Thailand Corrosion Protection Coating Market Overview

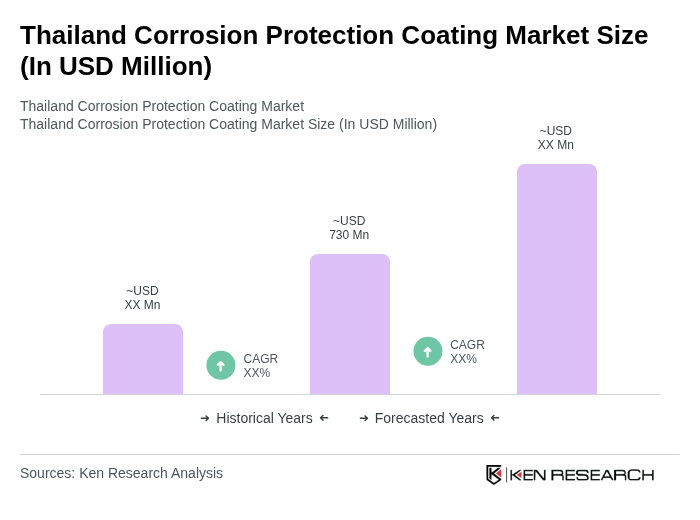

- The Thailand Corrosion Protection Coating Market is valued at USD 730 million, based on a five-year historical analysis. This growth is primarily driven by the increasing demand for protective coatings in various industries, including automotive, construction, and oil & gas, alongside rapid urbanization, government infrastructure projects in the Eastern Economic Corridor, and rising needs in marine and renewable energy sectors. The rising awareness of corrosion-related issues and the need for durable and long-lasting coatings have further propelled market expansion.

- Key cities such as Bangkok, Chonburi, and Rayong dominate the market due to their industrial activities and infrastructure development. Bangkok, as the capital, serves as a hub for various industries, while Chonburi and Rayong are known for their manufacturing and shipping activities, making them critical players in the corrosion protection coating sector.

- The Green Label Scheme, 1994 issued by the Thailand Business Council for Sustainable Development (TBCSD) under the Ministry of Natural Resources and Environment, mandates eco-friendly low-VOC coatings for public infrastructure projects exceeding THB 10 million in value. This initiative requires compliance certification for paints used in government buildings, bridges, and roads, covering scope for volatile organic compounds below 50 g/L and heavy metal restrictions, thereby enhancing the demand for advanced corrosion protection solutions.

Thailand Corrosion Protection Coating Market Segmentation

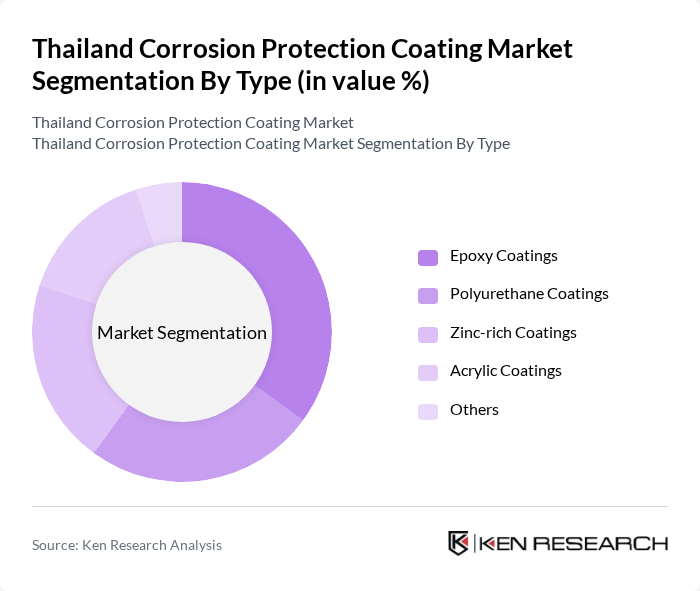

By Type:The market is segmented into various types of coatings, including Epoxy Coatings, Polyurethane Coatings, Zinc-rich Coatings, Acrylic Coatings, and Others. Each type serves specific applications and industries, contributing to the overall market dynamics.

The Epoxy Coatings segment is currently dominating the market due to their excellent adhesion, chemical resistance, and durability, making them ideal for various industrial applications. The automotive and construction sectors are particularly inclined towards epoxy coatings for their protective properties against corrosion and wear. Additionally, the growing trend of using epoxy coatings in marine applications further solidifies their market leadership.

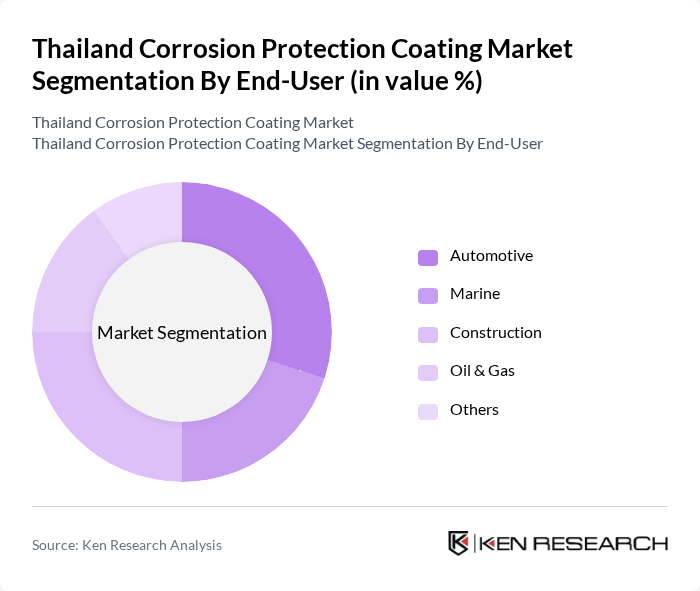

By End-User:The market is segmented based on end-users, including Automotive, Marine, Construction, Oil & Gas, and Others. Each end-user category has distinct requirements and preferences for corrosion protection solutions.

The Automotive segment is leading the market due to the increasing production of vehicles and the need for protective coatings to enhance durability and aesthetics. The demand for corrosion-resistant coatings in automotive applications is driven by consumer preferences for long-lasting and low-maintenance vehicles. Additionally, the construction sector is also witnessing significant growth, fueled by ongoing infrastructure projects and urban development.

Thailand Corrosion Protection Coating Market Competitive Landscape

The Thailand Corrosion Protection Coating Market is characterized by a dynamic mix of regional and international players. Leading participants such as PPG Industries, AkzoNobel, Sherwin-Williams, BASF, Jotun, Hempel, RPM International, Kansai Paint, Nippon Paint, Tnemec Company, Carboline Company, Valspar, Sika AG, DuPont, 3M Company contribute to innovation, geographic expansion, and service delivery in this space.

Thailand Corrosion Protection Coating Market Industry Analysis

Growth Drivers

- Increasing Industrialization and Infrastructure Development:Thailand's industrial sector is projected to contribute approximately THB 3.5 trillion to the GDP in future, driven by significant investments in infrastructure projects. The government has allocated THB 1.2 trillion for infrastructure development, including transportation and energy sectors. This surge in industrial activity necessitates effective corrosion protection coatings to enhance the longevity of structures and machinery, thereby driving market demand significantly.

- Rising Awareness of Corrosion Prevention:The awareness of corrosion-related issues has increased, with an estimated 30% of industrial maintenance budgets in Thailand now allocated to corrosion prevention. This shift is supported by industry reports indicating that corrosion costs the Thai economy around THB 200 billion annually. As businesses recognize the financial implications of corrosion, the demand for protective coatings is expected to rise, fostering market growth.

- Government Initiatives Promoting Sustainable Practices:The Thai government has introduced various initiatives aimed at promoting sustainable practices, including the "Thailand 4.0" policy, which emphasizes eco-friendly technologies. In future, the government plans to invest THB 500 million in research and development for sustainable materials, including corrosion-resistant coatings. This investment is expected to stimulate innovation and increase the adoption of environmentally friendly coatings in various industries.

Market Challenges

- High Initial Costs of Corrosion Protection Coatings:The initial investment required for high-quality corrosion protection coatings can be substantial, often exceeding THB 1 million for large-scale applications. This financial barrier can deter small and medium-sized enterprises from adopting these essential coatings, limiting market penetration. As a result, many businesses may opt for cheaper alternatives, which may not provide adequate protection, posing a challenge to market growth.

- Limited Availability of Skilled Labor:The corrosion protection coating industry in Thailand faces a significant challenge due to a shortage of skilled labor. According to the Ministry of Labor, there is a gap of approximately 50,000 skilled workers in the coatings sector. This shortage hampers the effective application of coatings and can lead to subpar results, ultimately affecting the overall market growth and the quality of corrosion protection solutions available.

Thailand Corrosion Protection Coating Market Future Outlook

The future of the corrosion protection coating market in Thailand appears promising, driven by technological advancements and increasing environmental awareness. The shift towards smart coatings, which can self-repair and provide real-time monitoring, is expected to gain traction. Additionally, the integration of nanotechnology in coatings is anticipated to enhance performance and durability. As industries increasingly prioritize sustainability, the demand for eco-friendly coatings will likely rise, creating new avenues for growth and innovation in the market.

Market Opportunities

- Expansion in the Automotive and Aerospace Sectors:The automotive sector in Thailand is projected to produce over 2 million vehicles in future, creating a substantial demand for corrosion protection coatings. Similarly, the aerospace industry is expected to grow by 10% annually, further driving the need for advanced coatings that ensure durability and safety in these high-performance applications.

- Increasing Demand for Eco-Friendly Coatings:With the Thai government promoting sustainable practices, the demand for eco-friendly coatings is set to rise. The market for these coatings is expected to reach THB 1 billion by future, driven by consumer preferences for environmentally responsible products. This trend presents a significant opportunity for manufacturers to innovate and capture a growing segment of environmentally conscious consumers.