Region:Europe

Author(s):Geetanshi

Product Code:KRAB2716

Pages:81

Published On:October 2025

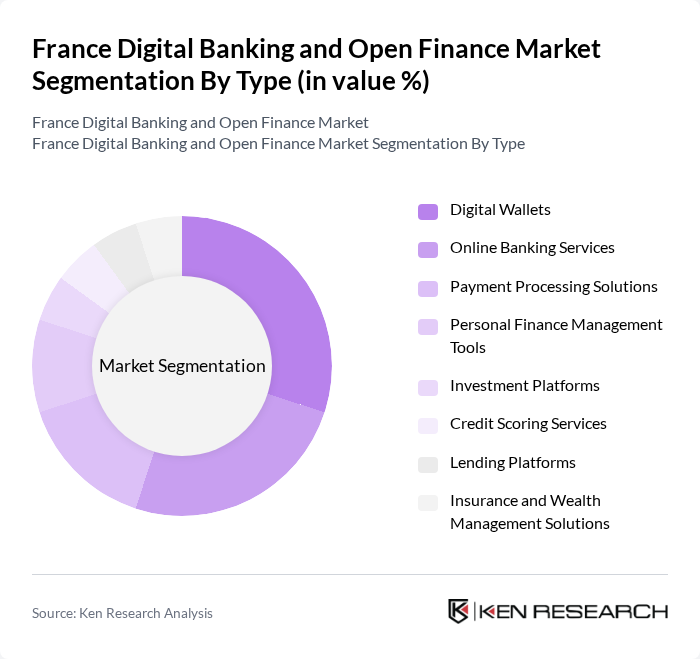

By Type:The market is segmented into various types, including Digital Wallets, Online Banking Services, Payment Processing Solutions, Personal Finance Management Tools, Investment Platforms, Credit Scoring Services, Lending Platforms, and Insurance and Wealth Management Solutions. Among these,Digital WalletsandOnline Banking Servicesare particularly prominent due to their convenience and user-friendly interfaces, which cater to the evolving needs of consumers. The rapid adoption of mobile wallets and the integration of AI-driven personal finance tools are notable trends .

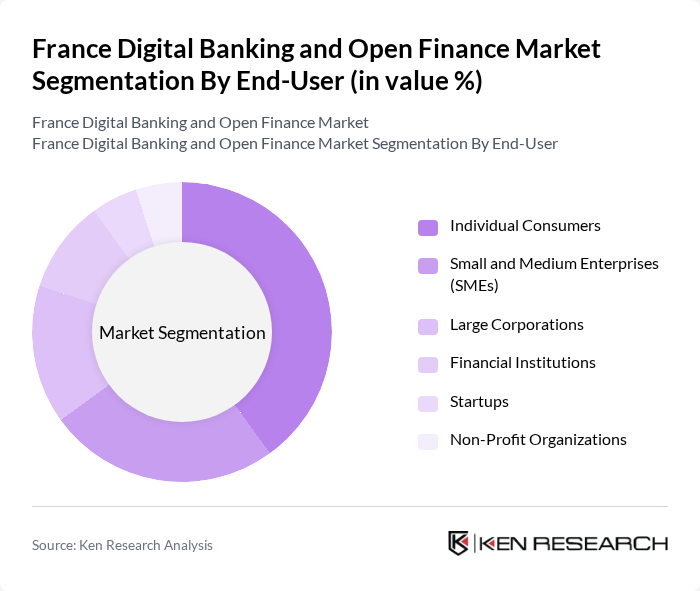

By End-User:The end-user segmentation includes Individual Consumers, Small and Medium Enterprises (SMEs), Large Corporations, Financial Institutions, Startups, and Non-Profit Organizations.Individual ConsumersandSMEsare the primary users of digital banking services, driven by the need for accessible financial solutions and the growing trend of digitalization in everyday transactions. The adoption of digital banking among SMEs is further supported by government programs like "France Num," which accelerates digital transformation for businesses .

The France Digital Banking and Open Finance Market is characterized by a dynamic mix of regional and international players. Leading participants such as BNP Paribas, Société Générale, Crédit Agricole, La Banque Postale, Orange Bank, N26, Revolut, Lydia, Qonto, Shine, Alan, Younited Credit, Bankin', Anytime, Boursorama Banque, Hello bank!, Floa Bank, October (formerly Lendix), Pretto, ING contribute to innovation, geographic expansion, and service delivery in this space .

The future of the France digital banking and open finance market appears promising, driven by technological advancements and evolving consumer preferences. As digital payment solutions gain traction, the integration of artificial intelligence in financial services is expected to enhance personalization and efficiency. Additionally, the collaboration between fintechs and traditional banks will likely foster innovation, creating a more robust ecosystem that meets the diverse needs of consumers while ensuring compliance with regulatory frameworks.

| Segment | Sub-Segments |

|---|---|

| By Type | Digital Wallets Online Banking Services Payment Processing Solutions Personal Finance Management Tools Investment Platforms Credit Scoring Services Lending Platforms (Personal Loans, Business Loans, Peer-to-Peer Loans, Green Loans, etc.) Insurance and Wealth Management Solutions |

| By End-User | Individual Consumers Small and Medium Enterprises (SMEs) Large Corporations Financial Institutions Startups Non-Profit Organizations |

| By Application | Retail Banking Corporate Banking Investment Banking Wealth Management Debt Consolidation Home Improvement Education Expenses Business Expansion Green/Energy Efficiency Projects |

| By Distribution Channel | Online Platforms Mobile Applications Direct Sales Partnerships with Financial Institutions Embedded Finance (via Third-Party Apps) |

| By Customer Segment | Retail Customers Corporate Clients Government Entities Self-Employed/Professionals |

| By Service Model | B2C (Business to Consumer) B2B (Business to Business) B2B2C (Business to Business to Consumer) |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Support Initiatives |

| By Credit Score Range | Low Credit Score (<600) Medium Credit Score (600–749) High Credit Score (750+) |

| By Loan Amount | Micro Loans (<€5,000) Small Loans (€5,000–€50,000) Medium Loans (€50,001–€250,000) Large Loans (>€250,000) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Digital Banking Users | 100 | Retail Banking Customers, Mobile Banking Users |

| Fintech Service Providers | 60 | Product Managers, Business Development Executives |

| Regulatory Bodies | 40 | Policy Makers, Compliance Officers |

| Investment Platforms | 50 | Investment Advisors, Financial Planners |

| Consumer Financial Services | 80 | Customer Service Representatives, Marketing Managers |

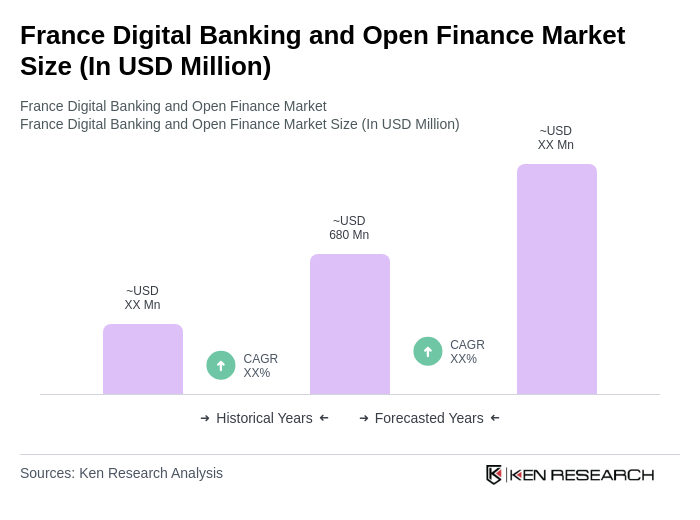

The France Digital Banking and Open Finance Market is valued at approximately USD 680 million, driven by the increasing adoption of digital banking solutions, fintech growth, and consumer preference for online financial services.