focus for developers. Condominiums and apartments are increasingly popular in urban centers, while landed houses and villas retain appeal in suburban and emerging regions .

By End-User:End-user segmentation consists of first-time homebuyers, investors, renters, and real estate developers. First-time homebuyers represent the largest segment, supported by favorable government policies, expanded financing options, and a strong desire for home ownership. Urban migration and demographic shifts continue to fuel demand, while investors and renters are increasingly active due to rising workforce mobility and the popularity of co-living concepts. Real estate developers remain critical in shaping supply and responding to evolving market needs .

The Indonesia Residential Real Estate Market is characterized by a dynamic mix of regional and international players. Leading participants such as Agung Podomoro Land, Ciputra Development, Summarecon Agung, Bumi Serpong Damai (BSD City), Alam Sutera Realty, Pakuwon Jati, Lippo Group, Jababeka, Intiland Development, Sinar Mas Land, Triniti Land, Modernland Realty, Duta Anggada Realty, Tokyu Land Indonesia, and CitraLand contribute to innovation, geographic expansion, and service delivery in this space.

The Indonesia residential real estate market is poised for significant transformation as urbanization accelerates and the middle class expands. In future, the integration of smart home technologies and eco-friendly developments will likely reshape consumer preferences. Additionally, government initiatives aimed at improving infrastructure and housing accessibility will further stimulate market activity. As these trends unfold, the sector is expected to adapt, creating a more sustainable and technologically advanced housing landscape that meets the evolving needs of urban residents.

| Segment | Sub-Segments |

|---|---|

| By Property Type | Condominiums and Apartments Villas and Landed Houses Townhouses Luxury Properties Affordable Housing Others |

| By End-User | First-Time Homebuyers Investors Renters Real Estate Developers |

| By Price Range | Below IDR 500 Million IDR 500 Million - IDR 1 Billion IDR 1 Billion - IDR 2 Billion Above IDR 2 Billion |

| By Location | Jakarta Surabaya Semarang Bandung Bali Other Urban Areas Suburban Areas Rural Areas |

| By Development Stage | Pre-Construction Under Construction Completed |

| By Financing Type | Bank Loans Government Subsidies Private Equity |

| By Policy Support | Subsidies Tax Exemptions Housing Grants |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Property Buyers | 120 | First-time homebuyers, Investors |

| Real Estate Developers | 60 | Project Managers, Business Development Heads |

| Real Estate Agents | 50 | Sales Agents, Brokers |

| Financial Institutions | 40 | Mortgage Advisors, Loan Officers |

| Urban Planners | 40 | City Planners, Policy Makers |

The Indonesia Residential Real Estate Market is valued at approximately USD 45 billion, driven by urbanization, rising incomes, and a growing middle class. This valuation reflects a five-year historical analysis of market trends and consumer demand.