Region:Europe

Author(s):Shubham

Product Code:KRAC0671

Pages:81

Published On:August 2025

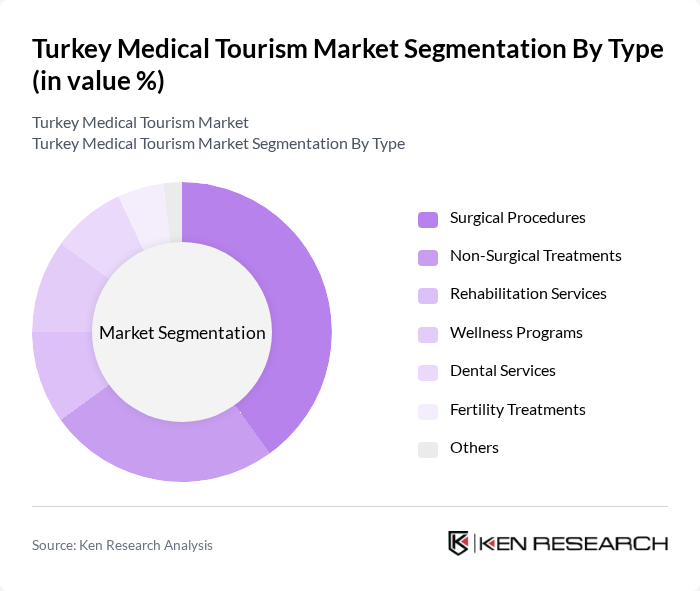

By Type:The market is segmented into various types of medical services, including surgical procedures, non-surgical treatments, rehabilitation services, wellness programs, dental services, fertility treatments, and others. Among these, surgical procedures are the most sought-after due to the high demand for cosmetic, orthopedic, and transplant-related surgeries, alongside strong volumes in ophthalmology and hair restoration. Non-surgical treatments are also gaining popularity as patients look for less invasive options and faster recovery pathways .

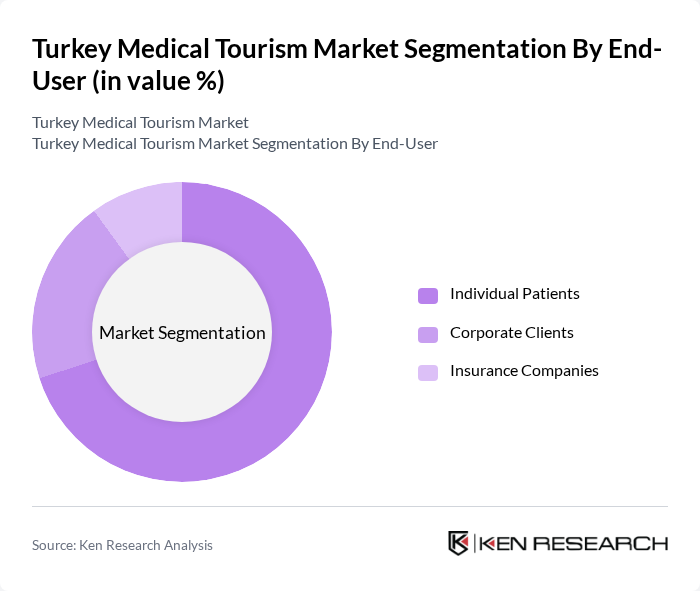

By End-User:The market is segmented based on end-users, including individual patients, corporate clients, and insurance companies. Individual patients dominate the market as they seek affordable and high-quality medical treatments abroad, especially in elective specialties (aesthetics, dental, ophthalmic, hair, and orthopedic). Corporate clients are increasingly opting for structured cross-border care and check-up packages, while insurance-linked medical travel remains a smaller but gradually formalizing segment supported by accredited providers and facilitator networks .

The Turkey Medical Tourism Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ac?badem Healthcare Group, Anadolu Medical Center (Affiliated with Johns Hopkins Medicine), Medical Park Hospitals (MLP Care), Florence Nightingale Hospitals, Liv Hospital, Memorial Healthcare Group, Medipol Mega University Hospital (?stanbul Medipol Üniversitesi), VKV American Hospital (Vehbi Koç Foundation), Istinye University Hospital (?stinye Üniversitesi Hastanesi), Emsey Hospital, Dunyagoz Hospitals Group (Dünya Göz), DentGroup (Dental Clinics Network), EsteWorld (Aesthetics & Hair Transplant), Turkiye Health Tourism Association (TÜSATDER), Hisar Hospital Intercontinental contribute to innovation, geographic expansion, and service delivery in this space .

The future of Turkey's medical tourism market appears promising, driven by increasing global healthcare demands and the country's strategic initiatives to enhance its healthcare infrastructure. With a projected annual growth rate of 15% in medical tourism arrivals, Turkey is likely to expand its service offerings, focusing on niche markets such as fertility treatments and geriatric care. Additionally, the integration of digital health solutions will further streamline patient experiences, making Turkey an attractive destination for international patients seeking comprehensive healthcare services.

| Segment | Sub-Segments |

|---|---|

| By Type | Surgical Procedures Non-Surgical Treatments Rehabilitation Services Wellness Programs Dental Services Fertility Treatments Others |

| By End-User | Individual Patients Corporate Clients Insurance Companies |

| By Service Provider | Private Hospitals Clinics Medical Tourism Agencies |

| By Destination | Istanbul Antalya Izmir Bursa Others |

| By Treatment Type | Cosmetic and Plastic Surgery Dental Treatment Hair Transplantation Orthopedic and Spine Surgery Cardiovascular (Cardiac) Procedures Oncology (Cancer) Treatments IVF and Reproductive Medicine Ophthalmology (Eye) Procedures Bariatric and Metabolic Surgery Organ Transplantation |

| By Payment Method | Out-of-Pocket Payments International Insurance Coverage Financing/Installment Plans |

| By Duration of Stay | Short-Term Stays Long-Term Stays Others |

| By Source Country | Middle East and North Africa Europe (EU/UK) CIS and Central Asia North America Others |

| By Care Setting | Inpatient Outpatient/Day Care |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cosmetic Surgery Patients | 120 | International Patients, Medical Tourism Facilitators |

| Dental Care Seekers | 100 | Patients from Europe and the Middle East, Dental Clinics |

| Fertility Treatment Clients | 80 | Couples Seeking IVF, Fertility Specialists |

| Orthopedic Surgery Patients | 70 | Patients from North America, Orthopedic Surgeons |

| Health and Wellness Tourists | 90 | Wellness Retreat Organizers, Health Tourists |

The Turkey Medical Tourism Market is valued at approximately USD 4.0 billion, reflecting a consistent growth trend supported by increasing international patient volumes and competitive healthcare pricing in accredited hospitals.