Region:Global

Author(s):Shubham

Product Code:KRAD3072

Pages:82

Published On:January 2026

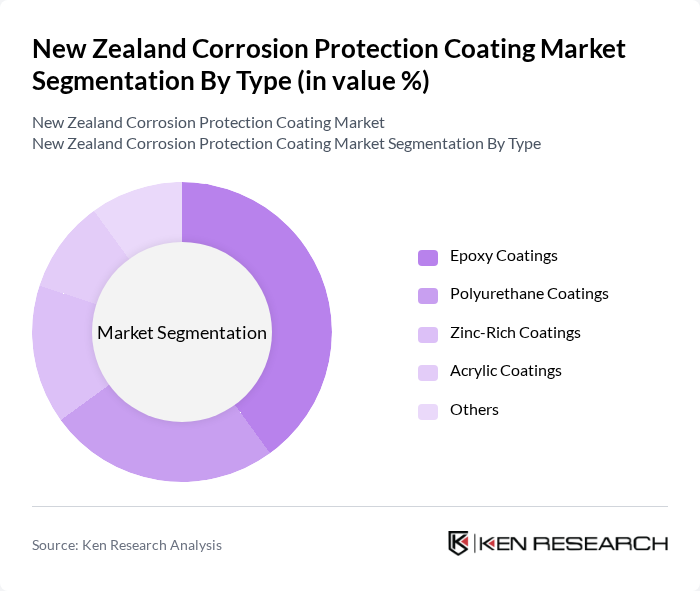

By Type:

The market is segmented into various types of coatings, including Epoxy Coatings, Polyurethane Coatings, Zinc-Rich Coatings, Acrylic Coatings, and Others. Among these, Epoxy Coatings dominate the market due to their excellent adhesion, chemical resistance, and durability, making them ideal for industrial applications. The growing trend towards high-performance coatings in sectors such as construction and automotive further solidifies the position of epoxy coatings as the leading sub-segment.

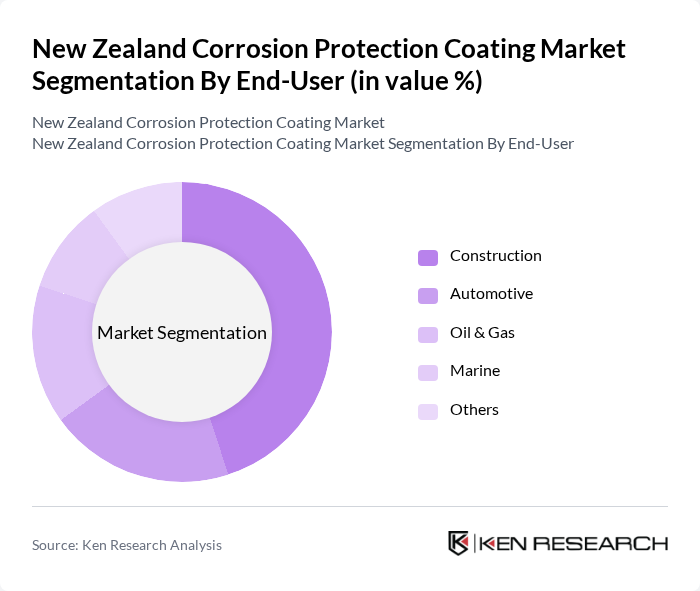

By End-User:

The end-user segmentation includes Construction, Automotive, Oil & Gas, Marine, and Others. The Construction sector is the leading end-user, driven by the increasing demand for protective coatings in building and infrastructure projects. The focus on enhancing the lifespan of structures and compliance with safety standards contributes to the dominance of this segment, as it requires robust corrosion protection solutions.

The New Zealand Corrosion Protection Coating Market is characterized by a dynamic mix of regional and international players. Leading participants such as DuluxGroup, PPG Industries, AkzoNobel, Jotun, Sherwin-Williams, Hempel, Rust-Oleum, BASF, Sika, Carboline, International Paint, Valspar, Tnemec Company, RPM International, Hempel A/S contribute to innovation, geographic expansion, and service delivery in this space.

The New Zealand corrosion protection coating market is poised for significant growth, driven by increasing infrastructure investments and a shift towards sustainable practices. As industries adopt eco-friendly coatings and smart technologies, the market will likely see enhanced product offerings. Additionally, the integration of IoT in coating solutions will provide real-time monitoring capabilities, further driving demand. Overall, the market is expected to evolve, focusing on innovation and sustainability to meet the changing needs of various sectors.

| Segment | Sub-Segments |

|---|---|

| By Type | Epoxy Coatings Polyurethane Coatings Zinc-Rich Coatings Acrylic Coatings Others |

| By End-User | Construction Automotive Oil & Gas Marine Others |

| By Application | Protective Coatings Decorative Coatings Industrial Coatings Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Geography | North Island South Island |

| By Coating Technology | Solvent-Based Coatings Water-Based Coatings Powder Coatings Others |

| By Market Segment | Commercial Residential Industrial Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Marine Coating Applications | 100 | Marine Engineers, Shipyard Managers |

| Industrial Coating Solutions | 80 | Plant Managers, Maintenance Supervisors |

| Infrastructure Protection Coatings | 90 | Civil Engineers, Project Managers |

| Corrosion Prevention Technologies | 70 | R&D Managers, Product Development Engineers |

| Regulatory Compliance in Coatings | 60 | Compliance Officers, Environmental Managers |

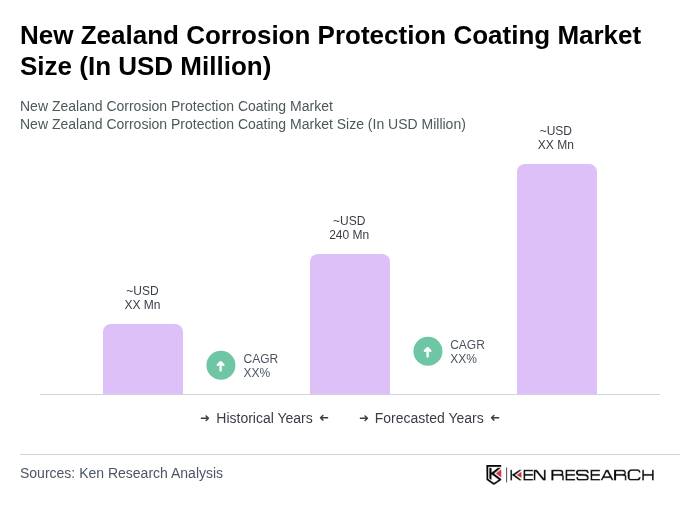

The New Zealand Corrosion Protection Coating Market is valued at approximately USD 240 million, reflecting a five-year historical analysis. This growth is driven by increasing industrial activities and infrastructure development, alongside a focus on asset longevity and compliance with environmental regulations.