Region:Middle East

Author(s):Shubham

Product Code:KRAD5502

Pages:99

Published On:December 2025

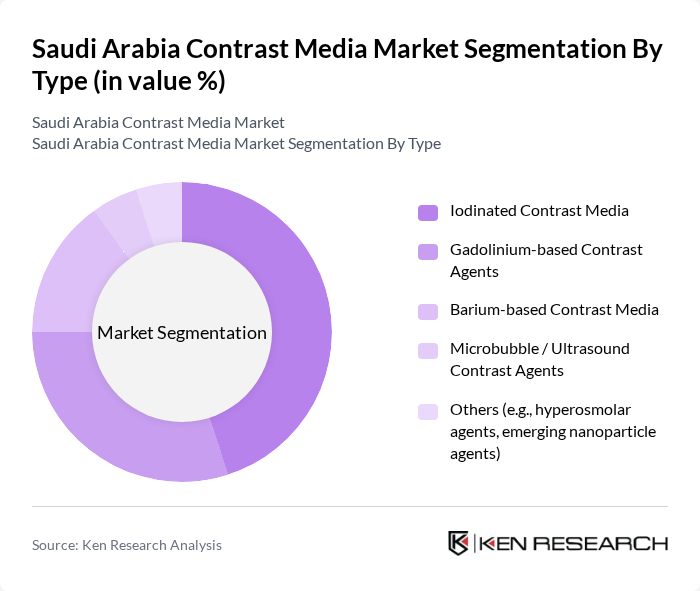

By Type:The market is segmented into various types of contrast media, including Iodinated Contrast Media, Gadolinium-based Contrast Agents, Barium-based Contrast Media, Microbubble / Ultrasound Contrast Agents, and Others (e.g., hyperosmolar agents, emerging nanoparticle agents). Among these, Iodinated Contrast Media is the leading sub-segment due to its widespread use in X-ray and CT imaging, driven by its effectiveness and safety profile. Gadolinium-based agents are also gaining traction, particularly in MRI applications, as they provide enhanced imaging quality. The demand for Barium-based Contrast Media remains stable, primarily for gastrointestinal imaging, while Microbubble agents are emerging in ultrasound applications. The Others category includes innovative products that are gradually entering the market, catering to specific imaging needs.

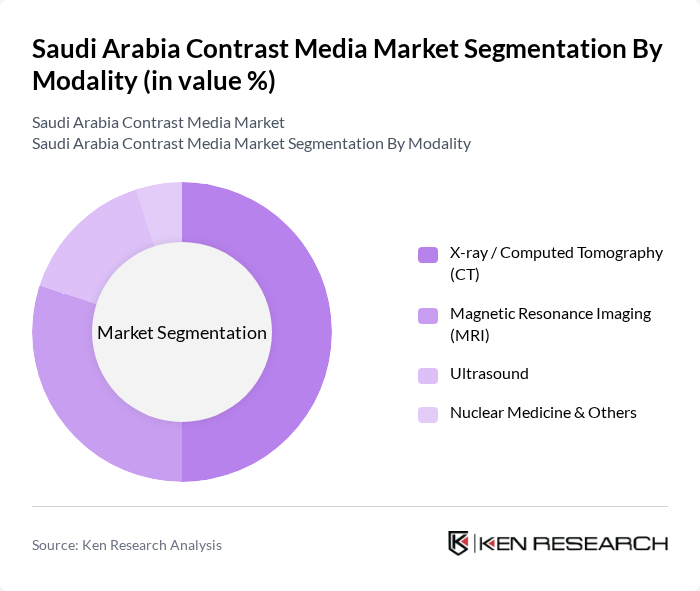

By Modality:The segmentation by modality includes X-ray / Computed Tomography (CT), Magnetic Resonance Imaging (MRI), Ultrasound, and Nuclear Medicine & Others. The X-ray / CT modality dominates the market due to the high volume of procedures performed and the reliance on iodinated contrast media for enhanced imaging. MRI is also significant, particularly with the increasing use of Gadolinium-based agents. Ultrasound is gaining popularity, especially with the introduction of Microbubble agents, while Nuclear Medicine remains a niche but essential segment. The growth in these modalities is driven by technological advancements and the rising demand for accurate diagnostic imaging.

The Saudi Arabia Contrast Media Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bayer AG (Bayer Radiology), GE HealthCare Technologies Inc., Bracco Imaging S.p.A., Guerbet Group, Lantheus Holdings, Inc., Canon Medical Systems Corporation, Siemens Healthineers AG, Fujifilm Holdings Corporation, Koninklijke Philips N.V. (Philips Healthcare), Jiangsu Hengrui Pharmaceuticals Co., Ltd., Jodas Expoim Pvt. Ltd., Trivitron Healthcare Pvt. Ltd., Sanochemia Pharmazeutika GmbH, Nano Therapeutics Pvt. Ltd., and local distributors contribute to innovation, geographic expansion, and service delivery in this space.

The future of the contrast media market in Saudi Arabia appears promising, driven by technological advancements and increasing healthcare investments. As the healthcare infrastructure expands, the demand for outpatient imaging services is expected to rise significantly. Additionally, the growing emphasis on personalized medicine will likely lead to the development of innovative contrast agents tailored to specific patient needs, enhancing diagnostic accuracy and treatment efficacy in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Iodinated Contrast Media Gadolinium-based Contrast Agents Barium-based Contrast Media Microbubble / Ultrasound Contrast Agents Others (e.g., hyperosmolar agents, emerging nanoparticle agents) |

| By Modality | X-ray / Computed Tomography (CT) Magnetic Resonance Imaging (MRI) Ultrasound Nuclear Medicine & Others |

| By Application | Radiology & Diagnostic Imaging Interventional Cardiology Interventional Radiology Oncology Imaging Neurology & CNS Imaging Gastrointestinal & Hepatobiliary Imaging Others |

| By End-User | Public Hospitals (MOH and other government hospitals) Private Hospitals Diagnostic Imaging Centers Specialty & Cardiac Centers Others (including research & academic institutions) |

| By Distribution Channel | Direct Sales to Healthcare Facilities Tender-based / Government Procurement Local Distributors & Importers Others |

| By Region | Central Region (including Riyadh) Western Region (including Makkah & Madinah) Eastern Region (including Dammam & Al Khobar) Southern Region Northern Region |

| By Patient Demographics | Pediatric Patients Adult Patients Geriatric Patients High-risk Patients (e.g., renal impairment, allergies) |

| By Regulatory & Quality Compliance | Saudi FDA (SFDA) Approved Products Products with CE Mark Products with US FDA Approval Locally Manufactured / Repackaged Products |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Imaging Departments | 120 | Radiologists, Imaging Technologists |

| Private Imaging Centers | 90 | Center Managers, Procurement Officers |

| Healthcare Distributors | 60 | Sales Managers, Product Specialists |

| Regulatory Bodies | 40 | Policy Makers, Health Administrators |

| Research Institutions | 55 | Medical Researchers, Academic Professors |

The Saudi Arabia Contrast Media Market is valued at approximately USD 85 million, reflecting a five-year historical analysis. This growth is driven by the rising prevalence of chronic diseases and advancements in imaging technologies.