Region:Africa

Author(s):Geetanshi

Product Code:KRAA6652

Pages:97

Published On:September 2025

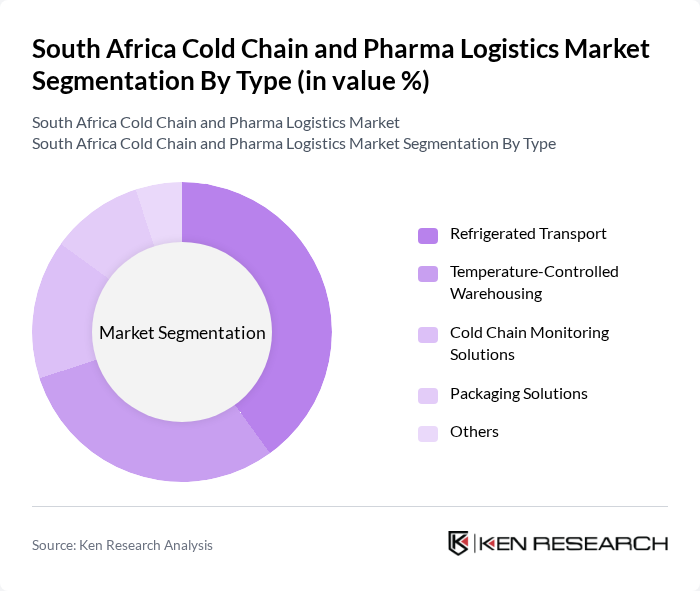

By Type:

The South Africa Cold Chain and Pharma Logistics Market is segmented into various types, including Refrigerated Transport, Temperature-Controlled Warehousing, Cold Chain Monitoring Solutions, Packaging Solutions, and Others. Among these, Refrigerated Transport is the leading sub-segment, driven by the increasing demand for the safe and efficient transportation of temperature-sensitive pharmaceuticals and biologics. The rise in e-commerce and direct-to-consumer delivery models has further fueled the need for reliable refrigerated transport solutions, ensuring that products maintain their efficacy throughout the supply chain.

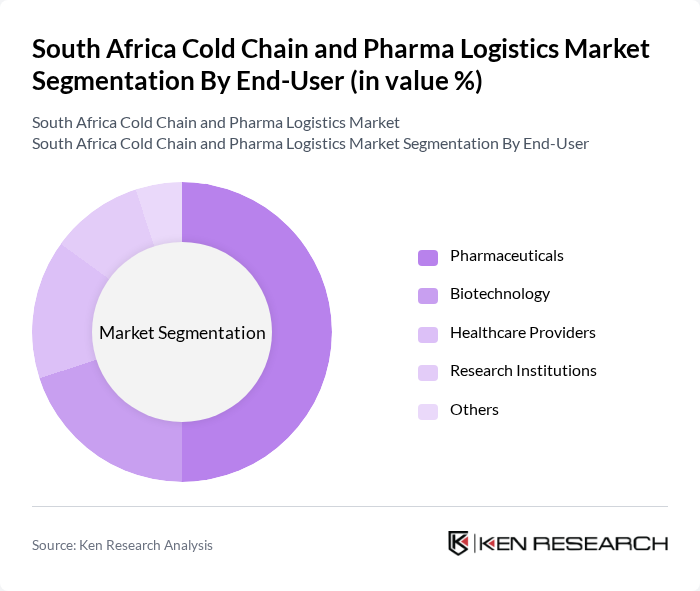

By End-User:

This market is also segmented by end-users, including Pharmaceuticals, Biotechnology, Healthcare Providers, Research Institutions, and Others. The Pharmaceuticals segment holds the largest market share, driven by the increasing production of temperature-sensitive drugs and vaccines. The growing emphasis on vaccine distribution, especially in light of recent global health challenges, has significantly boosted the demand for cold chain logistics tailored to the pharmaceutical industry.

The South Africa Cold Chain and Pharma Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Imperial Logistics, Bidvest Panalpina Logistics, DSV South Africa, Kuehne + Nagel South Africa, DHL Supply Chain South Africa, Cold Chain Solutions, Transnet Freight Rail, Pharmalex, Medlog, TFG Logistics, Barloworld Logistics, Rhenus Logistics, Agility Logistics, Mainstream Logistics, SAA Cargo contribute to innovation, geographic expansion, and service delivery in this space.

The future of the South African cold chain and pharma logistics market appears promising, driven by technological advancements and increasing consumer demand for quality healthcare products. The integration of IoT technologies is expected to enhance tracking and monitoring capabilities, ensuring compliance with temperature regulations. Additionally, the government's commitment to improving healthcare logistics infrastructure will likely facilitate better access to temperature-sensitive pharmaceuticals, ultimately benefiting both providers and consumers in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Refrigerated Transport Temperature-Controlled Warehousing Cold Chain Monitoring Solutions Packaging Solutions Others |

| By End-User | Pharmaceuticals Biotechnology Healthcare Providers Research Institutions Others |

| By Distribution Mode | Direct Distribution Third-Party Logistics E-commerce Platforms Others |

| By Application | Vaccines Blood Products Biologics Clinical Trials Others |

| By Sales Channel | Online Sales Retail Sales Wholesale Distribution Others |

| By Price Range | Budget Mid-Range Premium |

| By Policy Support | Subsidies for Cold Chain Infrastructure Tax Incentives for Logistics Providers Grants for Technology Adoption |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Distribution Logistics | 100 | Logistics Directors, Supply Chain Managers |

| Cold Chain Compliance and Regulation | 80 | Regulatory Affairs Managers, Quality Assurance Officers |

| Temperature-Controlled Storage Solutions | 70 | Warehouse Managers, Operations Supervisors |

| Last-Mile Delivery in Pharma | 90 | Delivery Managers, Logistics Coordinators |

| Pharmaceutical Supply Chain Innovations | 75 | R&D Managers, Technology Officers |

The South Africa Cold Chain and Pharma Logistics Market is valued at approximately USD 1.2 billion, reflecting a significant growth driven by the increasing demand for temperature-sensitive products in the pharmaceutical and biotechnology sectors.