Region:Europe

Author(s):Geetanshi

Product Code:KRAB2768

Pages:96

Published On:October 2025

By Type:The market is segmented into various types, including Retail Banking, Corporate Banking, Investment Banking, Wealth Management, Payment Services, Digital Wallets, Lending Platforms, Insurtech Services, and Others. Each of these segments plays a crucial role in shaping the overall landscape of digital banking and open finance in Italy. Retail banking and payment services are particularly prominent due to widespread consumer adoption of digital channels, while lending platforms and insurtech are rapidly growing as consumers and businesses seek more flexible, technology-driven financial solutions .

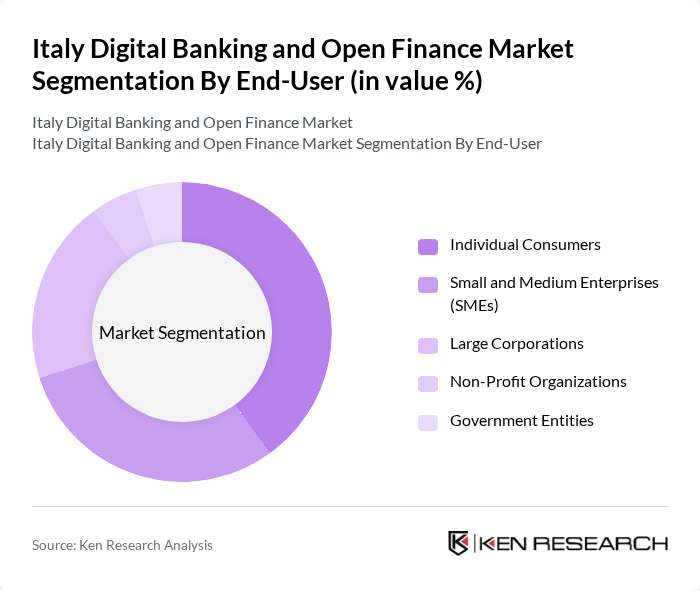

By End-User:The end-user segmentation includes Individual Consumers, Small and Medium Enterprises (SMEs), Large Corporations, Non-Profit Organizations, and Government Entities. Each segment has unique needs and preferences that influence their engagement with digital banking and open finance services. Individual consumers represent the largest share, reflecting the widespread adoption of mobile and online banking, while SMEs and corporates are increasingly leveraging digital solutions for efficiency and access to tailored financial products .

The Italy Digital Banking and Open Finance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Intesa Sanpaolo S.p.A., UniCredit S.p.A., Banca Sella Holding S.p.A., FinecoBank S.p.A., Nexi S.p.A., Revolut Ltd., N26 GmbH, Hype S.p.A., Satispay S.p.A., Credimi S.p.A., Oval Money Ltd., YAP (Mooney S.p.A.), Buddybank (UniCredit S.p.A.), Tinaba S.p.A., Banca Ifis S.p.A., Banca Mediolanum S.p.A., Credem (Credito Emiliano S.p.A.), Banca Nazionale del Lavoro S.p.A. (BNL), Younited Credit, Soisy S.p.A. contribute to innovation, geographic expansion, and service delivery in this space .

The future of Italy's digital banking and open finance market appears promising, driven by technological advancements and evolving consumer preferences. As mobile banking continues to gain traction, institutions are expected to invest in enhancing user experiences through innovative features. Additionally, the collaboration between fintechs and traditional banks will likely foster a more integrated financial ecosystem. With regulatory support and a focus on security, the market is poised for sustainable growth, adapting to the dynamic needs of consumers and businesses alike.

| Segment | Sub-Segments |

|---|---|

| By Type | Retail Banking Corporate Banking Investment Banking Wealth Management Payment Services Digital Wallets Lending Platforms Insurtech Services Others |

| By End-User | Individual Consumers Small and Medium Enterprises (SMEs) Large Corporations Non-Profit Organizations Government Entities |

| By Application | Personal Finance Management Loan Management Investment Tracking Payment Processing Debt Consolidation Home Improvement Financing Education Expenses Emergency Expenses |

| By Distribution Channel | Online Platforms Mobile Applications Direct Banks Financial Advisors |

| By Customer Segment | Millennials Gen Z Gen X Baby Boomers Others |

| By Service Model | B2C (Business to Consumer) B2B (Business to Business) B2B2C (Business to Business to Consumer) |

| By Policy Support | Subsidies for Digital Transformation Tax Incentives for Fintech Startups Regulatory Support for Innovation |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Banking Customers | 100 | Individual Account Holders, Retail Banking Managers |

| Fintech Users | 60 | Tech-Savvy Consumers, Fintech Product Managers |

| Corporate Banking Clients | 40 | Corporate Treasurers, CFOs of SMEs |

| Regulatory Stakeholders | 40 | Policy Makers, Financial Regulators |

| Industry Experts | 40 | Consultants, Academic Researchers in Finance |

The Italy Digital Banking and Open Finance Market is valued at approximately USD 45 billion, reflecting significant growth driven by the adoption of digital banking solutions and the rise of fintech companies, enhancing accessibility and convenience for consumers.