Region:Middle East

Author(s):Geetanshi

Product Code:KRAD3861

Pages:90

Published On:November 2025

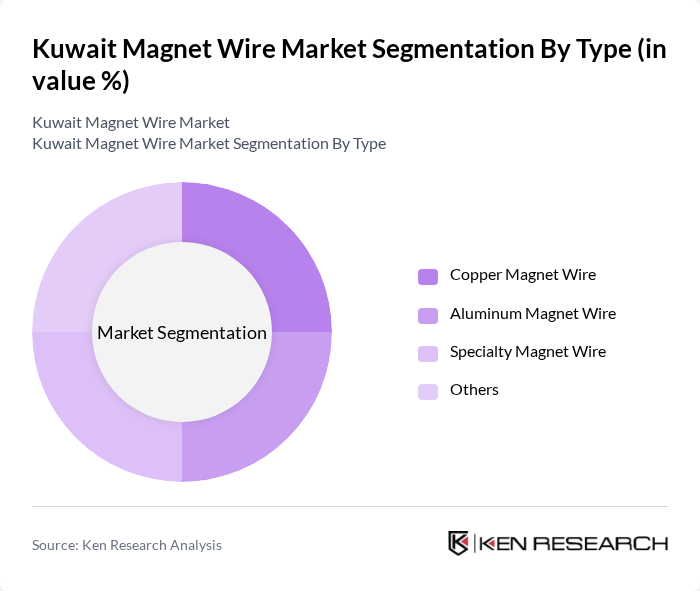

By Type:The market is segmented into various types of magnet wire, including Copper Magnet Wire, Aluminum Magnet Wire, Specialty Magnet Wire, and Others. Copper Magnet Wire is the most widely used due to its superior conductivity and efficiency in electrical applications. Aluminum Magnet Wire is gaining traction due to its lightweight and cost-effectiveness, while Specialty Magnet Wire caters to niche applications requiring specific properties.

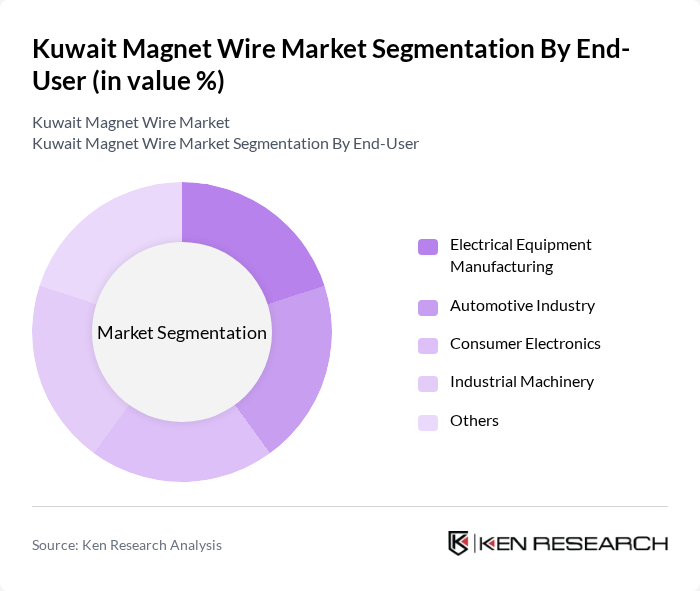

By End-User:The end-user segments include Electrical Equipment Manufacturing, Automotive Industry, Consumer Electronics, Industrial Machinery, and Others. The Electrical Equipment Manufacturing sector is the largest consumer of magnet wire, driven by the increasing demand for transformers and motors. The Automotive Industry is also a significant contributor, as electric vehicles and advanced automotive technologies require high-quality magnet wire for efficient performance.

The Kuwait Magnet Wire Market is characterized by a dynamic mix of regional and international players. Leading participants such as Gulf Cable and Electrical Industries Co., Kuwait Magnet Wire Co., Alghanim Industries, KME Group, Southwire Company, General Cable, Nexans, Prysmian Group, Sumitomo Electric Industries, LS Cable & System, Encore Wire Corporation, Rea Magnet Wire Company, Ametek, Inc., Belden Inc., Amphenol Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The Kuwait magnet wire market is poised for growth, driven by increasing investments in electric vehicles and renewable energy projects. As the government continues to support infrastructure development, local manufacturers are likely to benefit from heightened demand for high-quality magnet wire. Additionally, advancements in manufacturing technologies will enhance production efficiency, enabling companies to meet evolving market needs. The focus on sustainability and energy efficiency will further shape the market landscape, presenting opportunities for innovation and expansion in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Copper Magnet Wire Aluminum Magnet Wire Specialty Magnet Wire Others |

| By End-User | Electrical Equipment Manufacturing Automotive Industry Consumer Electronics Industrial Machinery Others |

| By Application | Transformers Motors Generators Others |

| By Coating Type | Enamel Coated Polyurethane Coated Polyester Coated Others |

| By Diameter | Thin Wire Medium Wire Thick Wire Others |

| By Region | Central Kuwait Southern Kuwait Northern Kuwait Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Magnet Wire Usage | 50 | Automotive Engineers, Procurement Managers |

| Construction Sector Applications | 40 | Project Managers, Electrical Contractors |

| Consumer Electronics Manufacturing | 40 | Product Development Engineers, Supply Chain Managers |

| Renewable Energy Sector | 40 | Energy Project Managers, Technical Directors |

| Industrial Equipment Manufacturers | 40 | Operations Managers, Quality Assurance Specialists |

The Kuwait Magnet Wire Market is valued at approximately USD 5 million, driven by increasing demand for electrical equipment and growth in the automotive and consumer electronics sectors, alongside investments in infrastructure and renewable energy projects.