Region:Asia

Author(s):Shubham

Product Code:KRAD3100

Pages:83

Published On:January 2026

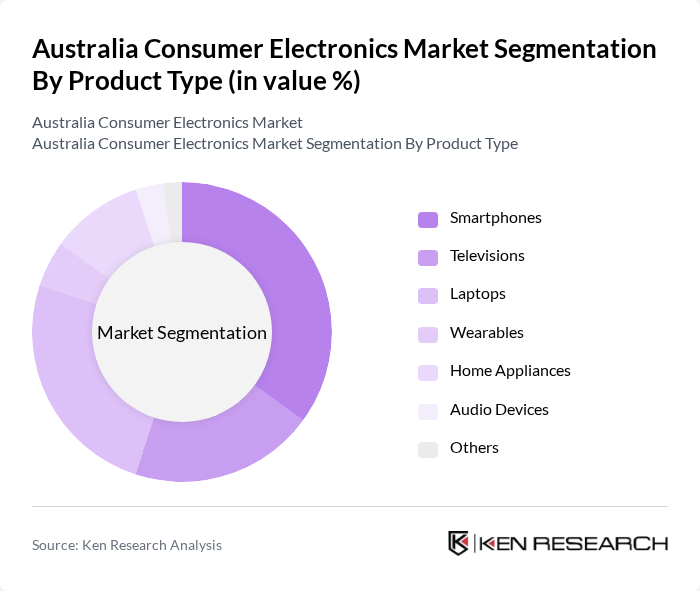

By Product Type:The product type segmentation includes various categories such as smartphones, televisions, laptops, wearables, home appliances, audio devices, and others. Among these, smartphones and laptops are the leading segments, driven by the increasing reliance on mobile technology and remote work trends. The demand for smart TVs and home appliances has also surged, reflecting consumer preferences for integrated and connected devices.

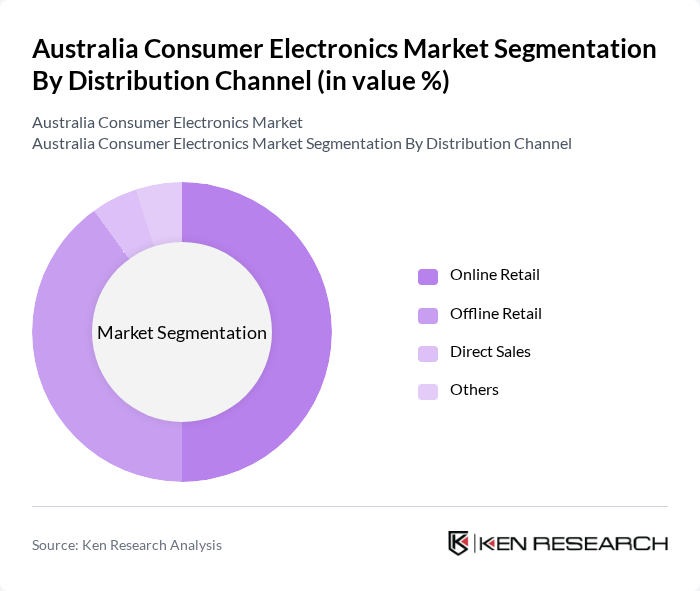

By Distribution Channel:The distribution channel segmentation encompasses online retail, offline retail, direct sales, and others. Online retail has gained significant traction, especially during the pandemic, as consumers increasingly prefer the convenience of shopping from home. Offline retail remains relevant, particularly in urban areas where consumers value the tactile experience of purchasing electronics in-store.

The Australia Consumer Electronics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Samsung Electronics Australia, Sony Australia, LG Electronics Australia, Apple Australia, Panasonic Australia, Microsoft Australia, Dell Australia, HP Australia, Lenovo Australia, JBL Australia, Bose Australia, Google Australia, Fitbit Australia, Xiaomi Australia, and Asus Australia contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Australian consumer electronics market appears promising, driven by technological advancements and evolving consumer preferences. As the integration of artificial intelligence and smart technologies becomes more prevalent, companies are likely to innovate their product offerings. Additionally, the focus on sustainability will push manufacturers to develop eco-friendly products, aligning with consumer demand for environmentally responsible options. This dynamic environment will foster growth and adaptation in the industry, ensuring its resilience in the face of challenges.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Smartphones Televisions Laptops Wearables Home Appliances Audio Devices Others |

| By Distribution Channel | Online Retail Offline Retail Direct Sales Others |

| By Price Tier | Premium Mid-range Budget Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Smartphone Market Insights | 150 | Consumers aged 18-45, Tech Enthusiasts |

| Laptop Purchase Behavior | 100 | Students, Professionals, IT Managers |

| Home Appliance Trends | 80 | Homeowners, Interior Designers |

| Wearable Technology Adoption | 70 | Fitness Enthusiasts, Health Professionals |

| Consumer Electronics Retail Experience | 90 | Retail Managers, Sales Associates |

The Australia Consumer Electronics Market is valued at approximately USD 27 billion, driven by technological advancements, increased consumer spending, and the rising demand for smart devices and immersive experiences.