Region:Europe

Author(s):Geetanshi

Product Code:KRAB1423

Pages:97

Published On:October 2025

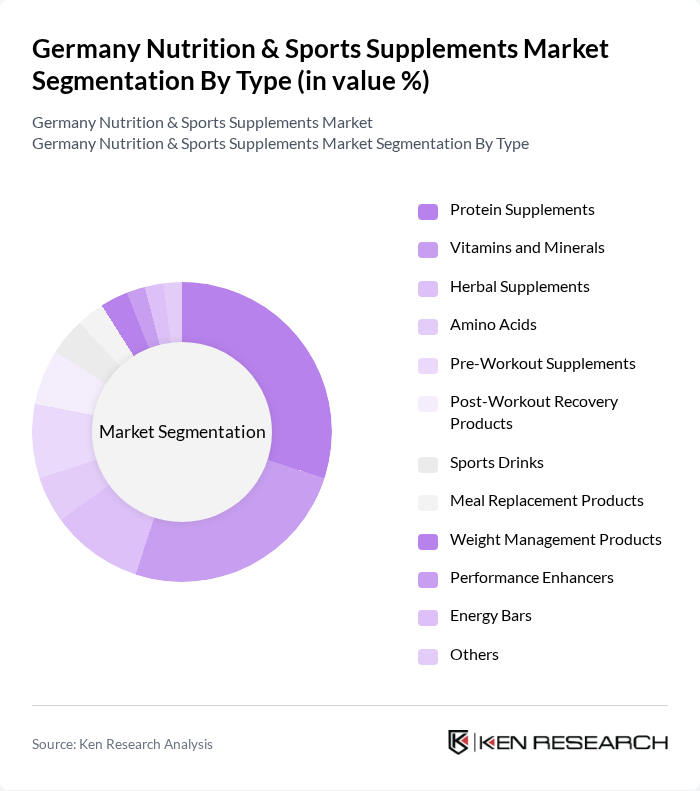

By Type:The market is segmented into various types of products, including Protein Supplements, Vitamins and Minerals, Herbal Supplements, Amino Acids, Pre-Workout Supplements, Post-Workout Recovery Products, Sports Drinks, Meal Replacement Products, Weight Management Products, Performance Enhancers, Energy Bars, and Others. Among these, Protein Supplements are particularly popular due to their effectiveness in muscle recovery and growth, appealing to both athletes and fitness enthusiasts. Vitamins and Minerals also hold a significant share as consumers increasingly focus on overall health and wellness.

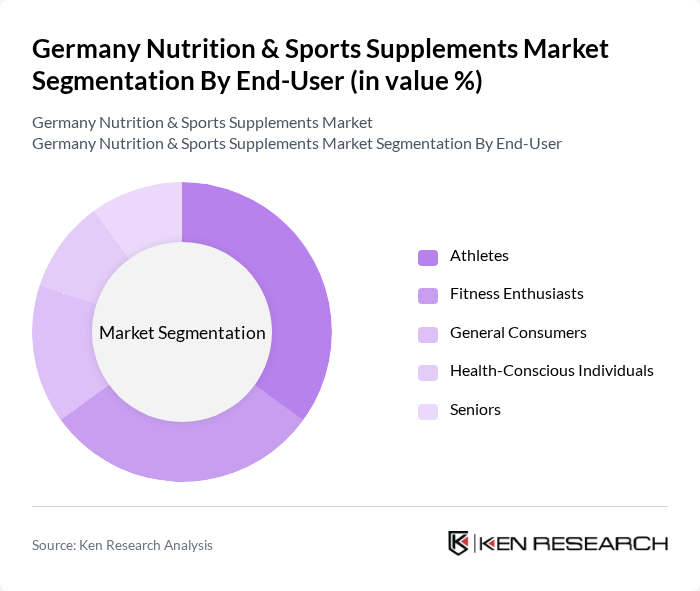

By End-User:The end-user segmentation includes Athletes, Fitness Enthusiasts, General Consumers, Health-Conscious Individuals, and Seniors. Athletes and Fitness Enthusiasts are the primary consumers of sports supplements, driven by their need for enhanced performance and recovery. Health-Conscious Individuals are increasingly turning to these products to support their wellness goals, while Seniors are also becoming a significant demographic as they seek to maintain their health and vitality.

The Germany Nutrition & Sports Supplements Market is characterized by a dynamic mix of regional and international players. Leading participants such as Queisser Pharma GmbH & Co. KG, Orthomol pharmazeutische Vertriebs GmbH, Nutraceuticals Group Europe, Dr. B. Scheffler Nachfolger GmbH & Co. KG, ZeinPharma Germany GmbH, Pamex Pharmaceuticals GmbH, Ayanda GmbH, Sabinsa Europe GmbH, Denk Pharma GmbH & Co. KG, Pascoe Naturmedizin, MyProtein (The Hut Group), Optimum Nutrition (Glanbia Performance Nutrition), Scitec Nutrition, PowerBar Europe GmbH, Nutricia GmbH (Danone Group) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Germany nutrition and sports supplements market appears promising, driven by evolving consumer preferences and technological advancements. As health consciousness continues to rise, brands are likely to focus on developing innovative products that cater to specific dietary needs. Additionally, the integration of technology in product development, such as personalized nutrition solutions, will enhance consumer engagement and satisfaction, positioning the market for sustained growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Protein Supplements Vitamins and Minerals Herbal Supplements Amino Acids Pre-Workout Supplements Post-Workout Recovery Products Sports Drinks Meal Replacement Products Weight Management Products Performance Enhancers Energy Bars Others |

| By End-User | Athletes Fitness Enthusiasts General Consumers Health-Conscious Individuals Seniors |

| By Distribution Channel | Online Retail Supermarkets/Hypermarkets Specialty Sports Stores Pharmacies Direct Sales Channels |

| By Formulation | Powders Capsules/Tablets Liquids Bars |

| By Price Range | Premium Mid-Range Budget |

| By Brand Loyalty | Established Brands Emerging Brands Private Labels |

| By Packaging Type | Single-Serve Packs Bulk Packaging Eco-Friendly Packaging |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sports Supplements | 100 | Store Managers, Sales Representatives |

| Online Sports Nutrition Sales | 80 | E-commerce Managers, Digital Marketing Specialists |

| Fitness Center Supplement Usage | 60 | Gym Owners, Personal Trainers |

| Consumer Preferences in Sports Nutrition | 100 | Athletes, Fitness Enthusiasts |

| Health and Wellness Influencers | 40 | Nutritionists, Health Coaches |

The Germany Nutrition & Sports Supplements Market is valued at approximately USD 5 billion, reflecting a significant growth trend driven by increased health consciousness, fitness activities, and demand for immunity-boosting products, particularly following the COVID-19 pandemic.