Region:Africa

Author(s):Shubham

Product Code:KRAB3190

Pages:92

Published On:October 2025

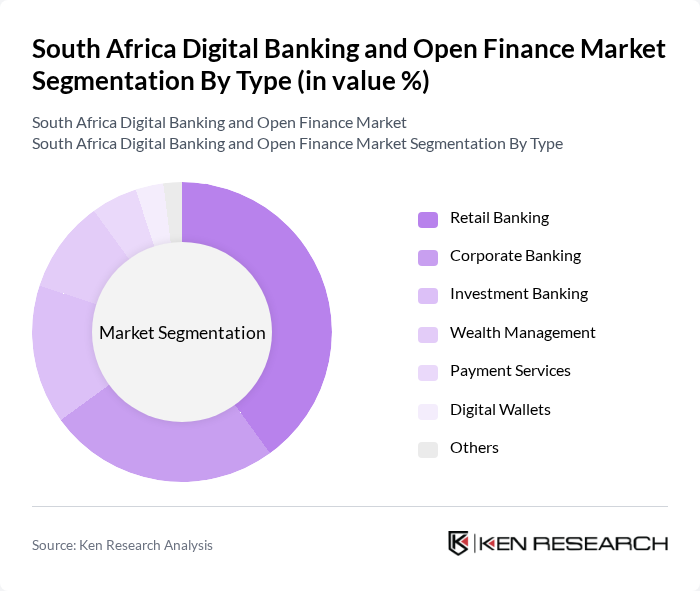

By Type:The market can be segmented into various types, including Retail Banking, Corporate Banking, Investment Banking, Wealth Management, Payment Services, Digital Wallets, and Others. Among these, Retail Banking is the most dominant segment, driven by the increasing number of consumers opting for online banking services and mobile applications. The convenience and accessibility of digital banking solutions have led to a significant shift in consumer behavior, with more individuals managing their finances online.

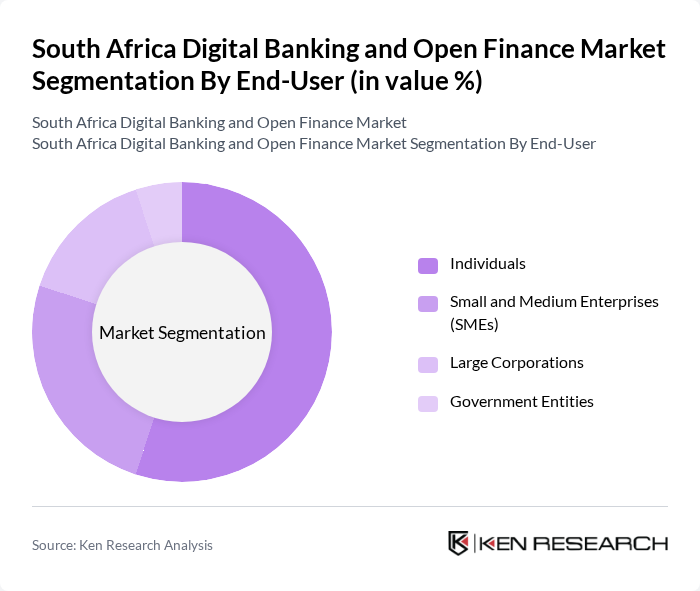

By End-User:The end-user segmentation includes Individuals, Small and Medium Enterprises (SMEs), Large Corporations, and Government Entities. The Individuals segment is the largest, as the growing trend of personal finance management through digital platforms has led to increased engagement from consumers. The convenience of accessing banking services from mobile devices has made digital banking particularly appealing to individual users.

The South Africa Digital Banking and Open Finance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Standard Bank Group, Absa Group Limited, FirstRand Limited, Nedbank Group Limited, Capitec Bank Holdings Limited, Discovery Limited, Investec Bank Limited, Sasfin Holdings Limited, African Bank Limited, TymeBank, Bank Zero, Finbond Group Limited, Ubank Limited, PayFast, Yoco contribute to innovation, geographic expansion, and service delivery in this space.

The South African digital banking and open finance market is poised for significant transformation, driven by technological advancements and evolving consumer expectations. As mobile banking continues to gain traction, financial institutions are likely to invest heavily in enhancing user experiences and security measures. Additionally, the integration of AI and machine learning will enable more personalized services, fostering customer loyalty. Collaborative efforts between banks and fintechs will further accelerate innovation, positioning South Africa as a leader in the digital finance landscape by future.

| Segment | Sub-Segments |

|---|---|

| By Type | Retail Banking Corporate Banking Investment Banking Wealth Management Payment Services Digital Wallets Others |

| By End-User | Individuals Small and Medium Enterprises (SMEs) Large Corporations Government Entities |

| By Service Model | BaaS (Banking as a Service) SaaS (Software as a Service) PaaS (Platform as a Service) |

| By Distribution Channel | Online Banking Mobile Banking Branch Banking |

| By Customer Segment | Retail Customers Business Customers Institutional Customers |

| By Payment Method | Credit/Debit Cards Bank Transfers Mobile Payments |

| By Regulatory Compliance | Fully Compliant Partially Compliant Non-Compliant |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Digital Banking Users | 150 | Retail Banking Customers, Mobile Banking Users |

| Fintech Service Providers | 100 | Product Managers, Business Development Executives |

| Regulatory Bodies | 50 | Policy Makers, Compliance Officers |

| Investment Platforms | 80 | Investment Advisors, Wealth Management Professionals |

| Consumer Finance Experts | 70 | Financial Analysts, Economic Researchers |

The South Africa Digital Banking and Open Finance Market is valued at approximately USD 5 billion, reflecting significant growth driven by increased adoption of digital banking solutions and enhanced internet penetration among consumers.