Region:Asia

Author(s):Shubham

Product Code:KRAB3269

Pages:80

Published On:October 2025

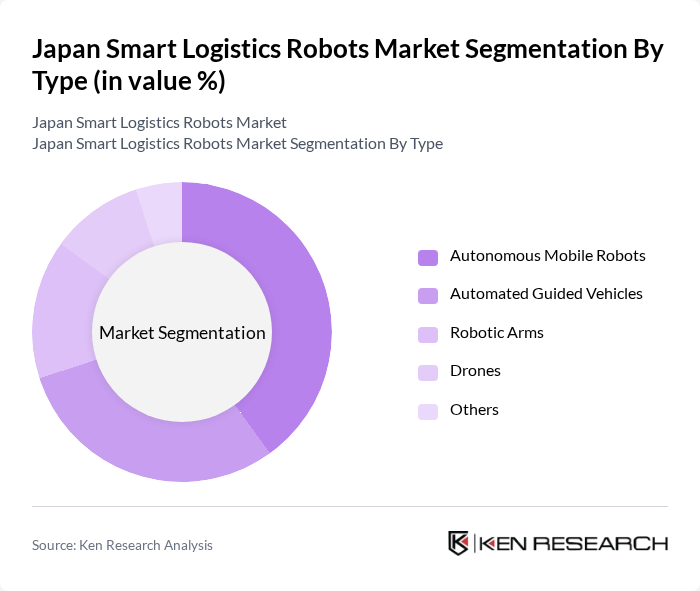

By Type:The market is segmented into various types of smart logistics robots, including Autonomous Mobile Robots, Automated Guided Vehicles, Robotic Arms, Drones, and Others. Among these, Autonomous Mobile Robots are gaining significant traction due to their versatility and ability to navigate complex environments autonomously. Automated Guided Vehicles are also popular, particularly in manufacturing and warehousing settings, where they streamline material handling processes. The demand for Drones is increasing, especially for inventory management and delivery applications, while Robotic Arms are primarily used for packaging and assembly tasks. The "Others" category includes specialized robots tailored for specific tasks.

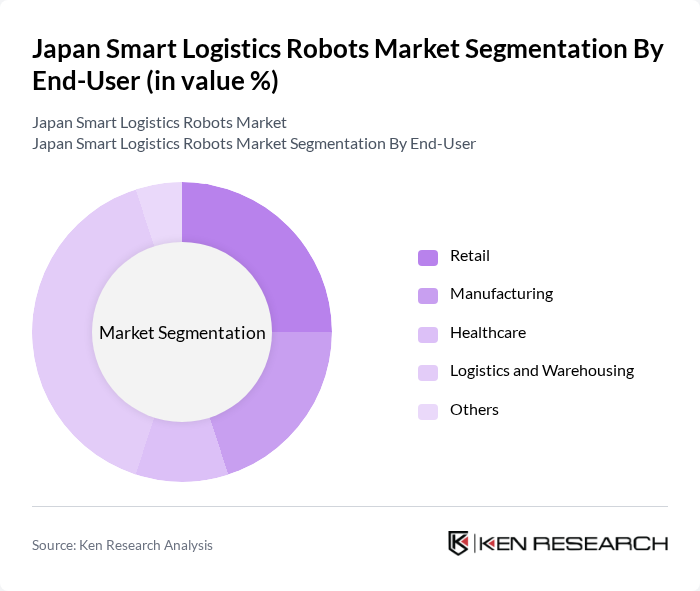

By End-User:The end-user segmentation includes Retail, Manufacturing, Healthcare, Logistics and Warehousing, and Others. The Logistics and Warehousing sector is the largest consumer of smart logistics robots, driven by the need for efficient inventory management and order fulfillment. Retail is also a significant segment, as companies increasingly adopt automation to enhance customer service and streamline operations. Manufacturing utilizes robotic solutions for assembly and quality control, while the Healthcare sector is gradually integrating robots for tasks such as medication delivery and patient assistance. The "Others" category encompasses various industries that are beginning to explore robotic solutions.

The Japan Smart Logistics Robots Market is characterized by a dynamic mix of regional and international players. Leading participants such as Fanuc Corporation, Yaskawa Electric Corporation, Kawasaki Heavy Industries, Ltd., Omron Corporation, Seiko Epson Corporation, Denso Corporation, Mitsubishi Electric Corporation, Hitachi, Ltd., Toyota Industries Corporation, Panasonic Corporation, Sony Corporation, NEC Corporation, Fujitsu Limited, SoftBank Robotics Corp., Cyberdyne Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Japan smart logistics robots market appears promising, driven by ongoing technological advancements and increasing demand for automation. As companies continue to prioritize efficiency and cost reduction, the integration of AI and IoT technologies will enhance the capabilities of logistics robots. Furthermore, the growing emphasis on sustainability will likely lead to innovations that align with environmental goals, fostering a more robust market landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Autonomous Mobile Robots Automated Guided Vehicles Robotic Arms Drones Others |

| By End-User | Retail Manufacturing Healthcare Logistics and Warehousing Others |

| By Application | Inventory Management Order Fulfillment Transportation Packaging Others |

| By Distribution Channel | Direct Sales Online Sales Distributors Retailers Others |

| By Region | Kanto Kansai Chubu Kyushu Others |

| By Price Range | Low-End Mid-Range High-End |

| By Technology | AI-Driven Robotics Sensor-Based Robotics Cloud-Connected Robotics Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Warehouse Automation Solutions | 100 | Warehouse Managers, Operations Directors |

| Last-Mile Delivery Robotics | 80 | Logistics Coordinators, Delivery Service Managers |

| Manufacturing Logistics Integration | 70 | Production Managers, Supply Chain Analysts |

| Retail Inventory Management | 90 | Inventory Managers, Retail Operations Heads |

| Healthcare Logistics Automation | 60 | Healthcare Logistics Managers, Procurement Officers |

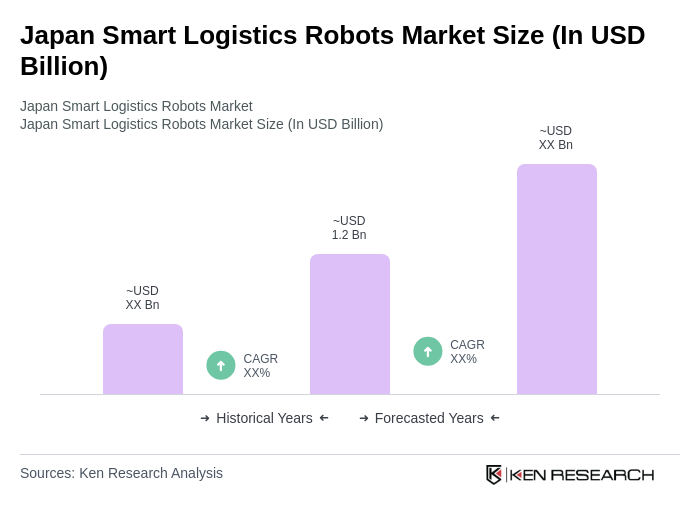

The Japan Smart Logistics Robots Market is valued at approximately USD 1.2 billion, reflecting a significant growth trend driven by increased automation demand in logistics and advancements in robotics technology.