Region:Europe

Author(s):Geetanshi

Product Code:KRAB2781

Pages:85

Published On:October 2025

By Type:The market is segmented into Retail Banking, Corporate Banking, Investment Banking, Wealth Management, Payment Services, Digital Wallets, Open Banking Platforms, Embedded Finance Solutions, and Others. Retail Banking remains the most dominant segment, driven by the increasing number of digital banking users and the growing preference for online banking services. The proliferation of mobile banking applications and AI-powered financial advisory tools have significantly contributed to the growth of this segment. Payment Services and Digital Wallets are also experiencing strong momentum, supported by the widespread adoption of BLIK and contactless payment solutions.

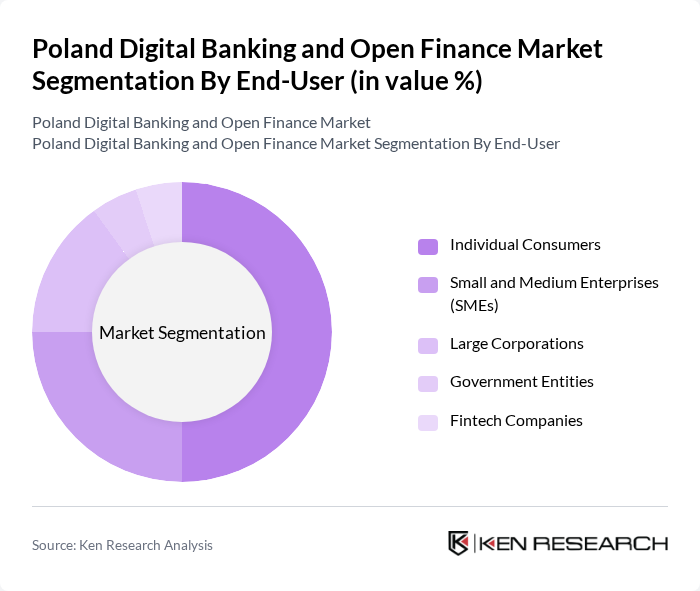

By End-User:The end-user segmentation includes Individual Consumers, Small and Medium Enterprises (SMEs), Large Corporations, Government Entities, and Fintech Companies. Individual Consumers represent the largest segment, driven by the increasing adoption of digital banking solutions for personal finance management. The convenience and accessibility of online banking services, combined with the expansion of mobile payment platforms and instant payment systems, have made digital banking the preferred choice for many consumers. SMEs are increasingly leveraging digital banking for e-commerce and omnichannel payment solutions, while fintech companies play a pivotal role in driving innovation across all segments.

The Poland Digital Banking and Open Finance Market is characterized by a dynamic mix of regional and international players. Leading participants such as PKO Bank Polski, mBank S.A., ING Bank ?l?ski, Santander Bank Polska, Bank Millennium, Alior Bank, VeloBank, BNP Paribas Bank Polska, Credit Agricole Bank Polska, T-Mobile Us?ugi Bankowe, Revolut Ltd., Curve, Twisto Payments, PayU, Przelewy24 (PayPro S.A.), BLIK (Polski Standard P?atno?ci), Klarna contribute to innovation, geographic expansion, and service delivery in this space.

The future of Poland's digital banking and open finance market appears promising, driven by technological advancements and evolving consumer preferences. The integration of artificial intelligence and machine learning is expected to enhance customer service and operational efficiency. Additionally, the focus on sustainable banking practices will likely gain traction, aligning with global trends. As fintech collaborations expand, traditional banks may adapt their strategies to remain competitive, fostering a dynamic environment that encourages innovation and customer-centric solutions.

| Segment | Sub-Segments |

|---|---|

| By Type | Retail Banking Corporate Banking Investment Banking Wealth Management Payment Services Digital Wallets Open Banking Platforms Embedded Finance Solutions Others |

| By End-User | Individual Consumers Small and Medium Enterprises (SMEs) Large Corporations Government Entities Fintech Companies |

| By Application | Personal Finance Management Loan Management Investment Tracking Payment Processing Account Aggregation Credit Scoring & Risk Assessment |

| By Distribution Channel | Online Banking Mobile Banking API-based Platforms Branch Banking |

| By Customer Segment | Millennials Gen Z Baby Boomers Unbanked/Underbanked |

| By Service Model | B2C (Business to Consumer) B2B (Business to Business) B2B2C (Business to Business to Consumer) |

| By Policy Support | Subsidies for Digital Transformation Tax Incentives for Fintech Startups Regulatory Support for Innovation EU Digital Finance Package Compliance |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Digital Banking Users | 120 | Individual Consumers, Retail Banking Customers |

| Small Business Digital Banking Solutions | 60 | Small Business Owners, Financial Managers |

| Fintech Service Adoption | 40 | Fintech Users, Early Adopters |

| Open Finance Awareness | 80 | Consumers, Financial Advisors |

| Regulatory Impact on Digital Banking | 40 | Regulatory Experts, Compliance Officers |

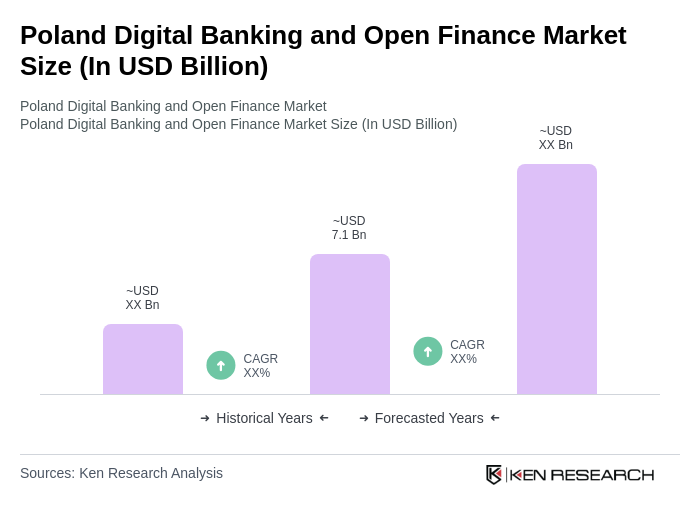

The Poland Digital Banking and Open Finance Market is valued at approximately USD 7.1 billion, driven by the rapid adoption of digital banking solutions and the expansion of fintech companies, alongside increasing consumer demand for secure financial services.