Region:Asia

Author(s):Dev

Product Code:KRAB2091

Pages:82

Published On:October 2025

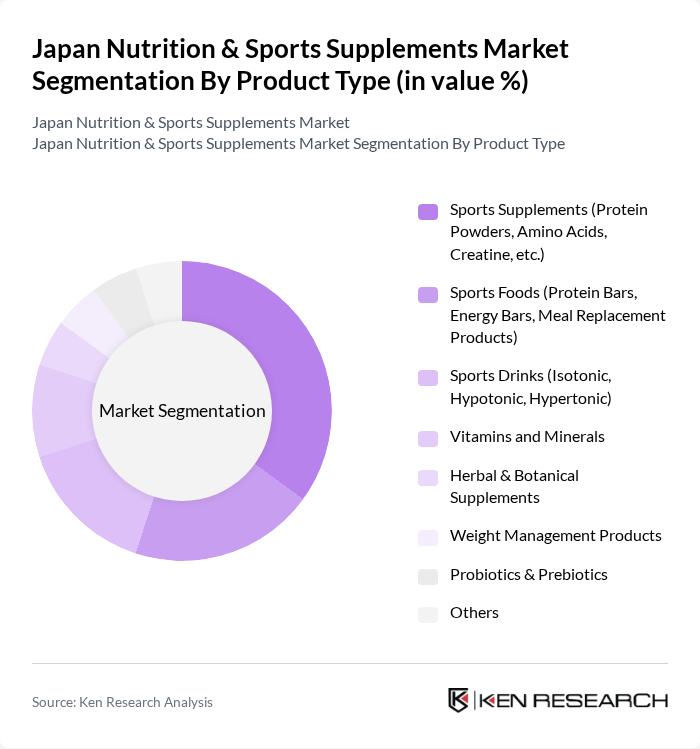

By Product Type:The product type segmentation includes various categories such as Sports Supplements, Sports Foods, Sports Drinks, Vitamins and Minerals, Herbal & Botanical Supplements, Weight Management Products, Probiotics & Prebiotics, and Others. Among these, Sports Supplements, particularly protein powders and amino acids, dominate the market due to the increasing number of fitness enthusiasts and athletes seeking performance-enhancing products. The trend towards health and fitness has led to a surge in demand for these products, making them a key driver of market growth. Sports Foods are also experiencing rapid growth, particularly with the popularity of protein bars and meal replacement products .

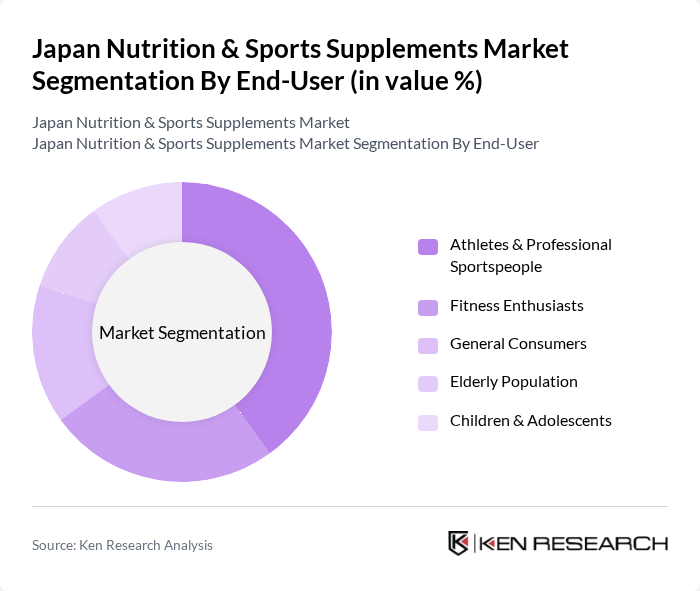

By End-User:The end-user segmentation includes Athletes & Professional Sportspeople, Fitness Enthusiasts, General Consumers, Elderly Population, and Children & Adolescents. Athletes and professional sportspeople represent the largest segment, driven by their need for specialized nutrition to enhance performance and recovery. This segment's growth is fueled by the increasing participation in competitive sports and the rising awareness of the importance of nutrition in athletic performance. Fitness enthusiasts are also a rapidly growing segment, reflecting the broader adoption of active lifestyles and preventive health measures .

The Japan Nutrition & Sports Supplements Market is characterized by a dynamic mix of regional and international players. Leading participants such as Otsuka Pharmaceutical Co., Ltd., Asahi Group Holdings, Ltd., Meiji Holdings Co., Ltd., Yakult Honsha Co., Ltd., Kewpie Corporation, DHC Corporation, FANCL Corporation, Ajinomoto Co., Inc., Suntory Holdings Limited, Shiseido Company, Limited, Kirin Holdings Company, Limited, Nissin Foods Holdings Co., Ltd., Maruha Nichiro Corporation, House Foods Group Inc., Morinaga & Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Japan nutrition and sports supplements market appears promising, driven by evolving consumer preferences and technological advancements. Personalization in product offerings is expected to gain traction, as consumers increasingly seek tailored solutions to meet their specific health needs. Additionally, the integration of digital platforms for marketing and sales will likely enhance consumer engagement, allowing brands to connect more effectively with their target audiences and adapt to changing market dynamics.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Sports Supplements (Protein Powders, Amino Acids, Creatine, etc.) Sports Foods (Protein Bars, Energy Bars, Meal Replacement Products) Sports Drinks (Isotonic, Hypotonic, Hypertonic) Vitamins and Minerals Herbal & Botanical Supplements Weight Management Products Probiotics & Prebiotics Others |

| By End-User | Athletes & Professional Sportspeople Fitness Enthusiasts General Consumers Elderly Population Children & Adolescents |

| By Distribution Channel | Online Retail Supermarkets/Hypermarkets Specialty Stores (Sports Nutrition Stores, Health Food Stores) Pharmacies & Drugstores Convenience Stores |

| By Form | Powder Tablets & Capsules Liquid Bars Gummies |

| By Price Range | Premium Mid-Range Budget |

| By Brand Type | Domestic Brands Private Labels International Brands |

| By Consumer Demographics | Age Group Gender Income Level |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Usage of Sports Supplements | 120 | Active Gym-Goers, Amateur Athletes |

| Retail Insights on Supplement Sales | 60 | Store Managers, Sales Representatives |

| Expert Opinions on Nutrition Trends | 40 | Nutritionists, Sports Dietitians |

| Fitness Industry Perspectives | 50 | Fitness Trainers, Gym Owners |

| Market Trends in Supplement Formulations | 45 | Product Developers, R&D Managers |

The Japan Nutrition & Sports Supplements Market is valued at approximately USD 2.8 billion, reflecting a significant growth trend driven by increasing health consciousness, fitness activities, and preventive healthcare among consumers.