Region:Middle East

Author(s):Shubham

Product Code:KRAD6790

Pages:100

Published On:December 2025

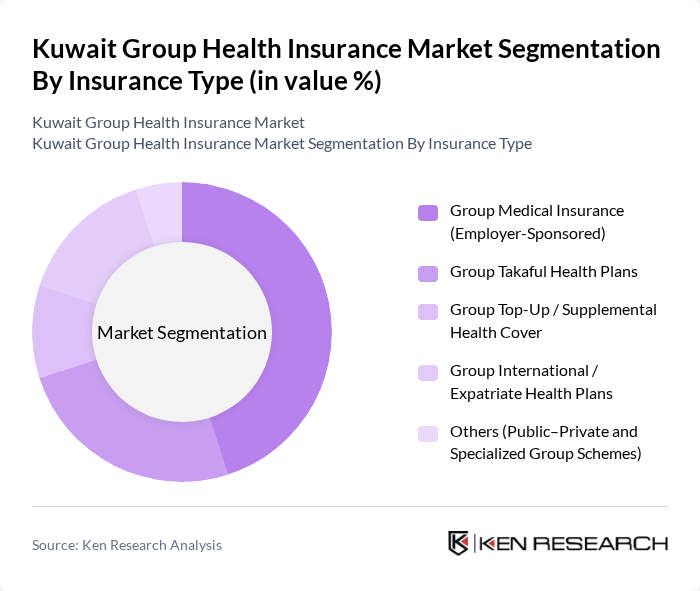

By Insurance Type:The insurance type segmentation includes various subsegments such as Group Medical Insurance (Employer-Sponsored), Group Takaful Health Plans, Group Top-Up / Supplemental Health Cover, Group International / Expatriate Health Plans, and Others (Public–Private and Specialized Group Schemes). Among these, Group Medical Insurance (Employer-Sponsored) is the leading subsegment, driven by the increasing number of employers offering health benefits to attract and retain talent amid rising expatriate populations and mandatory coverage requirements. The demand for comprehensive coverage and the rising healthcare costs further bolster this segment's growth.

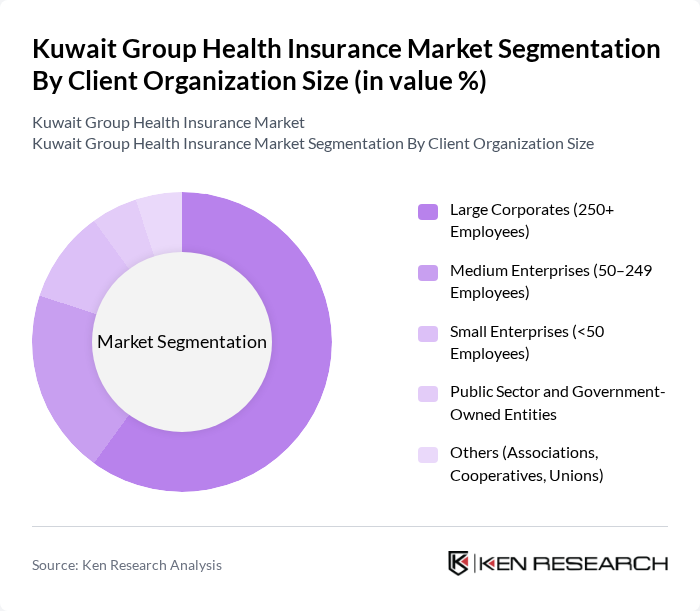

By Client Organization Size:This segmentation includes Large Corporates (250+ Employees), Medium Enterprises (50–249 Employees), Small Enterprises (<50 Employees), Public Sector and Government-Owned Entities, and Others (Associations, Cooperatives, Unions). The Large Corporates segment dominates the market, as these organizations typically have the resources to provide extensive health insurance benefits to their employees. The trend of prioritizing employee health and wellness initiatives further strengthens this segment's position.

The Kuwait Group Health Insurance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kuwait Insurance Company K.S.C.P., Gulf Insurance Group K.S.C.P. (GIG Kuwait), Warba Insurance Company K.S.C.P., Al Ahleia Insurance Company K.S.C.P., Al Mulla Insurance Brokerage Company, Kuwait Health Assurance Company (KHAC – Daman), Al Futtaim – Willis Towers Watson (Kuwait), Marsh & McLennan Companies (Kuwait), Aon Kuwait, Alkoot Insurance & Reinsurance Co. (Regional Group Health Player), Bupa Global (Regional Expatriate Group Health Provider), Allianz Partners (Regional Corporate Health Plans), MetLife Gulf (Regional Group Health Provider), Cigna Healthcare – Middle East (Regional Corporate Health), AXA – Gulf / GIG Gulf (Regional Group Medical Insurance) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait group health insurance market appears promising, driven by increasing healthcare demands and government support. As the population continues to grow, particularly among expatriates, insurers are likely to innovate their offerings, focusing on digital solutions and preventive care. Additionally, the integration of technology in claims processing and telemedicine services will enhance customer experience and operational efficiency, positioning the market for sustainable growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Insurance Type | Group Medical Insurance (Employer-Sponsored) Group Takaful Health Plans Group Top-Up / Supplemental Health Cover Group International / Expatriate Health Plans Others (Public–Private and Specialized Group Schemes) |

| By Client Organization Size | Large Corporates (250+ Employees) Medium Enterprises (50–249 Employees) Small Enterprises (<50 Employees) Public Sector and Government-Owned Entities Others (Associations, Cooperatives, Unions) |

| By Coverage Structure | Employee-Only Group Cover Employee + Dependents Group Cover Executive / VIP Group Plans Occupational / Industry-Specific Group Plans Others |

| By Distribution Channel | Direct Sales (Insurer Corporate Sales Teams) Insurance Brokers Bancassurance & Corporate Banking Channels Digital Platforms & Aggregators Others (Affinity & Consultants) |

| By Policy Funding Arrangement | Fully Insured Group Policies Self-Funded / Self-Insured Employer Plans Co-Funded Employer–Employee Schemes Government-Linked Group Schemes Others |

| By Premium Band (Per Member Per Year) | Low Premium Segment Mid Premium Segment High Premium / VIP Segment Ultra-High / International Executive Segment |

| By Insured Group Demographics | National vs Expatriate Employees Blue-Collar vs White-Collar Workforce Age Mix (Young Workforce vs Aging Workforce) Others (Gender Mix, Income Bands) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Individual Health Insurance Policyholders | 120 | Policyholders aged 25-60, diverse income levels |

| Corporate Health Insurance Clients | 100 | HR Managers, Benefits Coordinators from various industries |

| Healthcare Providers (Hospitals and Clinics) | 80 | Administrators, Financial Officers in healthcare facilities |

| Insurance Brokers and Agents | 70 | Insurance agents, Brokers specializing in health insurance |

| Regulatory Bodies and Health Policy Experts | 50 | Government officials, Health policy analysts |

The Kuwait Group Health Insurance Market is valued at approximately USD 1.1 billion, reflecting significant growth driven by increasing demand for comprehensive health coverage and government initiatives aimed at enhancing insurance penetration among businesses and expatriates.