Region:Europe

Author(s):Dev

Product Code:KRAB4306

Pages:89

Published On:October 2025

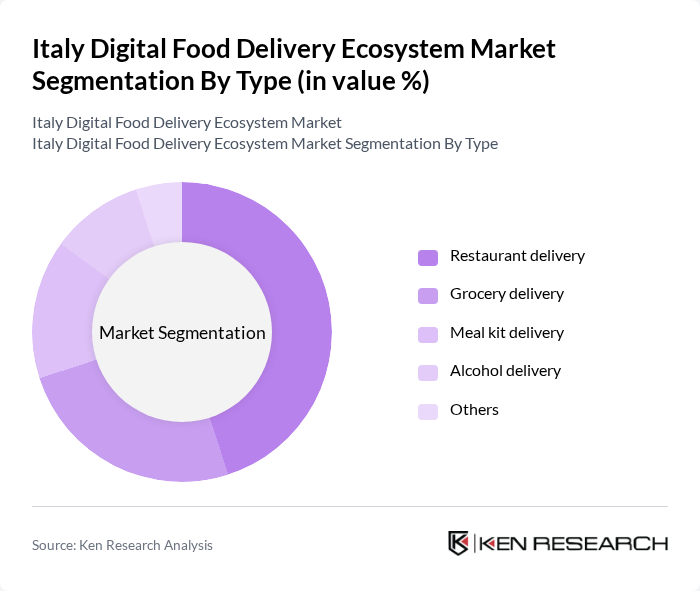

By Type:The market is segmented into various types, including restaurant delivery, grocery delivery, meal kit delivery, alcohol delivery, and others. Among these, restaurant delivery is the most dominant segment, driven by the increasing preference for convenience and the growing number of restaurants partnering with delivery platforms. Grocery delivery is also gaining traction as consumers seek to save time on shopping. Meal kit delivery is emerging as a popular choice for those looking to cook at home without the hassle of meal planning.

By End-User:The end-user segmentation includes individual consumers, corporate clients, and event organizers. Individual consumers represent the largest segment, driven by the convenience of ordering food online for personal consumption. Corporate clients are increasingly utilizing food delivery services for meetings and events, while event organizers are leveraging these services to cater to larger gatherings. The trend towards remote work has further boosted the demand from corporate clients.

The Italy Digital Food Delivery Ecosystem Market is characterized by a dynamic mix of regional and international players. Leading participants such as Just Eat, Deliveroo, Glovo, Uber Eats, Foodora, Takeaway.com, Domino's Pizza, McDonald's, Deliveroo Editions, Foorban, Cortilia, Sgnam, Tasty Box, Foodracers, Rappi contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Italy digital food delivery ecosystem appears promising, driven by technological advancements and evolving consumer preferences. As the market adapts to increasing demand for sustainable practices, companies are likely to invest in eco-friendly packaging and delivery methods. Additionally, the integration of AI and machine learning will enhance operational efficiency and customer experience, allowing platforms to offer personalized recommendations and streamline logistics, ultimately shaping a more responsive and innovative market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Restaurant delivery Grocery delivery Meal kit delivery Alcohol delivery Others |

| By End-User | Individual consumers Corporate clients Event organizers |

| By Sales Channel | Mobile applications Websites Third-party platforms |

| By Delivery Mode | Standard delivery Express delivery Scheduled delivery |

| By Cuisine Type | Italian Asian Fast food Vegan/Vegetarian |

| By Payment Method | Credit/Debit cards Digital wallets Cash on delivery |

| By Subscription Model | Monthly subscriptions Pay-per-order Annual subscriptions |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences in Food Delivery | 150 | Regular Users, Occasional Users, Non-Users |

| Restaurant Partnerships and Collaborations | 100 | Restaurant Owners, Managers, Franchise Operators |

| Delivery Service Operations | 80 | Logistics Managers, Delivery Coordinators |

| Market Trends and Innovations | 70 | Industry Analysts, Technology Providers |

| Consumer Satisfaction and Feedback | 120 | Frequent Users, Feedback Providers, Social Media Influencers |

The Italy Digital Food Delivery Ecosystem Market is valued at approximately USD 5 billion, reflecting significant growth driven by mobile technology adoption, changing consumer lifestyles, and a rising demand for convenience in food procurement.