Philippines Corrosion Protection Coating Market Overview

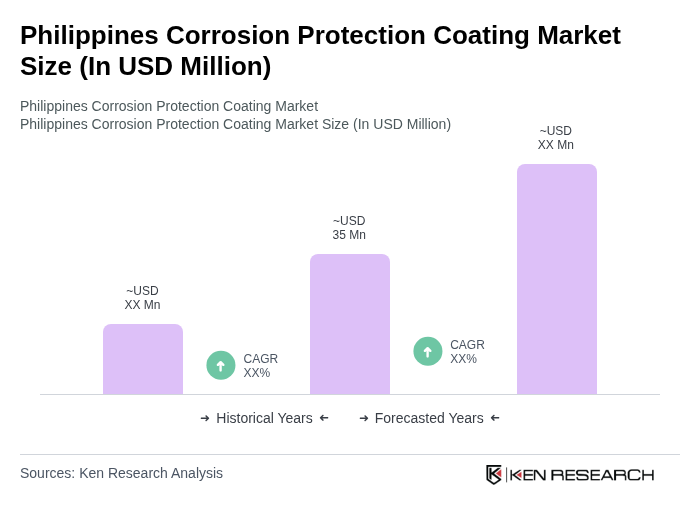

- The Philippines Corrosion Protection Coating Market is valued at approximately USD 35 million, based on a five-year historical analysis. This growth is primarily driven by the increasing demand for protective coatings in various industries, including construction, automotive, marine, oil & gas, power generation, and transportation, as well as the rising awareness of the importance of corrosion prevention in extending the lifespan of infrastructure and equipment.

- Metro Manila, Cebu, and Davao are the dominant cities in the Philippines Corrosion Protection Coating Market. Metro Manila, being the capital and the most populous region, has a high concentration of industrial activities and infrastructure projects. Cebu serves as a major trade and commerce hub, while Davao is rapidly developing, contributing to the demand for corrosion protection solutions.

- The Republic Act No. 12009 or the "New Government Procurement Act," 2024 issued by the Philippine Government, mandates the use of high-quality, durable, and corrosion-resistant materials in public infrastructure projects exceeding PHP 1 million in value. This regulation requires compliance through standardized bidding processes, performance standards for materials, and certification for longevity in harsh environments, thereby promoting the adoption of advanced corrosion protection coatings across various sectors.

Philippines Corrosion Protection Coating Market Segmentation

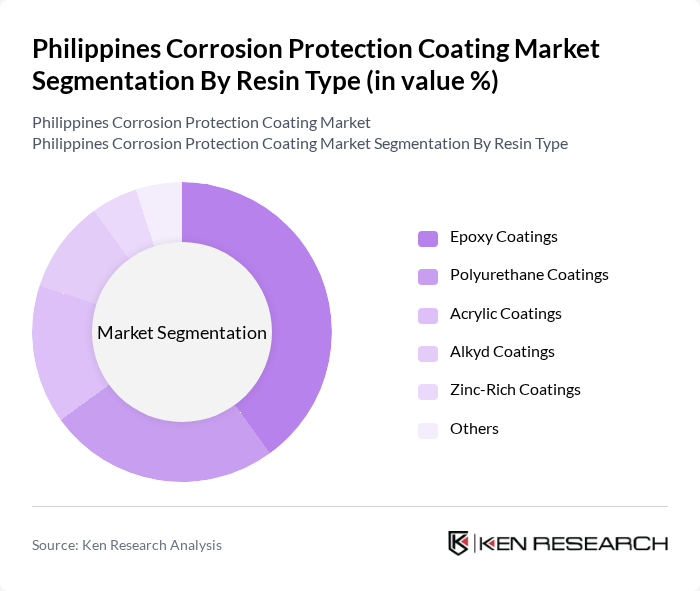

By Resin Type:

The resin type segmentation includes Epoxy Coatings, Polyurethane Coatings, Acrylic Coatings, Alkyd Coatings, Zinc-Rich Coatings, and Others. Among these, Epoxy Coatings dominate the market due to their excellent adhesion, chemical resistance, and durability, making them ideal for industrial applications. The growing construction and automotive sectors are driving the demand for epoxy coatings, as they provide long-lasting protection against corrosion. Polyurethane Coatings are also gaining traction due to their flexibility and aesthetic appeal, particularly in architectural applications.

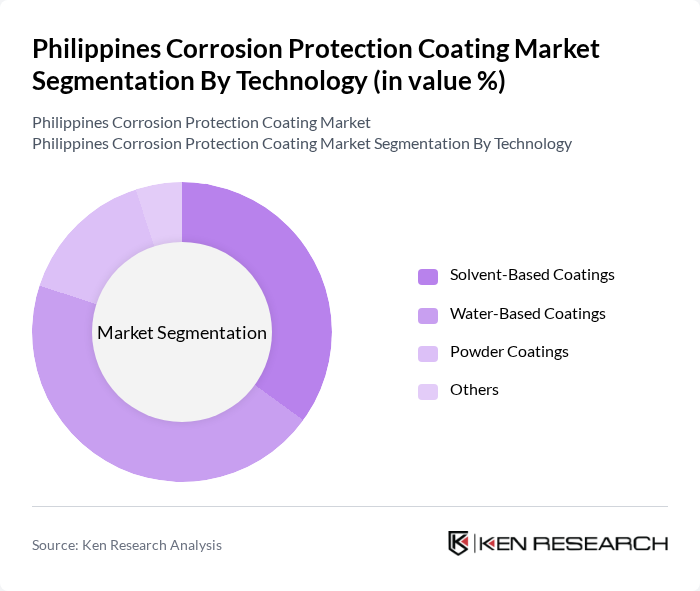

By Technology:

The technology segmentation includes Solvent-Based Coatings, Water-Based Coatings, Powder Coatings, and Others. Water-Based Coatings are leading the market due to their eco-friendliness and low VOC emissions, aligning with global sustainability trends. The increasing regulatory pressure for environmentally safe products is driving the shift towards water-based solutions. Solvent-Based Coatings still hold a significant share due to their superior performance in harsh environments, particularly in industrial applications.

Philippines Corrosion Protection Coating Market Competitive Landscape

The Philippines Corrosion Protection Coating Market is characterized by a dynamic mix of regional and international players. Leading participants such as Jotun Philippines, Inc., PPG Industries, Inc., Sherwin-Williams Company, AkzoNobel N.V., BASF SE, Hempel A/S, RPM International Inc., Carboline Company, Tnemec Company, Inc., Nippon Paint Holdings Co., Ltd., Asian Paints PPG Pvt. Ltd., Berger Paints Philippines, Inc., Valspar Corporation, DuPont de Nemours, Inc., 3M Company contribute to innovation, geographic expansion, and service delivery in this space.

Philippines Corrosion Protection Coating Market Industry Analysis

Growth Drivers

- Increasing Infrastructure Development:The Philippines is projected to invest approximately PHP 9 trillion (USD 180 billion) in infrastructure projects in the future, significantly boosting the demand for corrosion protection coatings. This investment is driven by the government's "Build, Build, Build" program, which aims to enhance transportation, utilities, and public facilities. As infrastructure expands, the need for durable coatings to protect against corrosion in various environments becomes critical, thereby driving market growth.

- Rising Demand from the Oil and Gas Sector:The oil and gas sector in the Philippines is expected to grow by 6% annually, reaching a market value of PHP 1.5 trillion (USD 30 billion) in the future. This growth is fueled by increasing exploration and production activities in offshore fields. Corrosion protection coatings are essential for maintaining the integrity of pipelines and storage facilities, thus creating a robust demand for advanced coating solutions tailored to this sector's specific needs.

- Technological Advancements in Coating Solutions:The Philippines is witnessing a surge in the adoption of innovative coating technologies, with investments in R&D reaching PHP 600 million (USD 12 million) in the future. These advancements include the development of high-performance, long-lasting coatings that offer superior corrosion resistance. As industries seek to enhance operational efficiency and reduce maintenance costs, the demand for these advanced solutions is expected to rise, further propelling market growth.

Market Challenges

- High Initial Costs of Coating Solutions:The initial investment for high-quality corrosion protection coatings can be substantial, often exceeding PHP 1,200 per liter (USD 24). This cost barrier can deter small and medium-sized enterprises from adopting advanced solutions, limiting market penetration. As a result, many businesses may opt for cheaper alternatives that do not provide adequate protection, leading to increased long-term maintenance costs and potential asset failures.

- Limited Awareness Among End-Users:A significant portion of end-users in the Philippines remains unaware of the benefits of corrosion protection coatings, with only 35% of industrial operators actively utilizing these solutions. This lack of awareness can hinder market growth, as potential customers may not recognize the long-term cost savings and operational efficiencies that effective coatings can provide. Educational initiatives are essential to bridge this knowledge gap and stimulate demand.

Philippines Corrosion Protection Coating Market Future Outlook

The Philippines corrosion protection coating market is poised for significant growth, driven by increasing infrastructure investments and technological advancements. As industries prioritize sustainability, the shift towards eco-friendly coatings will gain momentum, aligning with global environmental standards. Additionally, the rising demand for customized solutions tailored to specific industry needs will further enhance market dynamics. Collaborative efforts between manufacturers and government initiatives will also play a crucial role in fostering innovation and expanding market reach, ensuring a robust future for the industry.

Market Opportunities

- Development of Eco-Friendly Coatings:The growing emphasis on sustainability presents a significant opportunity for manufacturers to develop eco-friendly corrosion protection coatings. With the Philippine government promoting green initiatives, products that comply with environmental regulations can capture a larger market share, appealing to environmentally conscious consumers and industries.

- Collaborations with Key Industry Players:Strategic partnerships with major players in construction and manufacturing can enhance market penetration for coating solutions. Collaborations can lead to innovative product development and expanded distribution networks, allowing companies to leverage existing relationships and access new customer bases, ultimately driving growth in the corrosion protection coating market.