Region:Middle East

Author(s):Shubham

Product Code:KRAD3097

Pages:93

Published On:January 2026

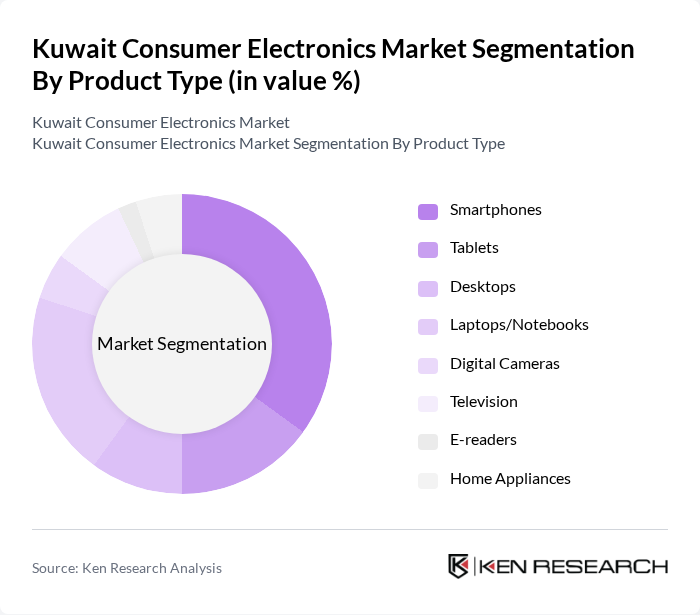

By Product Type:The product type segmentation includes various categories such as smartphones, tablets, desktops, laptops/notebooks, digital cameras, televisions, e-readers, and home appliances. Among these, smartphones and home appliances are particularly dominant due to their essential role in daily life and the increasing trend towards smart home technology. The demand for smartphones is driven by the need for connectivity and advanced features, while home appliances are increasingly sought after for their energy efficiency and smart capabilities.

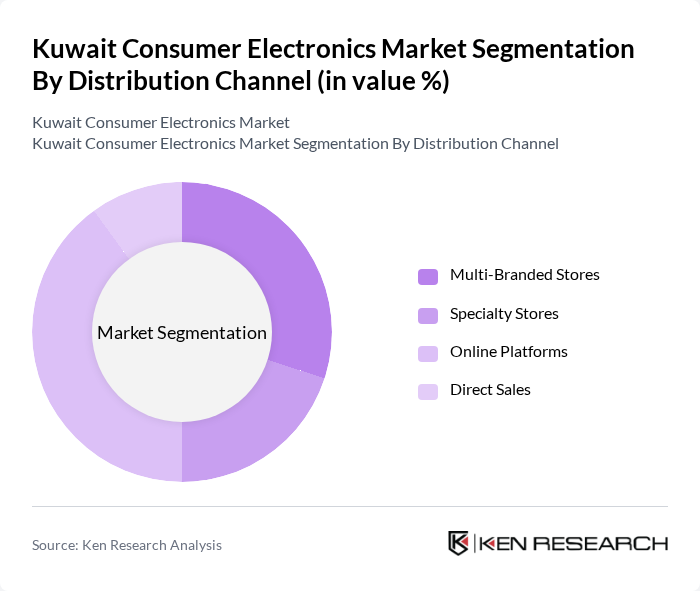

By Distribution Channel:The distribution channel segmentation encompasses multi-branded stores, specialty stores, online platforms, and direct sales. Online platforms have gained significant traction, especially post-pandemic, as consumers increasingly prefer the convenience of shopping from home. Multi-branded stores remain popular due to their wide selection and competitive pricing, while specialty stores cater to niche markets with specific product offerings.

The Kuwait Consumer Electronics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Apple, Samsung Electronics, Huawei, HP, Dell, Sony, Panasonic, Sharp, Midea, Electrolux, LG Electronics, Xiaomi, Alghanim Electronics, Carrefour Kuwait, and Lulu Hypermarket contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait consumer electronics market appears promising, driven by technological advancements and changing consumer preferences. As the adoption of 5G technology accelerates, it will enable faster connectivity and enhance the functionality of smart devices. Additionally, the growing trend towards eco-friendly products is likely to shape consumer choices, pushing brands to innovate sustainably. These factors will create a dynamic environment for growth, fostering opportunities for both established and emerging players in the market.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Smartphones Tablets Desktops Laptops/Notebooks Digital Cameras Television E-readers Home Appliances |

| By Distribution Channel | Multi-Branded Stores Specialty Stores Online Platforms Direct Sales |

| By Technology | Smart Technology Energy-Efficient Models Traditional Technology |

| By Price Range | Budget Mid-Range Premium |

| By End-User | Residential Commercial Industrial |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Electronics Retailers | 150 | Store Managers, Sales Executives |

| Online Electronics Marketplaces | 100 | eCommerce Managers, Digital Marketing Specialists |

| Consumer Insights on Electronics Purchases | 120 | General Consumers, Tech Enthusiasts |

| Product Development in Electronics | 80 | Product Managers, R&D Engineers |

| After-Sales Service Providers | 70 | Service Managers, Customer Support Representatives |

The Kuwait Consumer Electronics Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by increasing disposable incomes and a tech-savvy population. This market is particularly influenced by rising consumer spending on smartphones and home appliances.