Region:Central and South America

Author(s):Rebecca

Product Code:KRAB1689

Pages:80

Published On:October 2025

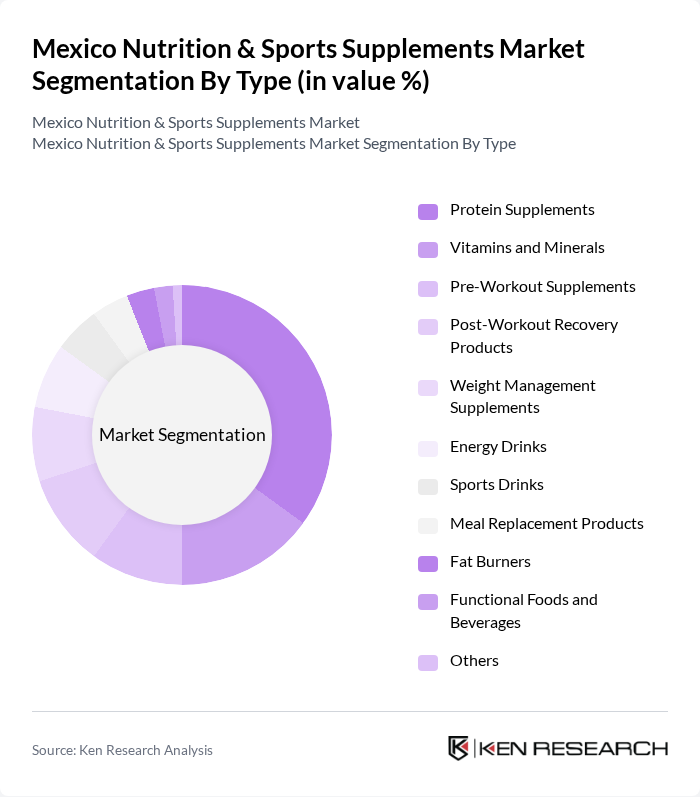

By Type:The market is segmented into various types of products, including protein supplements, vitamins and minerals, pre-workout supplements, post-workout recovery products, weight management supplements, energy drinks, sports drinks, meal replacement products, fat burners, functional foods and beverages, and others. Among these, protein supplements are popular due to their widespread use among athletes and fitness enthusiasts seeking muscle recovery and growth. The increasing trend of fitness and bodybuilding has significantly contributed to the popularity of protein supplements, making them a staple in the nutrition regimen of many consumers.

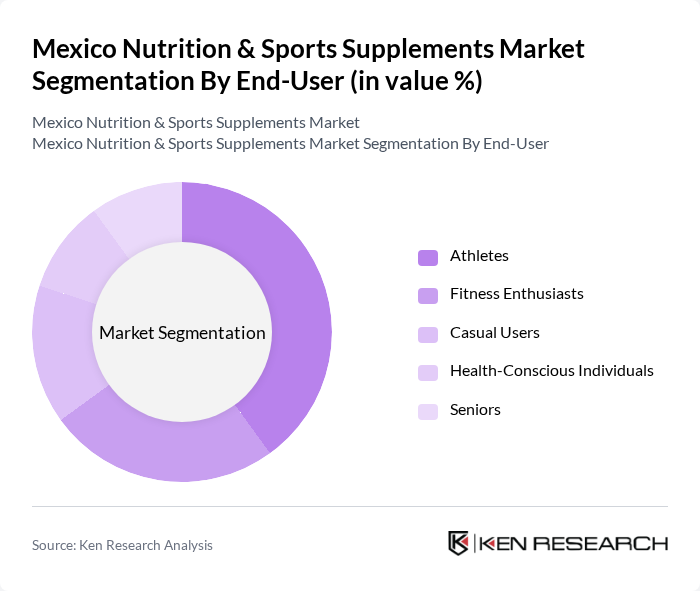

By End-User:The end-user segmentation includes athletes, fitness enthusiasts, casual users, health-conscious individuals, and seniors. Athletes represent a significant segment, driven by their need for specialized nutrition to enhance performance and recovery. Fitness enthusiasts also contribute significantly to the market, as they actively seek products that support their workout regimes. The growing awareness of health and wellness among casual users and seniors is also leading to increased consumption of sports supplements, further diversifying the market.

The Mexico Nutrition & Sports Supplements Market is characterized by a dynamic mix of regional and international players. Leading participants such as Herbalife Nutrition Ltd., GNC Holdings, Inc., Amway Corporation, Optimum Nutrition (Glanbia Performance Nutrition), Nature’s Bounty (The Bountiful Company), USANA Health Sciences, Inc., Isagenix International LLC, Quest Nutrition (The Simply Good Foods Company), BioPower Nutrition, Jamieson Wellness Inc., NOW Foods, Solgar (Nestlé Health Science), Vital Proteins LLC, Nature’s Way Products, LLC, Pioneer Supplements contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Mexico nutrition and sports supplements market appears promising, driven by a growing emphasis on health and wellness among consumers. As more individuals adopt fitness-oriented lifestyles, the demand for tailored nutrition solutions is expected to rise. Additionally, advancements in technology, such as personalized nutrition apps and wearable fitness devices, will likely enhance consumer engagement and product effectiveness, further propelling market growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Protein Supplements Vitamins and Minerals Pre-Workout Supplements Post-Workout Recovery Products Weight Management Supplements Energy Drinks Sports Drinks Meal Replacement Products Fat Burners Functional Foods and Beverages Others |

| By End-User | Athletes Fitness Enthusiasts Casual Users Health-Conscious Individuals Seniors |

| By Distribution Channel | Online Retail Supermarkets/Hypermarkets Specialty Stores Pharmacies Direct Sales |

| By Packaging Type | Bottles Sachets Tubs Pouches Cans |

| By Price Range | Economy Mid-Range Premium |

| By Brand Type | National Brands Private Labels International Brands |

| By Consumer Demographics | Age Group Gender Income Level Lifestyle |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sales of Sports Supplements | 100 | Store Managers, Sales Representatives |

| Consumer Preferences in Nutrition | 120 | Fitness Enthusiasts, Health-Conscious Consumers |

| Distribution Channels Analysis | 80 | Distributors, Wholesalers |

| Market Trends in Dietary Supplements | 60 | Nutritionists, Health Coaches |

| Impact of E-commerce on Supplement Sales | 40 | E-commerce Managers, Digital Marketing Specialists |

The Mexico Nutrition & Sports Supplements Market is valued at approximately USD 16 billion. This growth is driven by increasing health consciousness, a rise in fitness activities, and the popularity of sports nutrition products among consumers.