Region:Middle East

Author(s):Shubham

Product Code:KRAD3098

Pages:82

Published On:January 2026

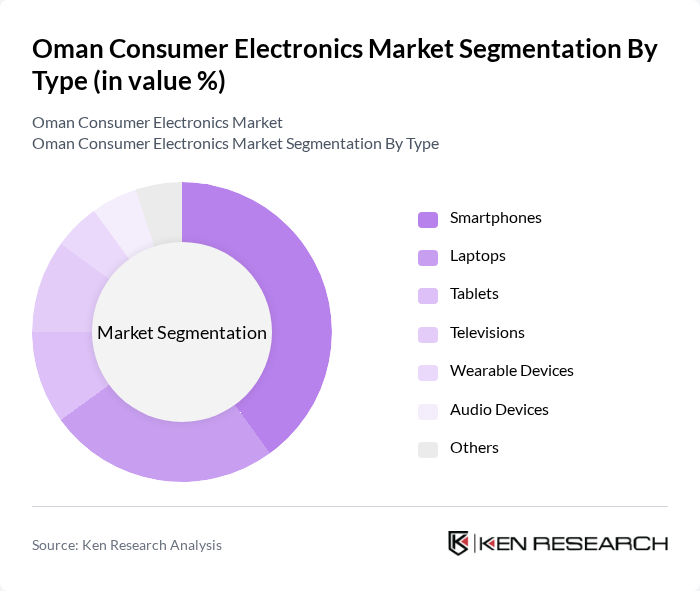

By Type:The consumer electronics market can be segmented into various types, including smartphones, laptops & notebooks, tablets & e-readers, televisions & smart TVs, wearable devices, audio devices, and others. Among these, smartphones and laptops are the most significant contributors to market revenue, driven by the increasing reliance on mobile technology and the demand for portable computing solutions. The trend towards remote work and online education has further accelerated the adoption of these devices.

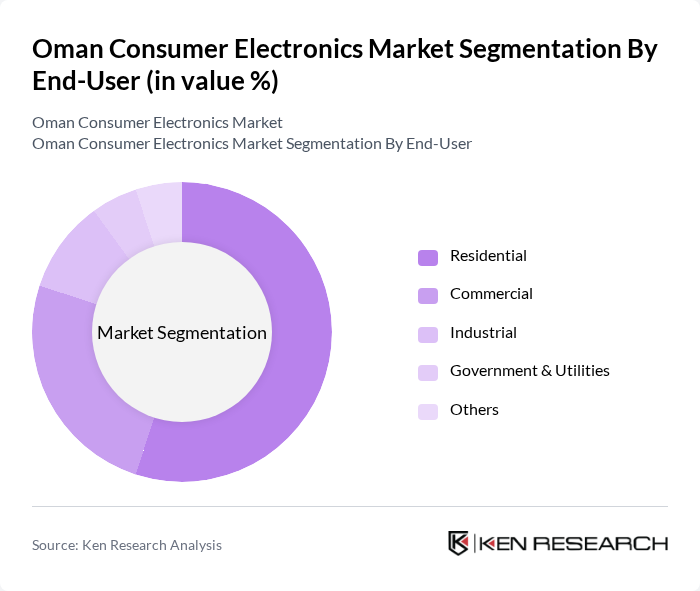

By End-User:The end-user segmentation includes residential, commercial, educational institutions, government & utilities, and others. The residential segment dominates the market, driven by the increasing adoption of smart home technologies and consumer electronics for personal use. The commercial sector is also growing, particularly in sectors like education and hospitality, where technology plays a crucial role in enhancing service delivery.

The Oman Consumer Electronics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Samsung Electronics, LG Electronics, Sony Corporation, Huawei Technologies, Apple Inc., Xiaomi Corporation, Panasonic Corporation, Dell Technologies, HP Inc., Lenovo Group, AsusTek Computer Inc., Microsoft Corporation, Philips Electronics, TCL Technology, OnePlus Technology contribute to innovation, geographic expansion, and service delivery in this space.

The Oman consumer electronics market is poised for significant transformation, driven by technological advancements and changing consumer preferences. The increasing integration of artificial intelligence and IoT devices is expected to redefine user experiences, enhancing convenience and functionality. Additionally, the shift towards eco-friendly products will likely gain momentum, as consumers become more environmentally conscious. Companies that adapt to these trends and invest in innovative solutions will be well-positioned to capture emerging opportunities in this dynamic market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Smartphones Laptops Tablets Televisions Wearable Devices Audio Devices Others |

| By End-User | Residential Commercial Industrial Government & Utilities Others |

| By Distribution Channel | Online Retail Offline Retail Direct Sales Distributors Others |

| By Brand | Local Brands International Brands Premium Brands Budget Brands Others |

| By Price Range | Low-End Mid-Range High-End Luxury Others |

| By Technology | Smart Technology Traditional Technology Hybrid Technology Others |

| By Application | Home Use Office Use Educational Use Entertainment Use Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Electronics Retailers | 150 | Store Managers, Sales Executives |

| Online Electronics Shoppers | 120 | Frequent Online Buyers, Tech Enthusiasts |

| Distributors of Consumer Electronics | 100 | Distribution Managers, Supply Chain Coordinators |

| Market Analysts and Consultants | 80 | Market Researchers, Industry Analysts |

| Consumer Electronics Repair Services | 70 | Service Center Managers, Technicians |

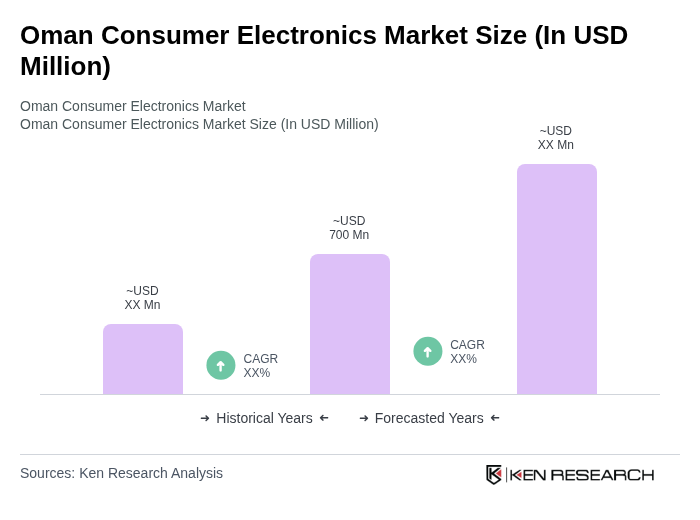

The Oman Consumer Electronics Market is valued at approximately USD 700 million, driven by factors such as increasing disposable incomes, urbanization, and a tech-savvy young population demanding smart devices and advanced technologies.