Egypt Digital Banking and Open Finance Market Overview

- The Egypt Digital Banking and Open Finance Market is valued at USD 7 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing adoption of digital payment solutions, the rise of fintech startups, and government initiatives aimed at enhancing financial inclusion. The market has witnessed a significant shift towards online banking and mobile payment solutions, reflecting changing consumer preferences and technological advancements.

- Cairo and Alexandria are the dominant cities in the Egypt Digital Banking and Open Finance Market due to their large populations, economic activities, and concentration of financial institutions. These cities serve as hubs for fintech innovation and digital banking services, attracting both local and international players. The urbanization and increasing smartphone penetration in these areas further contribute to the market's growth.

- The Central Bank of Egypt issued the "Regulations for Open Banking Services, 2023" under its authority, mandating that licensed banks provide secure open APIs to third-party providers with explicit customer consent. This regulation establishes operational standards for data sharing, customer authentication, and third-party licensing, aiming to foster competition, enhance customer experience, and promote innovation in financial services, ultimately leading to a more inclusive financial ecosystem.

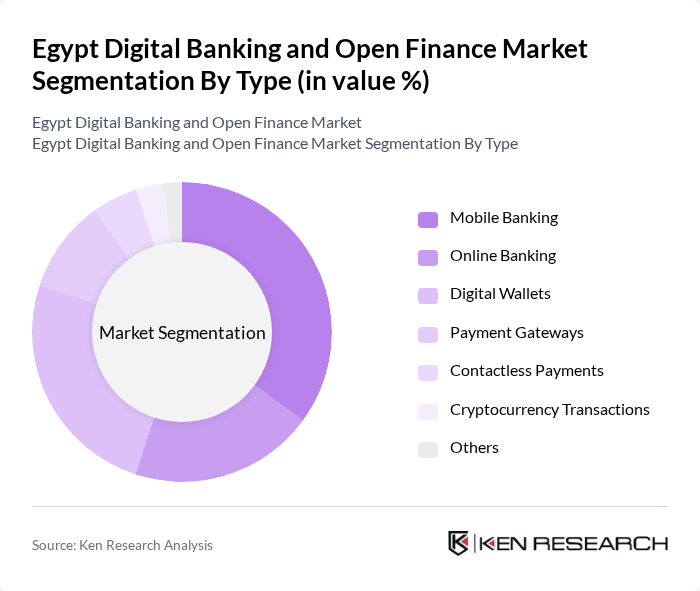

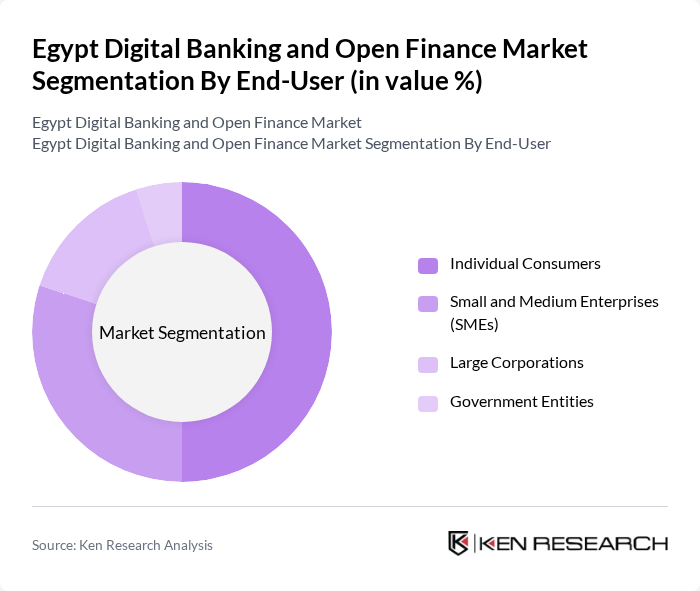

Egypt Digital Banking and Open Finance Market Segmentation

By Type:The market is segmented into various types, including Mobile Banking, Online Banking, Digital Wallets, Payment Gateways, Contactless Payments, Cryptocurrency Transactions, and Others. Among these,Mobile BankingandDigital Walletsare particularly prominent due to their convenience and the growing trend of cashless transactions. The increasing smartphone penetration and the demand for seamless payment solutions are driving the growth of these segments.

By End-User:The market is segmented by end-users, including Individual Consumers, Small and Medium Enterprises (SMEs), Large Corporations, and Government Entities.Individual ConsumersandSMEsare the leading segments, driven by the increasing adoption of digital banking solutions for personal finance management and business transactions. The growing trend of e-commerce and digital payments among consumers further supports the expansion of these segments.

Egypt Digital Banking and Open Finance Market Competitive Landscape

The Egypt Digital Banking and Open Finance Market is characterized by a dynamic mix of regional and international players. Leading participants such as National Bank of Egypt, Commercial International Bank (CIB), Banque Misr, QNB Al Ahli, Arab African International Bank, Fawry for Banking and Payment Technology Services, EFG Hermes, Banque du Caire, Abu Dhabi Islamic Bank Egypt, Misr Iran Development Bank, AlexBank, Suez Canal Bank, Arab Bank, HSBC Egypt, Emirates NBD Egypt, Misr Digital Innovation (onebank), valU, Paymob, Aman for Financial Services, Instapay contribute to innovation, geographic expansion, and service delivery in this space.

Egypt Digital Banking and Open Finance Market Industry Analysis

Growth Drivers

- Increasing Smartphone Penetration:As of future, Egypt's smartphone penetration rate is projected to reach 60%, with approximately 60 million smartphone users. This surge facilitates access to digital banking services, enabling more individuals to engage in online financial transactions. The World Bank reports that mobile banking transactions in Egypt increased by 150% in future, highlighting the growing reliance on mobile devices for financial services. This trend is expected to continue, driving further adoption of digital banking solutions.

- Rise in Digital Payment Adoption:In future, Egypt's digital payment transactions are anticipated to exceed 1.5 billion, reflecting a significant shift towards cashless transactions. The Central Bank of Egypt reported a 200% increase in digital payment usage from previous years, driven by consumer demand for convenience and security. This growing acceptance of digital payments is crucial for the expansion of digital banking services, as more consumers and businesses seek efficient payment solutions.

- Government Initiatives for Financial Inclusion:The Egyptian government aims to increase financial inclusion to 70% in future, up from 56% in previous years. Initiatives such as the National Financial Inclusion Strategy are designed to promote access to banking services for underserved populations. The government has also launched programs to incentivize the use of digital wallets, which have seen a 300% increase in registrations since previous years. These efforts are pivotal in fostering a more inclusive digital banking environment.

Market Challenges

- Cybersecurity Threats:The rise in digital banking has also led to increased cybersecurity threats, with reported cyberattacks on financial institutions in Egypt rising by 40% in future. The Egyptian Cybersecurity Authority noted that financial services are among the top targets for cybercriminals, posing significant risks to consumer data and trust. This challenge necessitates robust security measures and investments in cybersecurity infrastructure to protect users and maintain confidence in digital banking.

- Regulatory Compliance Complexities:Navigating the regulatory landscape in Egypt can be challenging for fintech companies, with over 50 regulations impacting digital banking operations. Compliance costs are estimated to account for 15% of operational expenses for fintechs, according to the Central Bank of Egypt. The complexity of these regulations can hinder innovation and slow down the growth of digital banking services, as companies must allocate significant resources to ensure compliance.

Egypt Digital Banking and Open Finance Market Future Outlook

The future of Egypt's digital banking and open finance market appears promising, driven by technological advancements and increasing consumer demand for seamless financial services. As mobile banking solutions gain traction, financial institutions are expected to enhance their digital offerings, focusing on user experience and security. Additionally, the integration of AI and machine learning will likely optimize service delivery, while regulatory frameworks evolve to support innovation. Overall, the market is poised for significant transformation, fostering a more inclusive financial ecosystem.

Market Opportunities

- Growth in E-commerce Transactions:E-commerce in Egypt is projected to reach $8 billion in future, creating substantial opportunities for digital banking services. As online shopping becomes more prevalent, the demand for secure and efficient payment solutions will rise, encouraging banks and fintechs to innovate and expand their offerings to cater to this growing market segment.

- Partnerships with Telecom Companies:Collaborations between banks and telecom providers are expected to enhance mobile banking accessibility. With over 100 million mobile subscribers in Egypt, partnerships can facilitate the development of mobile wallets and payment solutions, driving financial inclusion and expanding the customer base for digital banking services.