Region:Middle East

Author(s):Shubham

Product Code:KRAA6640

Pages:100

Published On:January 2026

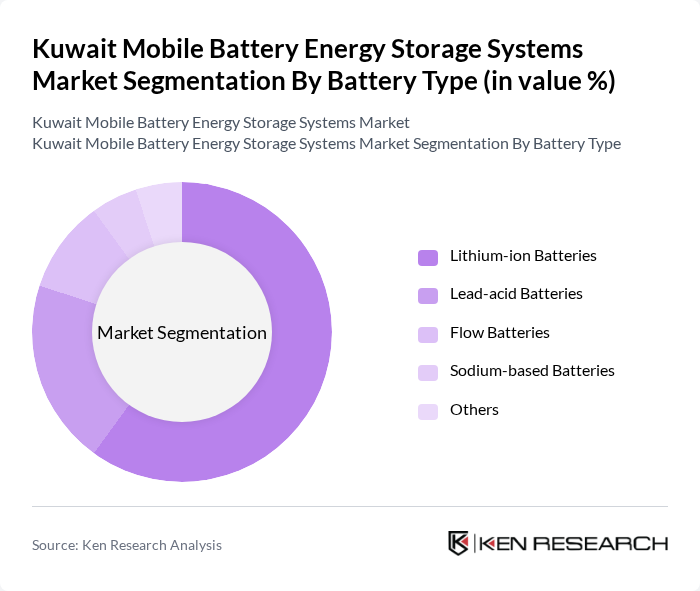

By Battery Type:The market is segmented into various battery types, including Lithium-ion Batteries, Lead-acid Batteries, Flow Batteries, Sodium-based Batteries, and Others. Among these, Lithium-ion Batteries are leading the market due to their high energy density, longer lifespan, and decreasing costs, making them the preferred choice for both residential and commercial applications. The demand for Lithium-ion technology is further fueled by advancements in battery management systems and increasing investments in renewable energy integration.

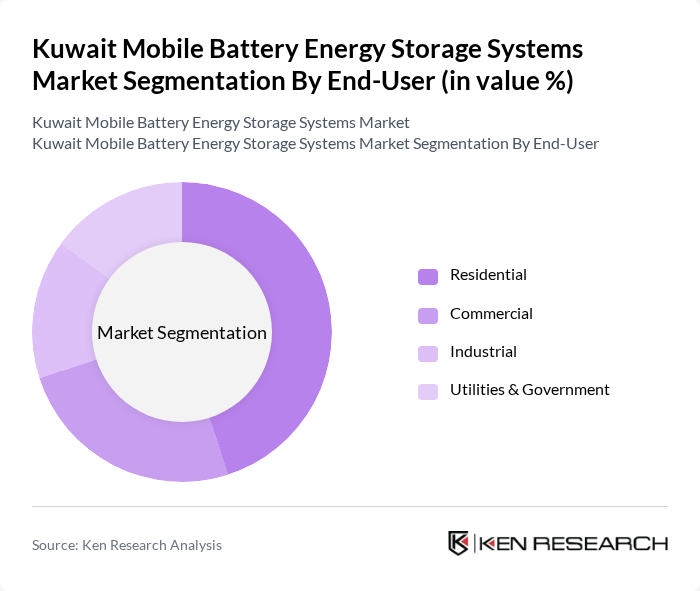

By End-User:The end-user segmentation includes Residential, Commercial, Industrial, and Utilities & Government. The Residential segment is currently dominating the market, driven by the increasing adoption of home energy storage systems to manage energy consumption and reduce electricity bills. The trend towards energy independence and the integration of solar power systems in homes are also contributing to the growth of this segment.

The Kuwait Mobile Battery Energy Storage Systems Market is characterized by a dynamic mix of regional and international players. Leading participants such as National Technology Enterprises Company (NTEC), Kuwait National Petroleum Company (KNPC), Kuwait Oil Company (KOC), EnerTech Holding Company, Alghanim Industries, Siemens Energy Kuwait, ABB Kuwait, Eaton Corporation, Schneider Electric Kuwait, Tesla (Middle East & North Africa), Huawei Digital Power Kuwait, Gulf Energy Solutions, Al-Dhow Engineering, KGL Holding, Boubyan Technical Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait mobile battery energy storage systems market appears promising, driven by increasing investments in renewable energy and supportive government policies. As the country progresses towards its renewable energy targets, the demand for efficient energy storage solutions will likely rise. Additionally, advancements in battery technology and decreasing costs will further enhance market viability, making energy storage systems more accessible to consumers and businesses alike, fostering a sustainable energy ecosystem.

| Segment | Sub-Segments |

|---|---|

| By Battery Type | Lithium-ion Batteries Lead-acid Batteries Flow Batteries Sodium-based Batteries Others |

| By End-User | Residential Commercial Industrial Utilities & Government |

| By Application | Grid-Connected Systems Off-Grid Systems Backup Power Solutions Renewable Energy Integration Others |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Capacity | Up to 100 KW 101 to 500 KW Above 500 KW |

| By Regional Distribution | Northern Kuwait Central Kuwait Southern Kuwait Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Energy Storage Users | 100 | Homeowners, Energy Managers |

| Commercial Battery Storage Solutions | 80 | Facility Managers, Operations Directors |

| Utility-Scale Energy Storage Projects | 60 | Project Managers, Energy Analysts |

| Battery Manufacturers and Suppliers | 70 | Sales Executives, Product Development Managers |

| Government and Regulatory Bodies | 50 | Policy Makers, Regulatory Affairs Specialists |

The Kuwait Mobile Battery Energy Storage Systems Market is valued at approximately USD 165 million, reflecting a significant growth driven by the increasing demand for renewable energy solutions and energy storage to enhance grid stability and reliability.