Region:North America

Author(s):Shubham

Product Code:KRAA0839

Pages:89

Published On:August 2025

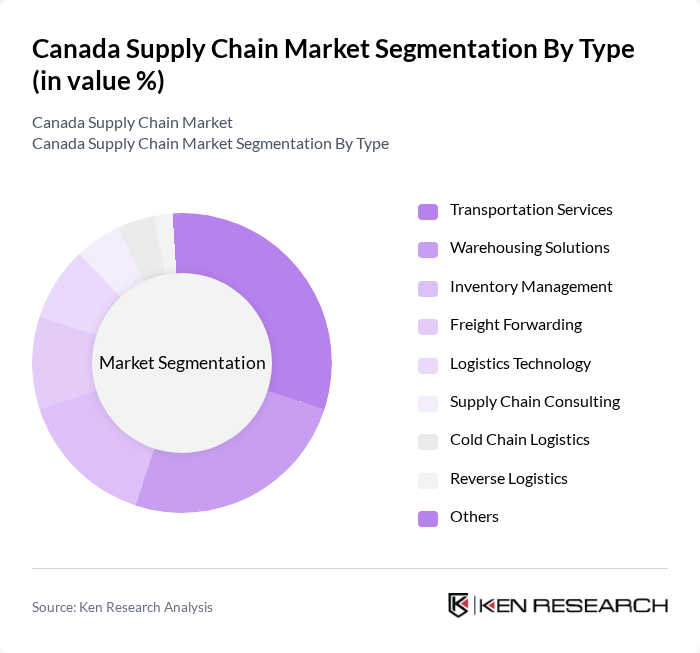

By Type:The market is segmented into Transportation Services, Warehousing Solutions, Inventory Management, Freight Forwarding, Logistics Technology, Supply Chain Consulting, Cold Chain Logistics, Reverse Logistics, and Others. Each segment plays a crucial role in the overall supply chain ecosystem, supporting diverse logistical needs and operational efficiencies. Transportation Services and Warehousing Solutions remain the largest segments, driven by demand for rapid fulfillment and the expansion of distribution networks. Logistics Technology and Cold Chain Logistics are experiencing accelerated growth due to increased adoption of automation, AI, and the need for temperature-controlled solutions in healthcare and food sectors .

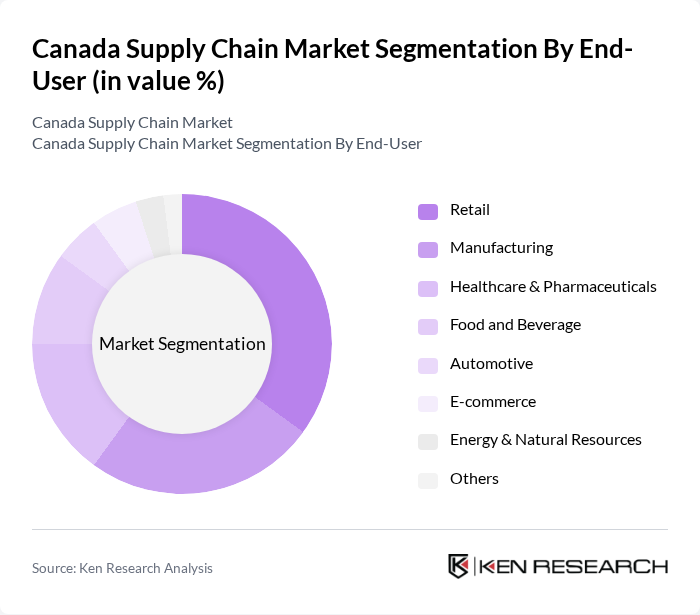

By End-User:The end-user segmentation includes Retail, Manufacturing, Healthcare & Pharmaceuticals, Food and Beverage, Automotive, E-commerce, Energy & Natural Resources, and Others. Each sector has unique supply chain requirements, influencing the demand for specific services and solutions. Retail and E-commerce are leading end-users, underpinned by the surge in online shopping and omnichannel distribution. Healthcare & Pharmaceuticals and Food and Beverage are also expanding rapidly, driven by the need for resilient, traceable, and temperature-controlled supply chains .

The Canada Supply Chain Market is characterized by a dynamic mix of regional and international players. Leading participants such as Canadian National Railway (CN), Canadian Pacific Kansas City (CPKC), TFI International Inc., Purolator Inc., Kuehne + Nagel Ltd., DHL Supply Chain Canada, FedEx Canada, XPO Logistics, C.H. Robinson Worldwide Inc., Ryder System, Inc., DB Schenker Canada, J.B. Hunt Transport Services, UPS Supply Chain Solutions Canada, Metro Supply Chain Group, A.P. Moller-Maersk, Amazon Canada Fulfillment Services, VersaCold Logistics Services, and Bolloré Logistics Canada contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Canadian supply chain market is poised for significant transformation, driven by technological advancements and evolving consumer expectations. Companies are increasingly focusing on building resilient supply chains that can adapt to disruptions while enhancing efficiency. The integration of AI and automation will streamline operations, while sustainability initiatives will shape logistics practices. As e-commerce continues to grow, businesses will need to innovate and invest in last-mile delivery solutions to meet consumer demands effectively, ensuring a competitive edge in the market.

| Segment | Sub-Segments |

|---|---|

| By Type | Transportation Services Warehousing Solutions Inventory Management Freight Forwarding Logistics Technology Supply Chain Consulting Cold Chain Logistics Reverse Logistics Others |

| By End-User | Retail Manufacturing Healthcare & Pharmaceuticals Food and Beverage Automotive E-commerce Energy & Natural Resources Others |

| By Distribution Mode | Road Transport Rail Transport Air Freight Sea Freight Intermodal Transport Pipeline Transport Others |

| By Service Type | Third-Party Logistics (3PL) Fourth-Party Logistics (4PL) Freight Brokerage Supply Chain Consulting Managed Transportation Services Others |

| By Supply Chain Model | Just-in-Time (JIT) Lean Supply Chain Agile Supply Chain Digital Supply Chain Sustainable/Green Supply Chain Others |

| By Pricing Strategy | Cost-Plus Pricing Value-Based Pricing Competitive Pricing Dynamic Pricing Others |

| By Customer Segment | Small and Medium Enterprises (SMEs) Large Enterprises Government Agencies Non-Profit Organizations Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Supply Chain Management | 100 | Supply Chain Managers, Logistics Coordinators |

| Manufacturing Logistics Optimization | 80 | Operations Managers, Production Supervisors |

| E-commerce Fulfillment Strategies | 90 | eCommerce Directors, Warehouse Operations Managers |

| Cold Chain Logistics in Food Sector | 60 | Quality Assurance Managers, Supply Chain Analysts |

| Technology Adoption in Supply Chains | 50 | IT Managers, Digital Transformation Leads |

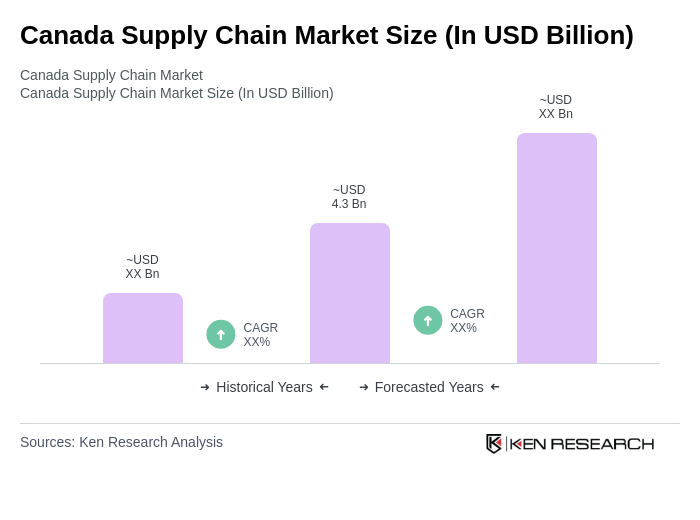

The Canada Supply Chain Market is valued at approximately USD 4.3 billion, reflecting its significant role within the North American supply chain management industry, driven by the demand for efficient logistics solutions and the rise of e-commerce.