Region:Asia

Author(s):Shubham

Product Code:KRAD3096

Pages:97

Published On:January 2026

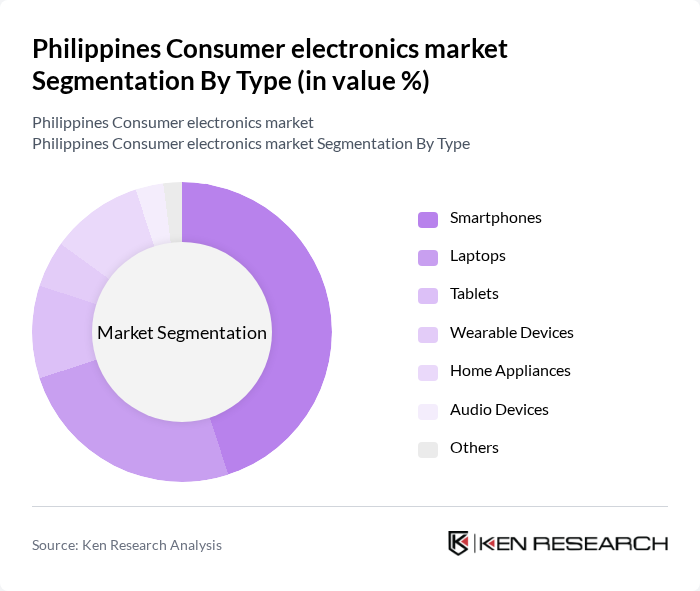

By Type:The consumer electronics market can be segmented into various types, including smartphones, laptops, tablets, wearable devices, home appliances, audio devices, and others. Among these, smartphones dominate the market due to their essential role in daily communication and internet access, making up over 55% of spending with strong demand for affordable feature-rich devices. The increasing demand for high-performance devices with advanced features including AI and IoT integration drives the growth of this segment. Laptops and home appliances also show significant market presence, catering to both personal and professional needs amid rising preference for energy-efficient appliances.

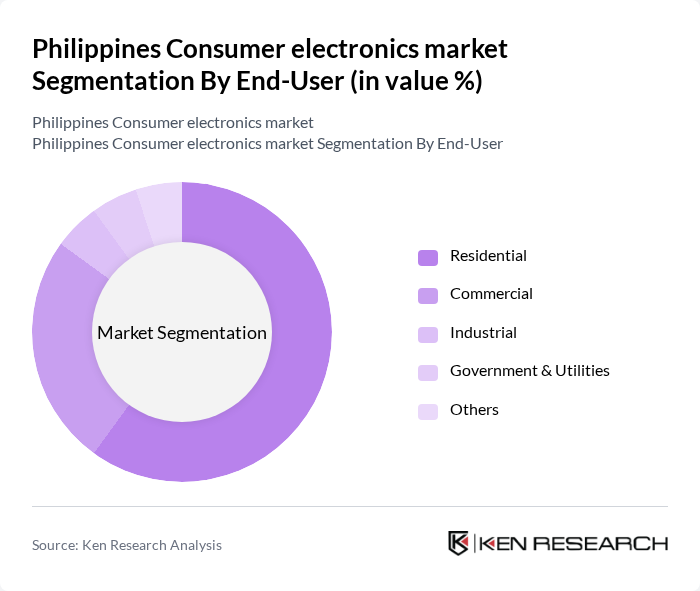

By End-User:The consumer electronics market is segmented by end-user into residential, commercial, industrial, government & utilities, and others. The residential segment leads the market, driven by the increasing adoption of smart home technologies and consumer electronics for personal use including AI-powered voice assistants and smart TVs. The commercial segment is also growing, as businesses invest in technology to enhance productivity and efficiency. The industrial and government sectors are gradually increasing their technology adoption, contributing to overall market growth.

The Philippines Consumer electronics market is characterized by a dynamic mix of regional and international players. Leading participants such as Samsung Electronics Philippines Corporation, LG Electronics Philippines, Inc., Sony Philippines, Inc., Xiaomi Philippines, ASUS Technology Philippines, Inc., Lenovo Philippines, Inc., Huawei Technologies (Philippines) Co., Ltd., Oppo Philippines, Vivo Philippines, Realme Philippines, Apple Philippines, TCL Electronics Philippines, Panasonic Manufacturing Philippines Corporation, Sharp Philippines Corporation, JBL Philippines contribute to innovation, geographic expansion, and service delivery in this space.

The Philippines consumer electronics market is poised for significant growth, driven by technological advancements and changing consumer preferences. As the demand for smart home devices and wearable technology increases, companies are expected to invest in research and development to enhance product offerings. Additionally, the integration of AI and IoT in consumer electronics will create new opportunities for innovation. The focus on sustainability will also shape product development, as consumers increasingly seek eco-friendly options in their purchasing decisions.

| Segment | Sub-Segments |

|---|---|

| By Type | Smartphones Laptops Tablets Wearable Devices Home Appliances Audio Devices Others |

| By End-User | Residential Commercial Industrial Government & Utilities Others |

| By Region | Luzon Visayas Mindanao |

| By Technology | LCD/LED OLED G Technology Smart Technology |

| By Application | Personal Use Business Use Educational Use Others |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Policy Support | Subsidies Tax Exemptions Regulatory Credits (RECs) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Smartphone Market Insights | 120 | Consumers aged 18-45, Tech Enthusiasts |

| Laptop Purchase Behavior | 100 | Students, Professionals, IT Managers |

| Home Appliance Trends | 80 | Homeowners, Newlyweds, Family Decision Makers |

| Consumer Electronics E-commerce Preferences | 100 | Online Shoppers, Digital Natives |

| Brand Loyalty in Electronics | 90 | Brand Advocates, Frequent Buyers |

The Philippines consumer electronics market is valued at approximately USD 10 billion, driven by increasing disposable incomes, urbanization, and a growing middle class that demands advanced technology and connectivity.