Region:Asia

Author(s):Rebecca

Product Code:KRAB4069

Pages:96

Published On:October 2025

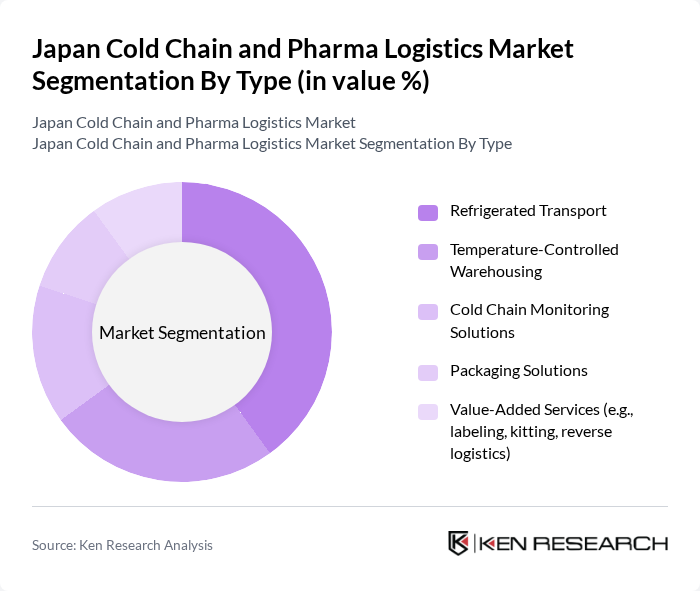

By Type:The market is segmented into various types, including Refrigerated Transport, Temperature-Controlled Warehousing, Cold Chain Monitoring Solutions, Packaging Solutions, and Value-Added Services. Among these, Refrigerated Transport is the leading sub-segment due to the increasing demand for efficient and reliable transportation of temperature-sensitive products. The rise in e-commerce and the need for timely delivery of pharmaceuticals have further propelled the growth of this segment.

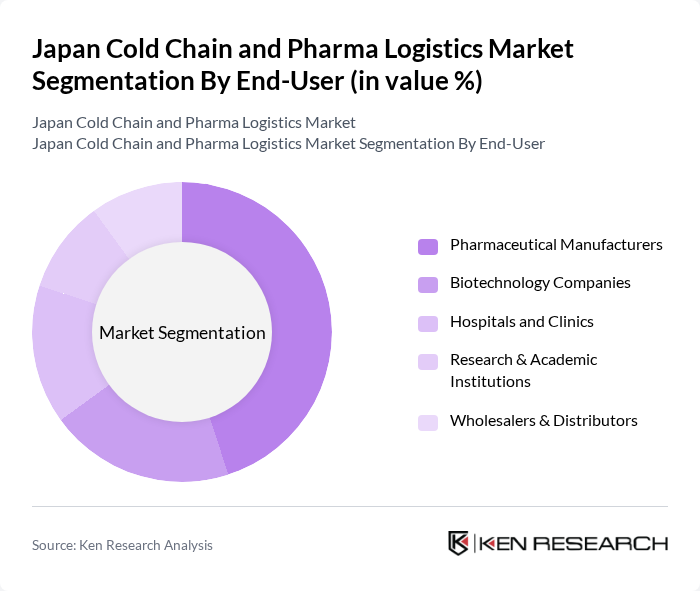

By End-User:The end-user segmentation includes Pharmaceutical Manufacturers, Biotechnology Companies, Hospitals and Clinics, Research & Academic Institutions, and Wholesalers & Distributors. Pharmaceutical Manufacturers dominate this segment, driven by the increasing production of biologics and the need for stringent temperature control during distribution. The growing focus on research and development in the pharmaceutical sector further supports the demand for cold chain logistics.

The Japan Cold Chain and Pharma Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nippon Express Co., Ltd., Kintetsu World Express, Inc., Yamato Holdings Co., Ltd., Seino Holdings Co., Ltd., Sagawa Express Co., Ltd., DB Schenker, DHL Supply Chain Japan, FedEx Express Japan, UPS Supply Chain Solutions Japan, Maersk Line Japan Ltd., CEVA Logistics Japan, Kuehne + Nagel Japan Ltd., Yusen Logistics Co., Ltd., Sankyu Inc., Hitachi Transport System, Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the cold chain and pharma logistics market in Japan appears promising, driven by technological advancements and increasing demand for biopharmaceuticals. As the market adapts to evolving consumer preferences and regulatory requirements, companies are likely to invest in innovative solutions that enhance efficiency and sustainability. The integration of AI and machine learning will further optimize logistics operations, ensuring product integrity while reducing costs. This dynamic environment presents significant opportunities for growth and expansion in future.

| Segment | Sub-Segments |

|---|---|

| By Type | Refrigerated Transport Temperature-Controlled Warehousing Cold Chain Monitoring Solutions Packaging Solutions Value-Added Services (e.g., labeling, kitting, reverse logistics) |

| By End-User | Pharmaceutical Manufacturers Biotechnology Companies Hospitals and Clinics Research & Academic Institutions Wholesalers & Distributors |

| By Distribution Mode | Road Transport Air Freight Sea Freight Rail Transport Last-Mile Delivery |

| By Application | Vaccines Blood Products Biologics & Biosimilars Clinical Trial Materials Diagnostics & Laboratory Samples |

| By Sales Channel | Direct Sales Distributors Online Platforms Tender/Contract Logistics |

| By Packaging Type | Insulated Containers Refrigerated Boxes Active Temperature-Controlled Packaging Passive Temperature-Controlled Packaging |

| By Service Type | Transportation Services Warehousing Services Monitoring & Tracking Services Consulting & Compliance Services |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Cold Chain Providers | 60 | Logistics Managers, Operations Directors |

| Healthcare Institutions | 50 | Pharmacy Managers, Supply Chain Coordinators |

| Regulatory Compliance Experts | 40 | Quality Assurance Managers, Regulatory Affairs Specialists |

| Technology Providers for Cold Chain | 45 | Product Managers, Business Development Executives |

| End-users of Cold Chain Logistics | 55 | Procurement Officers, Supply Chain Analysts |

The Japan Cold Chain and Pharma Logistics Market is valued at approximately USD 20 billion, reflecting the combined logistics for pharmaceuticals, food, and other temperature-sensitive products, with pharmaceuticals being a significant and rapidly growing segment.