Region:Europe

Author(s):Geetanshi

Product Code:KRAB1554

Pages:89

Published On:October 2025

By Type:The market is segmented into various types, including dietary supplements, functional beverages, herbal products, probiotics, omega-3 fatty acids, protein supplements, collagen-based products, adaptogen-infused beverages, plant-based functional beverages, and others. Among these, dietary supplements and functional beverages are the most prominent segments, driven by consumer preferences for convenient health solutions and the increasing popularity of wellness trends. The demand for probiotics, collagen-based products, and plant-based beverages is also rising, reflecting consumer interest in digestive health, healthy aging, and sustainable nutrition .

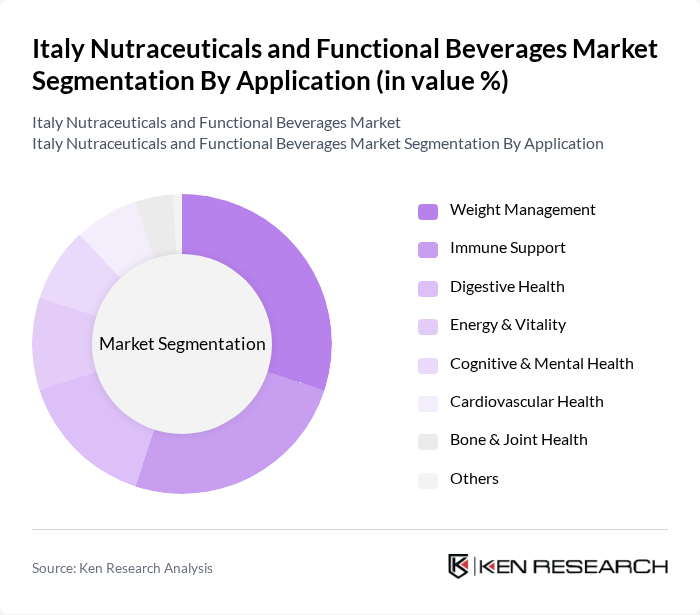

By Application:The applications of nutraceuticals and functional beverages include weight management, immune support, digestive health, energy boosting, cognitive function, heart health, skin health, stress relief & mood enhancement, and others. Weight management and immune support are the leading applications, reflecting the growing consumer focus on health and wellness, particularly in the wake of the COVID-19 pandemic. Digestive health and cognitive function are also significant, driven by an aging population and increased awareness of gut-brain health connections .

The Italy Nutraceuticals and Functional Beverages Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nestlé S.A., Danone S.A., Yakult Honsha Co., Ltd., San Benedetto S.p.A., Parmalat S.p.A. (Lactalis Group), Aboca S.p.A., Angelini Pharma S.p.A., Zuegg S.p.A., The Coca-Cola Company, PepsiCo, Inc., Unilever PLC, Herbalife Nutrition Ltd., Abbott Laboratories, Glanbia plc, DSM Nutritional Products contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Italian nutraceuticals and functional beverages market appears promising, driven by evolving consumer preferences and technological advancements. As personalization becomes a key trend, companies are likely to invest in tailored products that meet specific health needs. Additionally, the increasing focus on sustainability will push brands to adopt eco-friendly practices, enhancing their appeal to environmentally conscious consumers. These trends are expected to shape the market landscape significantly in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Dietary Supplements Functional Beverages Herbal Products Probiotics Omega-3 Fatty Acids Protein Supplements Collagen-Based Products Adaptogen-Infused Beverages Plant-Based Functional Beverages Others |

| By Application | Weight Management Immune Support Digestive Health Energy Boosting Cognitive Function Heart Health Skin Health Stress Relief & Mood Enhancement Others |

| By Distribution Channel | Supermarkets/Hypermarkets Health Food Stores Online Retail Pharmacies Fitness Centers & Wellness Retreats Direct Sales Others |

| By Consumer Demographics | Age Group (18-25, 26-35, 36-50, 51+) Gender Income Level Lifestyle Choices |

| By Packaging Type | Bottles Sachets Jars Pouches Tetra Packs Others |

| By Price Range | Budget Mid-Range Premium |

| By Brand Loyalty | Brand Loyal Consumers Price-Sensitive Consumers New Entrants |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Nutraceutical Product Development | 60 | Product Managers, R&D Directors |

| Functional Beverage Market Insights | 50 | Marketing Managers, Brand Strategists |

| Consumer Health Trends | 70 | Health Professionals, Nutritionists |

| Retail Distribution Channels | 40 | Retail Managers, Supply Chain Analysts |

| Market Regulation Impact | 40 | Regulatory Affairs Specialists, Compliance Officers |

The Italy Nutraceuticals and Functional Beverages Market is valued at approximately USD 8.2 billion, reflecting a significant growth trend driven by increasing health consciousness and demand for natural products among consumers.