Region:Asia

Author(s):Geetanshi

Product Code:KRAB0146

Pages:95

Published On:August 2025

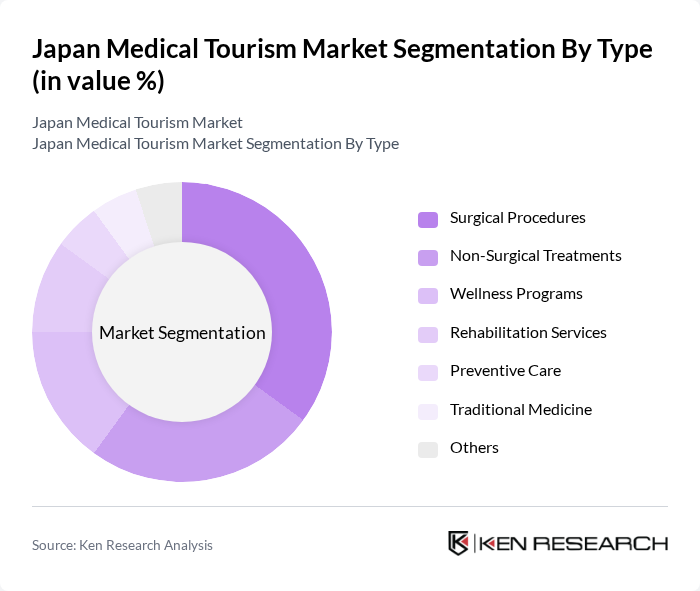

By Type:This segmentation includes various categories of medical services offered to international patients. The subsegments are Surgical Procedures, Non-Surgical Treatments, Wellness Programs, Rehabilitation Services, Preventive Care, Traditional Medicine, and Others. Each of these categories caters to different patient needs and preferences, reflecting the diverse offerings in the medical tourism sector .

The Surgical Procedures subsegment dominates the market due to the high demand for advanced surgical techniques and specialized treatments, particularly in fields such as orthopedic surgery, oncology, and cardiovascular interventions. Patients are increasingly seeking high-quality surgical options that Japan is renowned for, leading to a significant influx of international patients. Non-Surgical Treatments also hold a substantial share, driven by the popularity of aesthetic procedures, regenerative medicine, and alternative therapies. The trend towards wellness and preventive care is growing, but surgical procedures remain the primary focus for medical tourists .

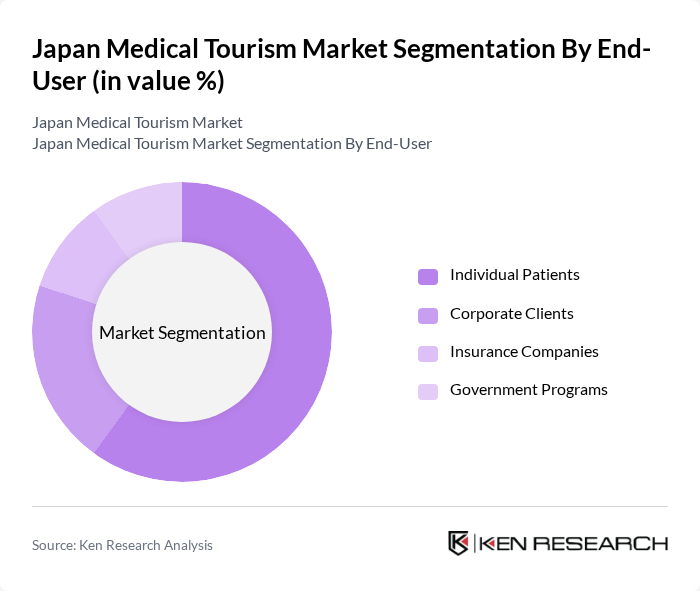

By End-User:This segmentation categorizes the market based on the type of clients utilizing medical tourism services. The subsegments include Individual Patients, Corporate Clients, Insurance Companies, and Government Programs. Each group has distinct needs and motivations for seeking medical services abroad .

Individual Patients represent the largest segment, driven by personal health needs and the desire for specialized treatments not available in their home countries. Corporate Clients are increasingly seeking medical tourism options for employee health benefits, while Insurance Companies and Government Programs are beginning to recognize the cost-effectiveness of medical tourism for their clients. The focus on individual patients highlights the personalized nature of medical tourism, where patients seek tailored healthcare solutions .

The Japan Medical Tourism Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tokyo Medical University Hospital, Keio University Hospital, St. Luke's International Hospital, Osaka University Hospital, Juntendo University Hospital, Kameda Medical Center, Shonan Kamakura General Hospital, Yokohama City University Medical Center, Nagoya University Hospital, Kobe University Hospital, Fujita Health University Hospital, Tohoku University Hospital, Chiba University Hospital, Showa University Hospital, Sapporo Medical University Hospital contribute to innovation, geographic expansion, and service delivery in this space.

The future of Japan's medical tourism market appears promising, driven by increasing global health awareness and the rising demand for specialized medical services. As the country enhances its healthcare infrastructure and invests in digital health solutions, it is likely to attract a broader range of international patients. Additionally, the integration of wellness tourism into medical packages will further bolster the sector, creating a holistic approach to health that appeals to a diverse clientele seeking comprehensive care and recovery experiences.

| Segment | Sub-Segments |

|---|---|

| By Type | Surgical Procedures Non-Surgical Treatments Wellness Programs Rehabilitation Services Preventive Care Traditional Medicine Others |

| By End-User | Individual Patients Corporate Clients Insurance Companies Government Programs |

| By Service Provider | Private Hospitals Public Hospitals Clinics Medical Tourism Agencies Wellness Centers |

| By Destination | Tokyo Osaka Kyoto Yokohama |

| By Treatment Type | Cardiovascular Treatments Oncology (Cancer Treatments) Neurology Orthopedic Surgery Cosmetic Surgery Dental Care Fertility Treatments Others |

| By Payment Method | Out-of-Pocket Payments Insurance Coverage Financing Options |

| By Duration of Stay | Short-term Visits Long-term Stays Extended Care |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| International Patient Experiences | 100 | Patients who traveled to Japan for medical treatment |

| Healthcare Provider Insights | 80 | Doctors, Surgeons, and Hospital Administrators |

| Travel Agency Perspectives | 60 | Travel Agents specializing in medical tourism |

| Insurance Company Feedback | 50 | Insurance Underwriters and Claims Adjusters |

| Government Policy Makers | 40 | Officials from health and tourism ministries |

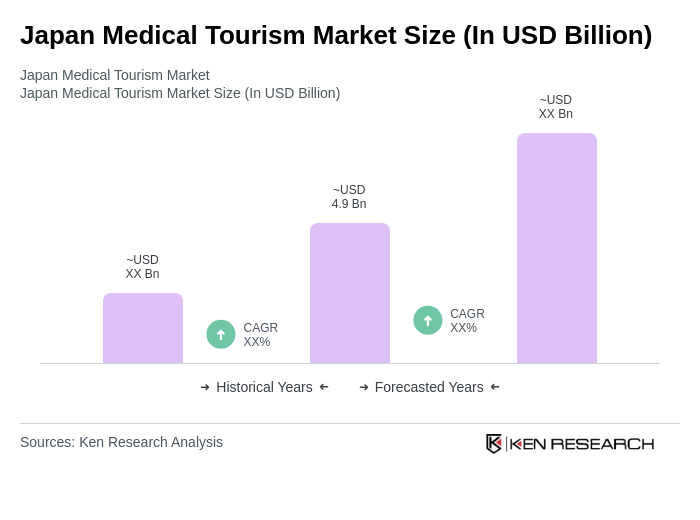

The Japan Medical Tourism Market is valued at approximately USD 4.9 billion, reflecting a significant growth trend driven by the country's advanced healthcare infrastructure and high-quality medical services that attract international patients seeking specialized treatments.