Region:Africa

Author(s):Rebecca

Product Code:KRAA0360

Pages:87

Published On:August 2025

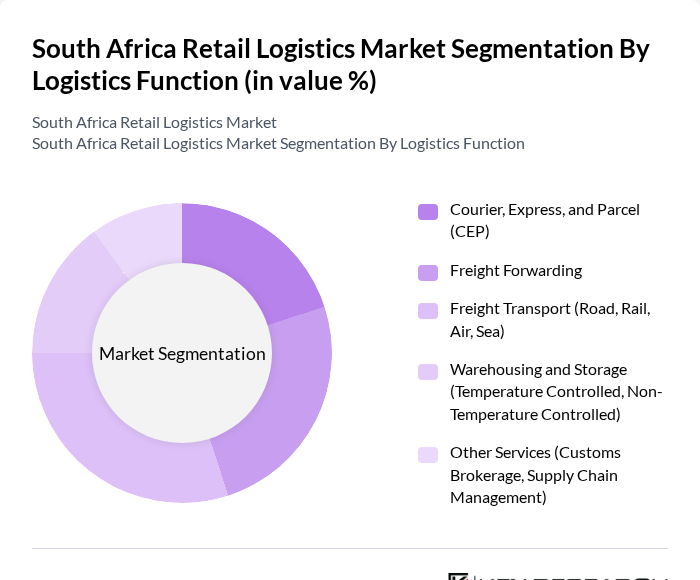

By Logistics Function:The logistics function segment encompasses a range of services critical for the efficient movement and storage of goods. The subsegments include Courier, Express, and Parcel (CEP), Freight Forwarding, Freight Transport (Road, Rail, Air, Sea), Warehousing and Storage (Temperature Controlled, Non-Temperature Controlled), and Other Services (Customs Brokerage, Supply Chain Management). Among these, Freight Transport remains the leading subsegment, driven by the growing demand for efficient and timely delivery of goods, especially with the expansion of e-commerce and regional trade .

By End-User Industry:The end-user industry segment includes a variety of sectors that depend on logistics services for their operations. The subsegments are Wholesale and Retail Trade, Consumer Goods, Automotive, Pharmaceuticals, Electronics, Agriculture, Fishing, and Forestry, Construction, Manufacturing, and Others. Wholesale and Retail Trade is the most significant subsegment, propelled by the rapid growth of e-commerce and the increasing need for agile supply chain solutions. Sectors such as pharmaceuticals and food retail are also driving demand for specialized logistics, particularly cold chain and temperature-controlled services .

The South Africa Retail Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Imperial Logistics, Bidvest International Logistics, DHL Supply Chain South Africa, Kuehne + Nagel South Africa, Transnet Freight Rail, Barloworld Logistics, Grindrod Limited, DSV South Africa, Rhenus Logistics South Africa, Aramex South Africa, Maersk South Africa, UPS South Africa, FedEx Express South Africa, Value Logistics, and Laser Logistics contribute to innovation, geographic expansion, and service delivery in this space .

The South Africa retail logistics market is poised for significant transformation as e-commerce continues to expand and urbanization accelerates. Companies are likely to invest heavily in technology and infrastructure to enhance efficiency and meet consumer expectations. The integration of sustainable practices and smart logistics solutions will become increasingly important, as businesses seek to reduce their environmental impact while optimizing operations. Collaboration with local retailers will also play a crucial role in adapting to changing market dynamics and consumer preferences.

| Segment | Sub-Segments |

|---|---|

| By Logistics Function | Courier, Express, and Parcel (CEP) Freight Forwarding Freight Transport (Road, Rail, Air, Sea) Warehousing and Storage (Temperature Controlled, Non-Temperature Controlled) Other Services (Customs Brokerage, Supply Chain Management) |

| By End-User Industry | Wholesale and Retail Trade Consumer Goods Automotive Pharmaceuticals Electronics Agriculture, Fishing, and Forestry Construction Manufacturing Others |

| By Region | Gauteng Western Cape KwaZulu-Natal Eastern Cape Limpopo Others |

| By Mode of Transport | Road Rail Air Sea and Inland Waterways Pipelines Others |

| By Delivery Model | Direct Delivery Scheduled Delivery On-Demand Delivery Others |

| By Packaging Type | Bulk Packaging Retail Packaging Custom Packaging Others |

| By Technology Utilization | IoT in Logistics AI and Machine Learning Blockchain Technology Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Grocery Retail Logistics | 100 | Logistics Managers, Supply Chain Analysts |

| Apparel Distribution Networks | 60 | Operations Directors, Inventory Managers |

| Electronics Supply Chain Management | 40 | Procurement Managers, Warehouse Supervisors |

| Online Retail Fulfillment Strategies | 80 | eCommerce Directors, Logistics Coordinators |

| Last-Mile Delivery Solutions | 50 | Delivery Managers, Customer Experience Leads |

The South Africa Retail Logistics Market is valued at approximately USD 25 billion, driven by the increasing demand for efficient supply chain solutions, the rise of e-commerce, and the expansion of retail sectors.