Region:Europe

Author(s):Rebecca

Product Code:KRAB1799

Pages:98

Published On:October 2025

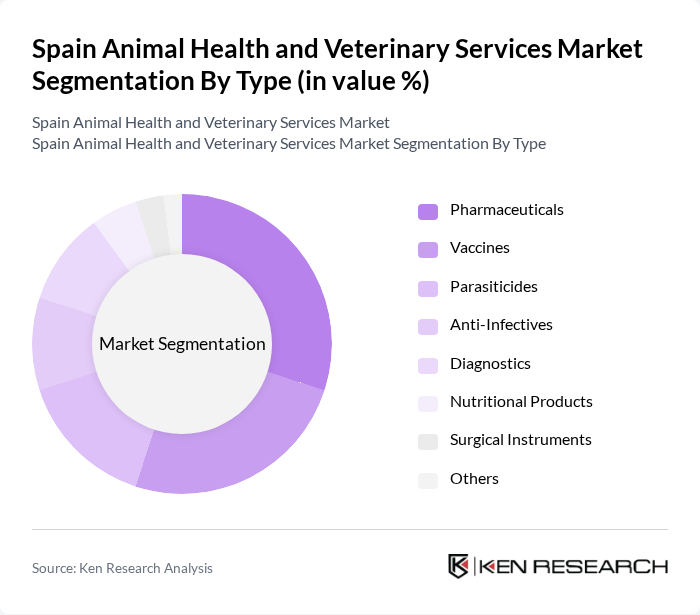

By Type:The market is segmented into various types, including Pharmaceuticals, Vaccines, Parasiticides, Anti-Infectives, Diagnostics, Nutritional Products, Surgical Instruments, and Others. Each of these subsegments plays a crucial role in ensuring the health and well-being of animals, with specific products catering to different health needs. Pharmaceuticals remain the largest segment by revenue, while diagnostics is experiencing the fastest growth due to increased focus on early disease detection and preventive care .

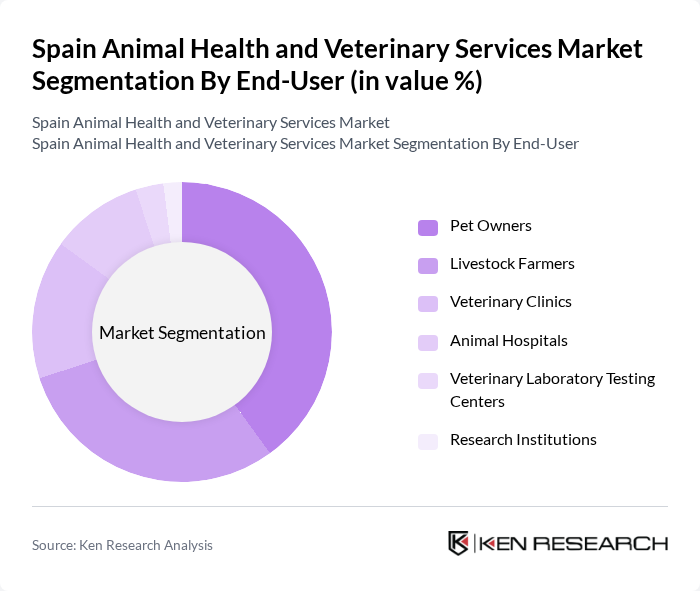

By End-User:The end-user segmentation includes Pet Owners, Livestock Farmers, Veterinary Clinics, Animal Hospitals, Veterinary Laboratory Testing Centers, and Research Institutions. Each segment has unique needs and contributes to the overall demand for veterinary services and products. Pet owners represent the largest end-user segment, reflecting the dominance of the companion animal market and the increasing trend of pet humanization .

The Spain Animal Health and Veterinary Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Zoetis Inc., Merck Animal Health, Elanco Animal Health, Boehringer Ingelheim, Ceva Santé Animale, Vetoquinol S.A., Virbac S.A., IDEXX Laboratories, Inc., Sevetys, AniCura AB, Independent Vetcare Ltd (IVC Evidensia), CVS Group PLC, National Veterinary Associates, Grupo Valdelvira, Hospital Veterinario Madrid Norte contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Spain Animal Health and Veterinary Services market appears promising, driven by ongoing trends in pet ownership and technological advancements. As pet owners increasingly prioritize preventive care, the demand for regular veterinary services is expected to rise. Additionally, the integration of telemedicine and AI in veterinary practices will likely enhance service accessibility and efficiency, catering to a broader audience. This evolving landscape presents significant opportunities for growth and innovation within the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Pharmaceuticals Vaccines Parasiticides Anti-Infectives Diagnostics Nutritional Products Surgical Instruments Others |

| By End-User | Pet Owners Livestock Farmers Veterinary Clinics Animal Hospitals Veterinary Laboratory Testing Centers Research Institutions |

| By Service Type | Preventive Care Emergency Care Routine Check-ups Specialty Services |

| By Distribution Channel | Online Retail Veterinary Clinics Pharmacies Direct Sales |

| By Animal Type | Companion Animals Production Animals Exotic Animals |

| By Geographic Region | Northern Spain Southern Spain Eastern Spain Western Spain |

| By Price Range | Budget Mid-range Premium |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Veterinary Clinics | 120 | Veterinarians, Clinic Managers |

| Animal Pharmaceutical Companies | 80 | Product Managers, Sales Directors |

| Livestock Farmers | 60 | Farm Owners, Animal Health Advisors |

| Pet Owners | 100 | Pet Owners |

| Animal Feed Manufacturers | 70 | Production Managers, Quality Control Officers |

The Spain Animal Health and Veterinary Services Market is valued at approximately USD 1.6 billion, reflecting a robust growth trajectory driven by increasing pet ownership, advancements in veterinary technology, and rising awareness of animal health.