Region:Europe

Author(s):Rebecca

Product Code:KRAB1719

Pages:83

Published On:October 2025

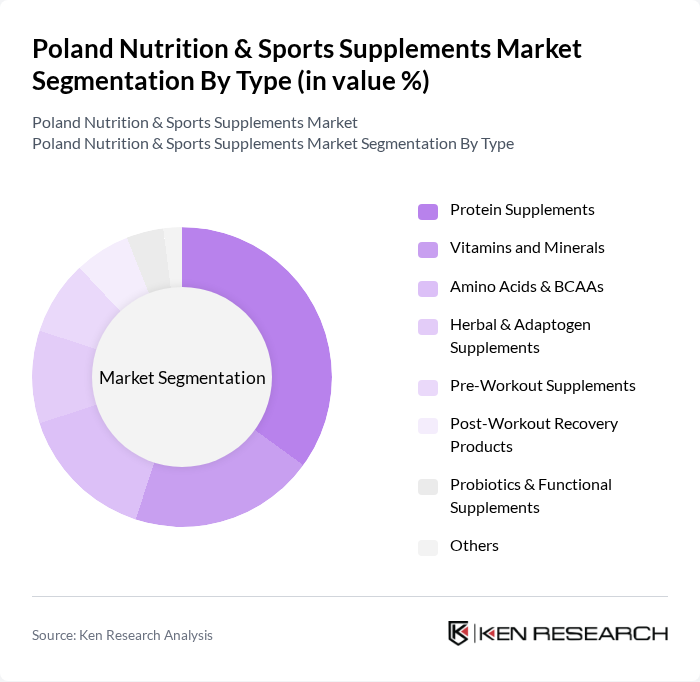

By Type:The market is segmented into various types of nutritional supplements, including Protein Supplements, Vitamins and Minerals, Amino Acids & BCAAs, Herbal & Adaptogen Supplements, Pre-Workout Supplements, Post-Workout Recovery Products, Probiotics & Functional Supplements, and Others. Among these, Protein Supplements lead the market, driven by widespread use among athletes and fitness enthusiasts seeking muscle recovery and growth. Vitamins and minerals also constitute a significant segment, reflecting the broad consumer base focused on immunity and overall wellness .

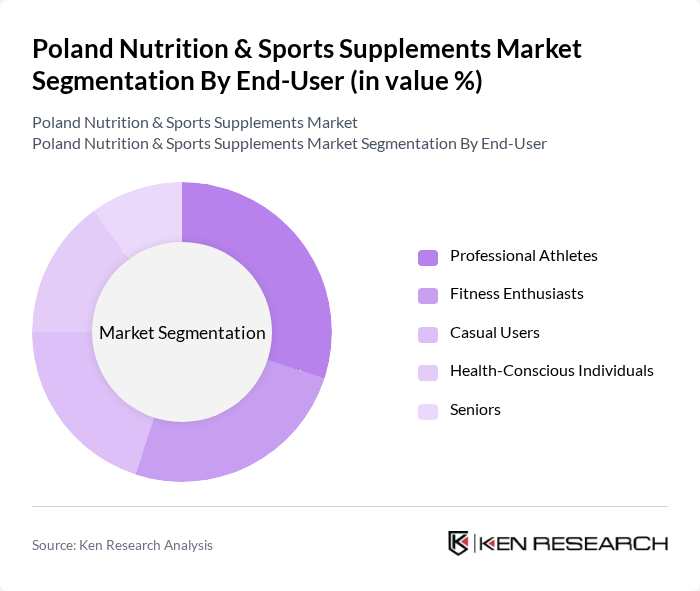

By End-User:The end-user segmentation includes Professional Athletes, Fitness Enthusiasts, Casual Users, Health-Conscious Individuals, and Seniors. Professional Athletes and Fitness Enthusiasts together represent the largest share, as these groups require specialized nutrition for performance and recovery. The market also sees strong participation from health-conscious individuals and seniors, reflecting the broader preventive health trend and aging population .

The Poland Nutrition & Sports Supplements Market is characterized by a dynamic mix of regional and international players. Leading participants such as Olimp Laboratories Sp. z o.o., Trec Nutrition Sp. z o.o., Aflofarm Farmacja Polska Sp. z o.o., USP Zdrowie Sp. z o.o., BioTech USA Kft., Nutrend D.S., s.r.o., SFD S.A., KFD Nutrition Sp. z o.o., Activlab Group Sp. z o.o., Allnutrition (SFD S.A. brand), Fit&Joy Sp. z o.o., Polpharma S.A., Herbalife Nutrition Ltd., Amway Corp., GSK plc contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Poland nutrition and sports supplements market appears promising, driven by evolving consumer preferences and technological advancements. The increasing focus on personalized nutrition, supported by advancements in data analytics, is expected to reshape product offerings. Additionally, the trend towards natural and organic ingredients will likely gain momentum, as consumers become more discerning about product formulations. These factors will create a dynamic environment for innovation and growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Protein Supplements Vitamins and Minerals Amino Acids & BCAAs Herbal & Adaptogen Supplements Pre-Workout Supplements Post-Workout Recovery Products Probiotics & Functional Supplements Others |

| By End-User | Professional Athletes Fitness Enthusiasts Casual Users Health-Conscious Individuals Seniors |

| By Distribution Channel | Online Retail & E-commerce Supermarkets/Hypermarkets Specialty Nutrition Stores Pharmacies & Drugstores Multi-level Marketing (MLM) |

| By Price Range | Budget Mid-Range Premium |

| By Formulation | Powders Capsules/Tablets Liquids Gummies & Shots |

| By Brand Loyalty | Brand Loyal Customers Price-Sensitive Customers New Customers |

| By Product Origin | Domestic Products Imported Products Organic & Natural Products |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sales of Sports Supplements | 150 | Store Managers, Sales Representatives |

| Consumer Preferences in Nutrition | 120 | Fitness Enthusiasts, Health-Conscious Consumers |

| Online Purchase Behavior | 100 | E-commerce Shoppers, Digital Marketing Experts |

| Trends in Dietary Supplement Usage | 80 | Nutritionists, Health Coaches |

| Market Insights from Distributors | 40 | Wholesale Distributors, Supply Chain Managers |

The Poland Nutrition & Sports Supplements Market is valued at approximately USD 2.2 billion, reflecting significant growth driven by increased health awareness and fitness activities among the population, particularly among younger demographics and the aging population.