Region:Europe

Author(s):Shubham

Product Code:KRAA0950

Pages:95

Published On:August 2025

By Solution:The retail logistics market can be segmented into various solutions that address different operational needs. The primary subsegments include Commerce Enablement, Supply Chain Solutions, Reverse Logistics & Liquidation, Transportation Management, and Others. Each of these solutions plays a crucial role in enhancing the efficiency and effectiveness of logistics operations .

The Commerce Enablement subsegment is currently dominating the market due to the rapid growth of e-commerce and the increasing need for businesses to integrate logistics solutions that facilitate online sales. This segment focuses on providing tools and services that enhance the customer shopping experience, streamline order fulfillment, and improve inventory management. As more retailers shift to online platforms, the demand for effective commerce enablement solutions continues to rise, making it a key driver in the retail logistics landscape .

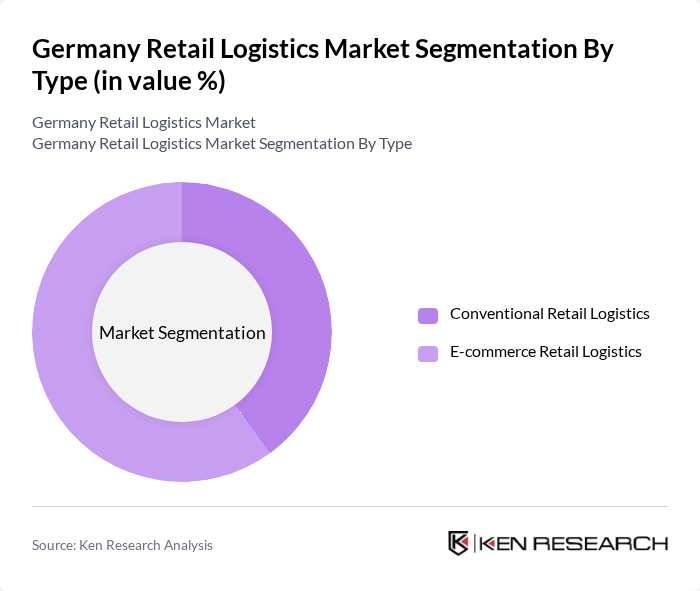

By Type:The market can also be categorized into Conventional Retail Logistics and E-commerce Retail Logistics. Each type addresses specific logistics needs and operational challenges faced by retailers in different sectors .

The E-commerce Retail Logistics subsegment is leading the market, driven by the exponential growth of online shopping and the need for efficient delivery systems. As consumers increasingly prefer online purchasing, logistics providers are adapting their services to meet the demands of fast and reliable delivery. This shift has resulted in significant investments in technology and infrastructure to support e-commerce logistics, making it a critical component of the retail logistics market .

The Germany Retail Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain, Kuehne + Nagel, DB Schenker, DPDgroup (GeoPost), Hermes Germany, Hellmann Worldwide Logistics, Rhenus Logistics, Dachser, FIEGE Logistics, UPS Supply Chain Solutions, CEVA Logistics, DB Cargo, GLS Germany, DSV, GEODIS contribute to innovation, geographic expansion, and service delivery in this space.

The future of the retail logistics market in Germany appears promising, driven by ongoing technological advancements and evolving consumer preferences. As e-commerce continues to expand, logistics providers will increasingly adopt automation and data analytics to enhance efficiency. Furthermore, the focus on sustainability will likely lead to the adoption of green logistics practices, ensuring that companies remain competitive while addressing environmental concerns. Collaborative logistics models may also emerge, fostering partnerships that optimize resource utilization and improve service delivery.

| Segment | Sub-Segments |

|---|---|

| By Solution | Commerce Enablement Supply Chain Solutions Reverse Logistics & Liquidation Transportation Management Others |

| By Type | Conventional Retail Logistics E-commerce Retail Logistics |

| By Mode of Transport | Roadways Railways Airways Waterways |

| By End-User | Food and Beverage Consumer Electronics Apparel and Footwear Home Goods Pharmaceuticals Automotive Others |

| By Region | North Rhine-Westphalia Bavaria Baden-Württemberg Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Grocery Retail Logistics | 100 | Logistics Directors, Supply Chain Managers |

| Apparel Supply Chain Management | 60 | Operations Managers, Inventory Control Specialists |

| Electronics Distribution Networks | 50 | Warehouse Managers, Logistics Coordinators |

| Pharmaceutical Logistics Compliance | 40 | Quality Assurance Managers, Regulatory Affairs Specialists |

| E-commerce Fulfillment Strategies | 70 | eCommerce Operations Managers, Customer Experience Directors |

The Germany Retail Logistics Market is valued at approximately USD 15 billion, reflecting significant growth driven by the demand for efficient supply chain solutions, the expansion of e-commerce, and advancements in logistics technology.