Region:Middle East

Author(s):Rebecca

Product Code:KRAD1332

Pages:88

Published On:November 2025

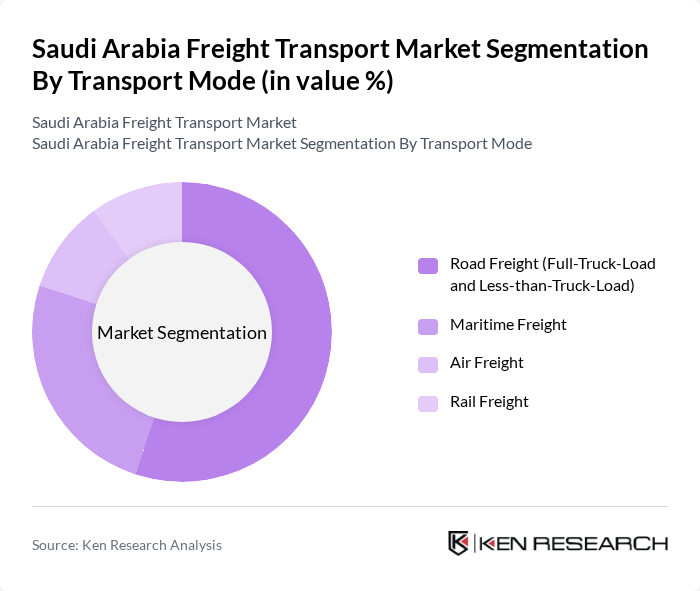

By Transport Mode:

The transport mode segmentation includes Road Freight (Full-Truck-Load and Less-than-Truck-Load), Maritime Freight, Air Freight, and Rail Freight. Among these, Road Freight is the dominant mode due to its flexibility, extensive network, and ability to cater to both urban and rural areas. The increasing demand for quick deliveries and the rise of e-commerce have further propelled the growth of road freight services. Maritime Freight follows closely, driven by the country's significant port facilities and international trade activities.

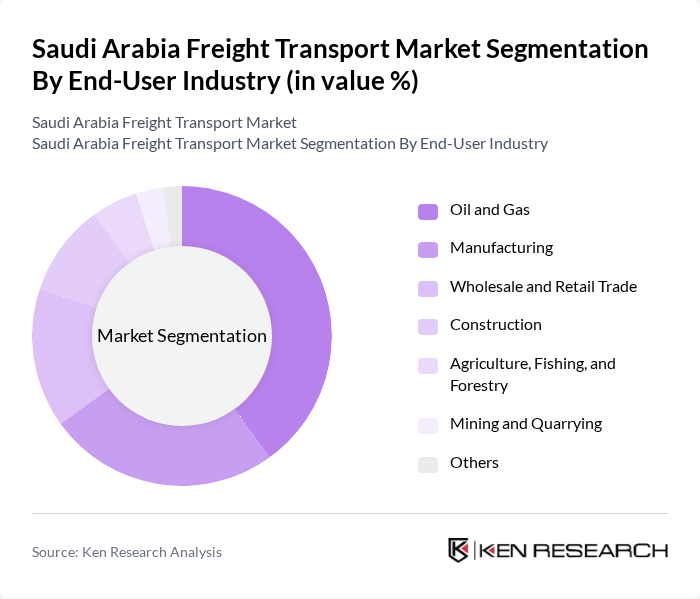

By End-User Industry:

This segmentation includes Oil and Gas, Manufacturing, Wholesale and Retail Trade, Construction, Agriculture, Fishing, and Forestry, Mining and Quarrying, and Others. The Oil and Gas sector is the leading end-user, driven by the country's vast petroleum resources and the need for efficient transport of crude oil and related products. Manufacturing and Wholesale and Retail Trade also contribute significantly, reflecting the growing industrial base and consumer demand in the region.

The Saudi Arabia Freight Transport Market is characterized by a dynamic mix of regional and international players. Leading participants such as Almajdouie Transportation, SMSA Express Transportation Company Ltd, Aramex, DHL Supply Chain, Kuehne + Nagel International AG, DB Schenker, FedEx Corporation, United Parcel Service Inc (UPS), Agility Logistics, Gulf Agency Company (GAC), Expeditors International of Washington Inc, DSV A/S, CEVA Logistics, Nippon Express Holdings Inc, National Shipping Company of Saudi Arabia (NSCSA) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia freight transport market appears promising, driven by ongoing investments in infrastructure and technology. As the government continues to enhance logistics capabilities, the sector is expected to adapt to emerging trends such as automation and digitalization. Furthermore, the increasing focus on sustainability will likely lead to the adoption of greener transport solutions, positioning the market for significant growth in the coming years, particularly in rail and cold chain logistics.

| Segment | Sub-Segments |

|---|---|

| By Transport Mode | Road Freight (Full-Truck-Load and Less-than-Truck-Load) Maritime Freight Air Freight Rail Freight |

| By End-User Industry | Oil and Gas Manufacturing Wholesale and Retail Trade Construction Agriculture, Fishing, and Forestry Mining and Quarrying Others |

| By Geographic Region | Central Region (Riyadh) Eastern Region (Petrochemical Clusters) Western Region (Jeddah and Ports) Northern Region Southern Region |

| By Service Type | Freight Forwarding Warehousing and Storage Last-Mile Delivery Logistics Management Cold Chain Logistics |

| By Cargo Type | Perishable Goods Non-Perishable Goods Hazardous Materials Containerized Cargo Bulk Liquid Cargo General Cargo |

| By Destination | Domestic International (GCC and Beyond) |

| By Distance | Short Haul Long Haul |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Road Freight Transport | 100 | Logistics Managers, Fleet Operators |

| Air Cargo Services | 60 | Airline Cargo Managers, Freight Forwarders |

| Maritime Freight Operations | 50 | Port Authorities, Shipping Line Executives |

| Rail Freight Services | 40 | Railway Logistics Coordinators, Operations Managers |

| Cold Chain Logistics | 40 | Supply Chain Directors, Temperature-Controlled Transport Managers |

The Saudi Arabia Freight Transport Market is valued at approximately USD 32 billion, reflecting significant growth driven by the country's strategic logistics position, increased trade activities, and substantial infrastructure investments.