Region:Middle East

Author(s):Geetanshi

Product Code:KRAD6020

Pages:87

Published On:December 2025

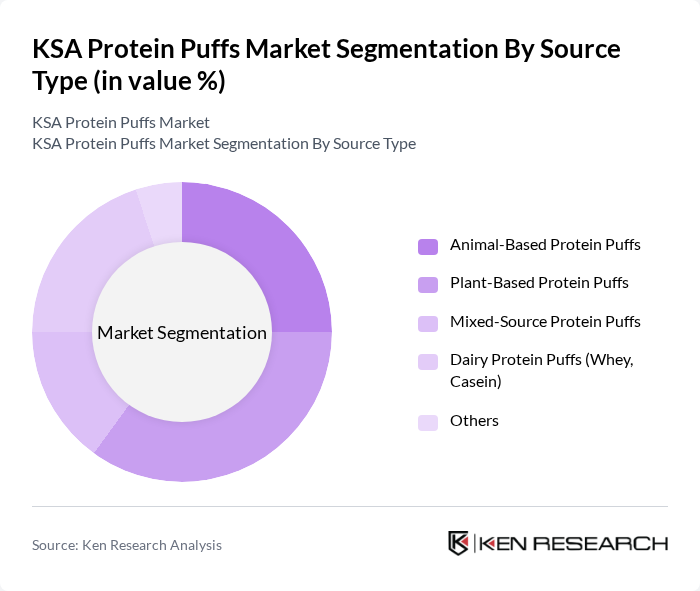

By Source Type:The KSA Protein Puffs Market is segmented into various source types, including Animal-Based Protein Puffs, Plant-Based Protein Puffs, Mixed-Source Protein Puffs, Dairy Protein Puffs (Whey, Casein), and Others. Among these, Plant-Based Protein Puffs are gaining significant traction due to the increasing number of consumers adopting vegetarian and vegan diets. The demand for sustainable and health-conscious snack options is driving this trend, making it a leading subsegment in the market.

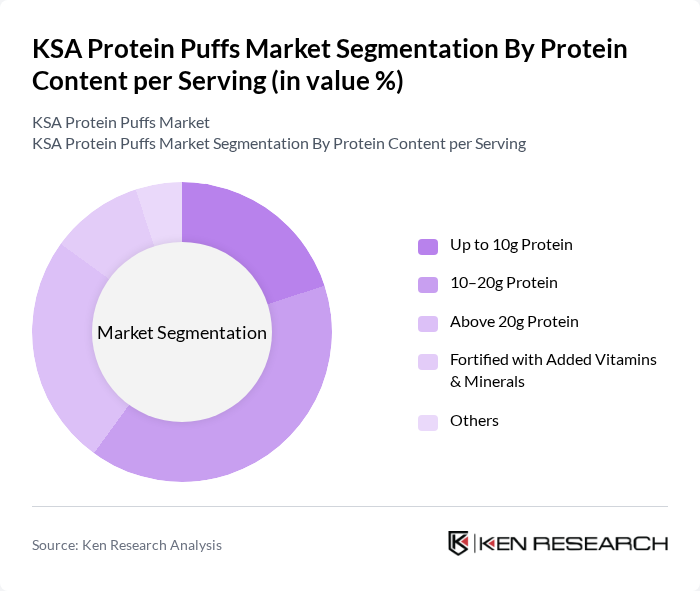

By Protein Content per Serving:The market is also segmented based on protein content per serving, including Up to 10g Protein, 10–20g Protein, Above 20g Protein, Fortified with Added Vitamins & Minerals, and Others. The segment of 10–20g Protein is particularly popular among fitness enthusiasts and health-conscious consumers, as it strikes a balance between taste and nutritional value. This segment is expected to lead the market due to the growing trend of protein supplementation in diets.

The KSA Protein Puffs Market is characterized by a dynamic mix of regional and international players. Leading participants such as Almarai Company, PepsiCo (Frito-Lay & Pioneer Foods Portfolio), Mondelez International, Nestlé Middle East FZE, Kellogg Company (Including Pringles), Hunter Foods LLC, International Food & Consumable Goods (IFCG) – Egypt / KSA, Almunajem Foods, Halwani Bros. Co., United Food Industries Corporation Ltd. (Tasali & Related Snacks), Savola Foods Company, Al Islami Foods, Local & Regional Healthy Snack Brands (e.g., Prozis Middle East, Body & Gym Shop Private Labels), Private Label Brands of Major Retailers (Panda Retail, Carrefour Saudi, Lulu Hypermarket), Emerging Saudi Start?Ups in High?Protein / Functional Snacks contribute to innovation, geographic expansion, and service delivery in this space.

The KSA Protein Puffs market is poised for significant growth, driven by evolving consumer preferences towards healthier snacking options. As the trend towards plant-based diets continues to gain traction, manufacturers are likely to innovate with new flavors and formulations. Additionally, the expansion of e-commerce platforms will facilitate broader market access, allowing brands to reach health-conscious consumers more effectively. Collaborations with fitness centers will further enhance brand visibility and consumer engagement, solidifying the market's growth trajectory.

| Segment | Sub-Segments |

|---|---|

| By Source Type | Animal-Based Protein Puffs Plant-Based Protein Puffs Mixed-Source Protein Puffs Dairy Protein Puffs (Whey, Casein) Others |

| By Protein Content per Serving | Up to 10g Protein –20g Protein Above 20g Protein Fortified with Added Vitamins & Minerals Others |

| By Consumer Segment | Sports & Fitness Enthusiasts Weight Management & Diet-Focused Consumers General Health-Conscious Consumers Children & Teens Others |

| By Distribution Channel | Supermarkets and Hypermarkets Convenience Stores & Small Grocers (Baqqalah) Pharmacies & Nutrition Stores Online Retailers & D2C Platforms Gyms, Fitness Centers & Vending Channels |

| By Packaging Type | Single-Serve Packs Multi-Pack / Family Packs Resealable Pouches Club & Bulk Packs Eco-Friendly & Recyclable Packaging |

| By Claim & Dietary Attribute | High-Protein / Protein-Enriched Low-Carb / Keto-Friendly Gluten-Free Halal-Certified & Clean Label Organic & Natural |

| By Region in KSA | Central Region (Riyadh and Surrounding) Western Region (Jeddah, Makkah, Madinah) Eastern Province (Dammam, Khobar, Dhahran) Northern Region Southern Region |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sector Insights | 100 | Store Managers, Category Buyers |

| Consumer Preferences | 120 | Health-Conscious Consumers, Snack Enthusiasts |

| Distribution Channel Analysis | 80 | Logistics Coordinators, Supply Chain Managers |

| Market Trend Evaluation | 70 | Nutritionists, Food Industry Analysts |

| Product Development Feedback | 60 | R&D Managers, Product Innovation Specialists |

The KSA Protein Puffs Market is valued at approximately USD 140 million, reflecting a significant growth trend driven by increasing health consciousness, the popularity of snacking, and the demand for high-protein diets among consumers.