Region:Asia

Author(s):Shubham

Product Code:KRAD3071

Pages:83

Published On:January 2026

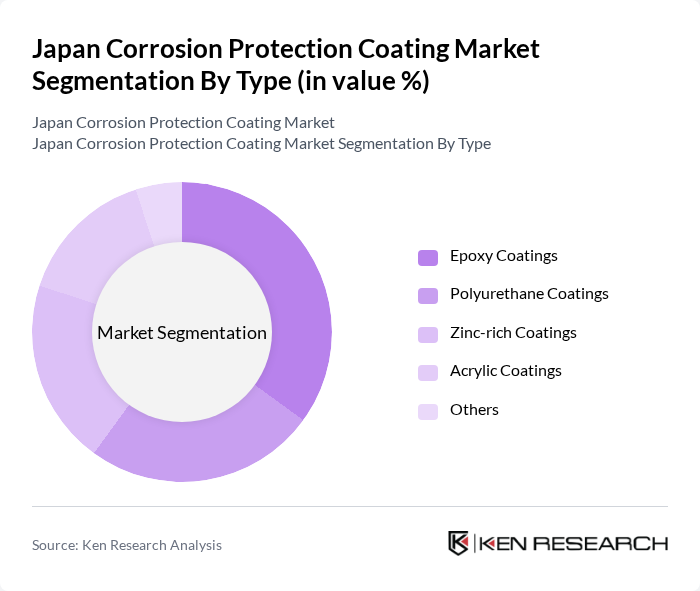

By Type:The market is segmented into various types of coatings, including Epoxy Coatings, Polyurethane Coatings, Zinc-rich Coatings, Acrylic Coatings, and Others. Each type serves specific applications and industries, with varying properties and performance characteristics.

The Epoxy Coatings segment is currently leading the market due to its excellent adhesion, chemical resistance, and durability, making it a preferred choice for industrial applications. The growing demand for high-performance coatings in sectors such as oil and gas, marine, and construction is driving the popularity of epoxy coatings. Additionally, advancements in formulation technology are enhancing the performance characteristics of epoxy coatings, further solidifying their market leadership.

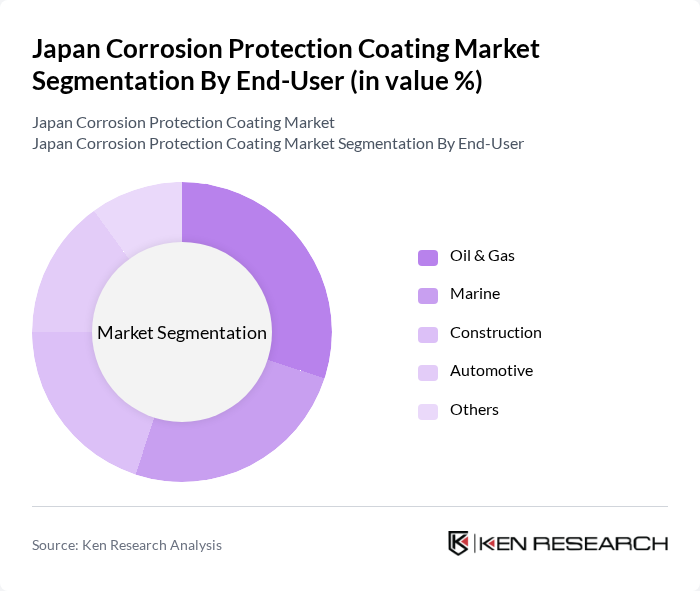

By End-User:The market is categorized based on end-users, including Oil & Gas, Marine, Construction, Automotive, and Others. Each end-user segment has unique requirements and applications for corrosion protection coatings.

The Oil & Gas sector is the dominant end-user of corrosion protection coatings, driven by the need for reliable and durable coatings to protect infrastructure from harsh environmental conditions. The increasing investments in oil and gas exploration and production activities, along with stringent safety regulations, are propelling the demand for high-performance coatings in this sector. Additionally, the marine industry also significantly contributes to the market, requiring specialized coatings to withstand corrosive marine environments.

The Japan Corrosion Protection Coating Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nippon Paint Holdings Co., Ltd., Kansai Paint Co., Ltd., Jotun A/S, AkzoNobel N.V., PPG Industries, Inc., Sherwin-Williams Company, BASF SE, Hempel A/S, RPM International Inc., Tnemec Company, Inc., Sika AG, Henkel AG & Co. KGaA, 3M Company, DuPont de Nemours, Inc., Valspar Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Japan corrosion protection coating market appears promising, driven by ongoing industrialization and a heightened focus on sustainability. As companies increasingly adopt eco-friendly practices, the demand for innovative, high-performance coatings is expected to rise. Additionally, the integration of smart technologies in coatings will likely enhance their functionality, leading to broader applications across various sectors. The market is poised for growth as industries prioritize long-term asset protection and environmental compliance, creating a dynamic landscape for manufacturers and suppliers.

| Segment | Sub-Segments |

|---|---|

| By Type | Epoxy Coatings Polyurethane Coatings Zinc-rich Coatings Acrylic Coatings Others |

| By End-User | Oil & Gas Marine Construction Automotive Others |

| By Application | Industrial Equipment Infrastructure Transportation Power Generation Others |

| By Formulation | Solvent-based Coatings Water-based Coatings Powder Coatings Others |

| By Region | Kanto Kansai Chubu Kyushu Others |

| By Technology | Conventional Coating Technology Advanced Coating Technology Others |

| By Market Channel | Direct Sales Distributors Online Sales Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Coating Applications | 100 | Production Managers, Quality Control Engineers |

| Marine Coating Solutions | 80 | Marine Engineers, Procurement Specialists |

| Industrial Equipment Protection | 90 | Maintenance Managers, Operations Directors |

| Construction Sector Coatings | 70 | Project Managers, Site Supervisors |

| Research & Development in Coating Technologies | 60 | R&D Managers, Product Development Engineers |

The Japan Corrosion Protection Coating Market is valued at approximately USD 2.1 billion, reflecting a significant growth driven by demand across various industries, including construction, automotive, and marine, alongside advancements in technology and sustainability practices.