Region:Asia

Author(s):Shubham

Product Code:KRAD3101

Pages:87

Published On:January 2026

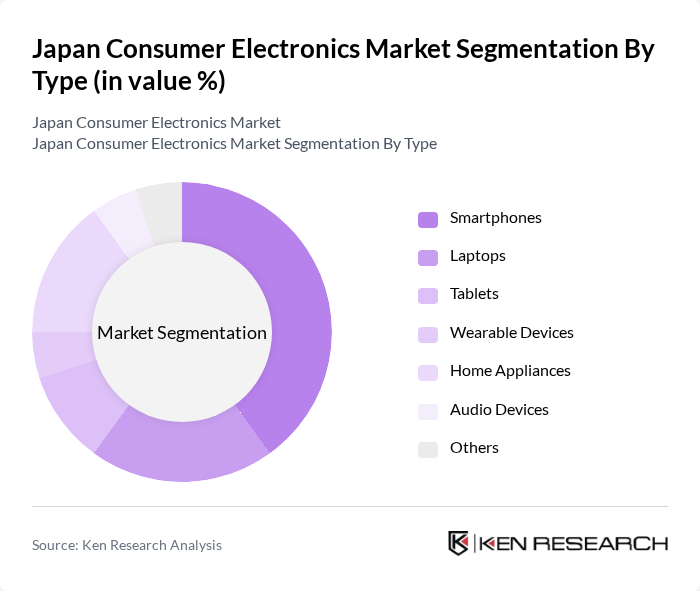

By Type:The consumer electronics market in Japan is segmented into various types, including smartphones, laptops, tablets, wearable devices, home appliances, audio devices, and others. Among these, smartphones and home appliances are the most significant contributors to market revenue. The increasing demand for smart home technologies and the proliferation of mobile devices have driven growth in these segments. Consumer preferences are shifting towards multifunctional devices that enhance convenience and connectivity.

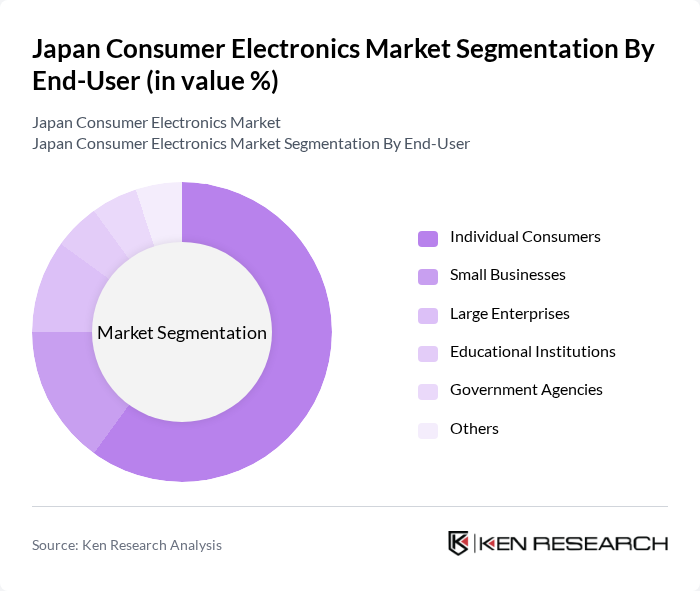

By End-User:The end-user segmentation of the consumer electronics market includes individual consumers, small businesses, large enterprises, educational institutions, government agencies, and others. Individual consumers dominate the market, driven by the increasing adoption of personal electronics and smart home devices. The trend towards remote work and online education has also boosted demand from small businesses and educational institutions, highlighting the diverse applications of consumer electronics across various sectors.

The Japan Consumer Electronics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Sony Corporation, Panasonic Corporation, Sharp Corporation, Toshiba Corporation, Hitachi, Ltd., Fujitsu Limited, NEC Corporation, Canon Inc., Nikon Corporation, Mitsubishi Electric Corporation, JVC Kenwood Corporation, Seiko Epson Corporation, Yamaha Corporation, Casio Computer Co., Ltd., Brother Industries, Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Japan consumer electronics market appears promising, driven by ongoing technological innovations and evolving consumer preferences. As the market adapts to the increasing demand for smart and eco-friendly products, companies are likely to invest in sustainable practices and advanced technologies. The integration of AI and IoT will further enhance user experiences, while the expansion into rural markets presents new growth avenues. Overall, the market is poised for transformation, with a focus on enhancing connectivity and sustainability.

| Segment | Sub-Segments |

|---|---|

| By Type | Smartphones Laptops Tablets Wearable Devices Home Appliances Audio Devices Others |

| By End-User | Individual Consumers Small Businesses Large Enterprises Educational Institutions Government Agencies Others |

| By Distribution Channel | Online Retail Brick-and-Mortar Stores Direct Sales Wholesale Distributors Others |

| By Price Range | Budget Mid-Range Premium Luxury Others |

| By Brand Loyalty | Brand Loyal Customers Price-Sensitive Customers Quality-Conscious Customers Others |

| By Product Lifecycle Stage | Introduction Stage Growth Stage Maturity Stage Decline Stage Others |

| By Technological Integration | Smart Technology Traditional Technology Hybrid Technology Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Smartphone Market Insights | 120 | Consumers aged 18-45, Tech-savvy Individuals |

| Laptop Purchase Behavior | 100 | Students, Professionals, IT Managers |

| Home Appliance Trends | 80 | Homeowners, Family Decision Makers |

| Wearable Technology Adoption | 70 | Fitness Enthusiasts, Health-conscious Consumers |

| Consumer Electronics After-sales Service | 90 | Customer Service Managers, Warranty Administrators |

The Japan Consumer Electronics Market is valued at approximately USD 105 billion, reflecting significant growth driven by technological advancements, increased demand for smart devices, and a shift towards home automation and AI-enabled appliances.