Region:Central and South America

Author(s):Geetanshi

Product Code:KRAB2784

Pages:80

Published On:October 2025

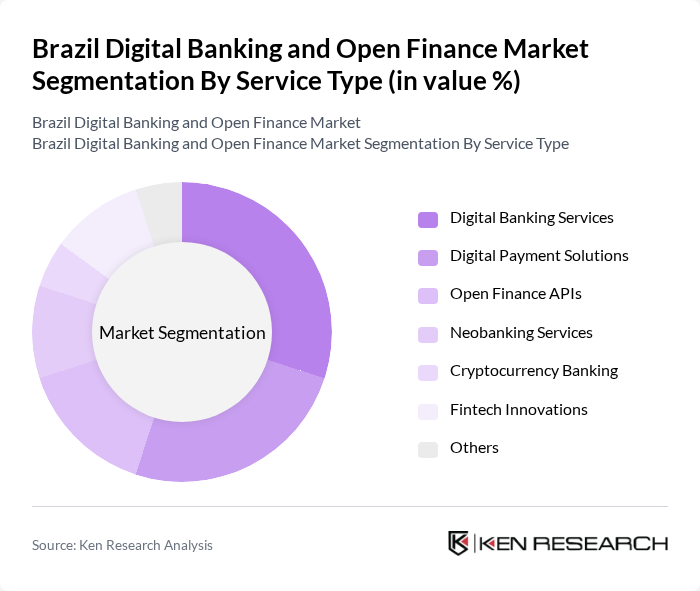

By Service Type:The service type segmentation includes various offerings that cater to the diverse needs of consumers and businesses. Digital banking services encompass traditional banking functions delivered through digital channels, while digital payment solutions facilitate seamless transactions. Open finance APIs enable third-party developers to create innovative financial products, and neobanking services provide a digital-only banking experience. Cryptocurrency banking and fintech innovations are emerging trends, alongside other services that enhance the overall financial ecosystem.

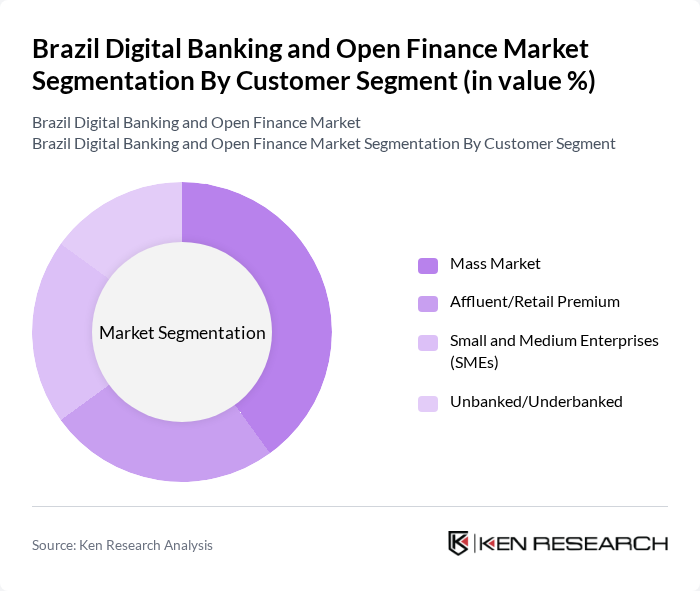

By Customer Segment:The customer segment classification highlights the diverse groups utilizing digital banking and open finance services. The mass market represents the largest segment, driven by the increasing smartphone penetration and internet access. Affluent and retail premium customers seek personalized financial services, while small and medium enterprises (SMEs) leverage digital solutions for operational efficiency. The unbanked and underbanked segments are gradually gaining access to financial services through innovative fintech solutions, promoting financial inclusion.

The Brazil Digital Banking and Open Finance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nubank, Banco Inter, C6 Bank, PagSeguro Digital Ltd., Banco Original, BTG Pactual, PicPay, Mercado Pago, Banco do Brasil, Itaú Unibanco, Bradesco, Santander Brasil, XP Inc., StoneCo Ltd., Neon Pagamentos contribute to innovation, geographic expansion, and service delivery in this space.

The future of Brazil's digital banking and open finance market appears promising, driven by technological advancements and evolving consumer preferences. The integration of artificial intelligence and machine learning is expected to enhance customer experiences and streamline operations. Additionally, the ongoing development of regulatory frameworks will likely foster innovation while ensuring consumer protection. As the market matures, collaboration between fintechs and traditional banks will become increasingly vital, paving the way for a more inclusive financial ecosystem that caters to diverse consumer needs.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Digital Banking Services Digital Payment Solutions Open Finance APIs Neobanking Services Cryptocurrency Banking Fintech Innovations Others |

| By Customer Segment | Mass Market Affluent/Retail Premium Small and Medium Enterprises (SMEs) Unbanked/Underbanked |

| By Product Type | Transactional Accounts Savings Accounts Loans Credit and Debit Cards Insurance & Investment Products |

| By Service Channel | Digital Banking Bank Branches ATM & Self-Service Kiosks Banking Agents |

| By Technology | Mobile Banking Applications Web-based Platforms API Integration Blockchain Technology |

| By End-User | Individual Consumers Corporate Clients Financial Institutions |

| By Geography | Urban Markets Rural Markets Metropolitan Areas |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Banking Users | 120 | Consumers aged 18-65 using digital banking services |

| Fintech Service Users | 100 | Users of mobile payment and lending applications |

| Banking Executives | 40 | Senior management from traditional banks and fintechs |

| Regulatory Bodies | 40 | Officials from financial regulatory agencies in Brazil |

| Industry Experts | 40 | Consultants and analysts specializing in financial technology |

The Brazil Digital Banking Market is valued at approximately USD 2.33 billion, reflecting significant growth driven by the increasing adoption of digital financial services and a surge in smartphone penetration among consumers.