Oman Mobile Battery Energy Storage Systems Market Overview

- The Oman Mobile Battery Energy Storage Systems market is valued at approximately USD 165 million, based on a five-year historical analysis. This growth is primarily driven by the increasing demand for renewable energy integration, the need for grid stability, and the rising adoption of electric vehicles. The market is also supported by advancements in battery technology, which enhance energy efficiency and storage capacity. Oman is positioned as the fastest-growing battery energy storage market in the Middle East region, with deployment closely tied to the country's ambitious Oman Vision 2040 and green hydrogen strategy.

- Key regions such as Muscat and Dhofar dominate the market due to their strategic locations and infrastructure development. Muscat, being the capital, has a higher concentration of commercial activities and government initiatives promoting renewable energy. Dhofar benefits from its geographical advantages and is emerging as a hub for energy projects, particularly with battery storage being integrated with solar and wind projects in the Dhofar and Al Wusta regions to balance grid reliability in remote areas, thus driving demand for mobile battery energy storage systems.

- The Omani government has established regulatory frameworks supporting energy storage integration as part of its renewable energy transition strategy. Battery storage is being deployed to support large-scale hydrogen production facilities under the government-backed Hydrogen Oman (Hydrom) initiative, which accelerates hybrid storage projects and ensures energy reliability and grid stability.

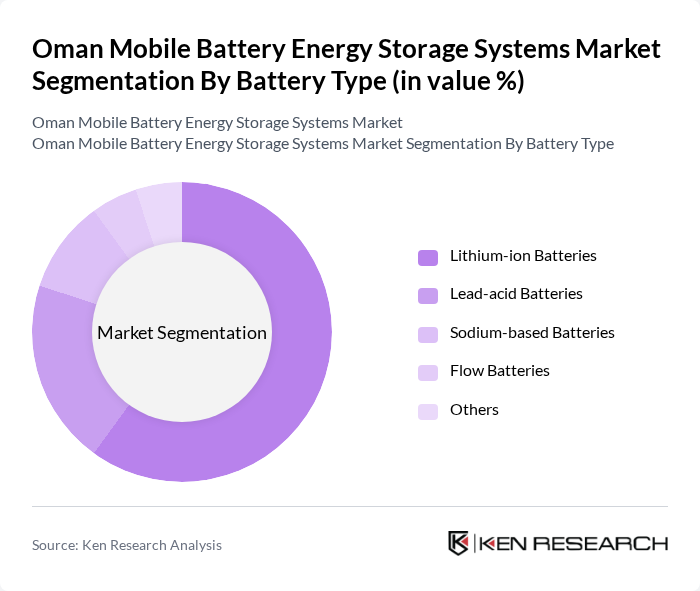

Oman Mobile Battery Energy Storage Systems Market Segmentation

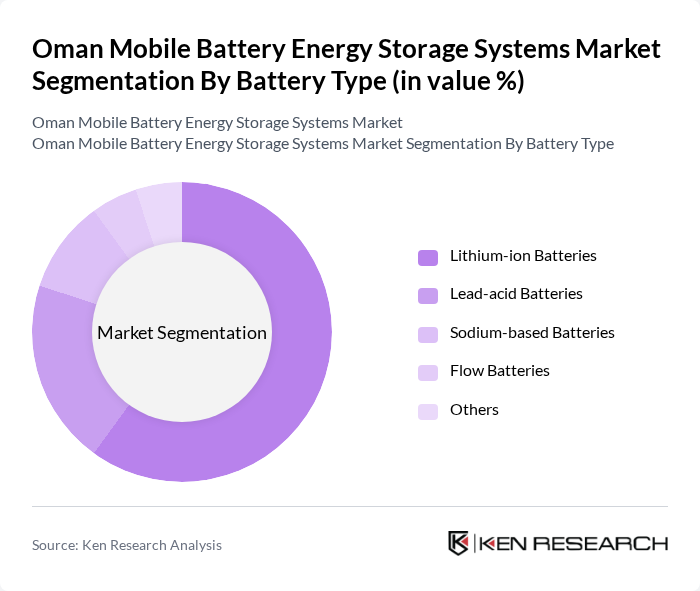

By Battery Type:The battery type segmentation includes Lithium-ion Batteries, Lead-acid Batteries, Sodium-based Batteries, Flow Batteries, and Others. Among these, Lithium-ion Batteries dominate the market due to their high energy density, longer lifespan, and decreasing costs, making them the preferred choice for various applications, including electric vehicles and renewable energy storage. Lithium-ion technology holds the highest revenue share in the Middle East battery energy storage systems market, reflecting its dominance across the region. The growing trend towards electrification and the need for efficient energy storage solutions further bolster the demand for Lithium-ion technology.

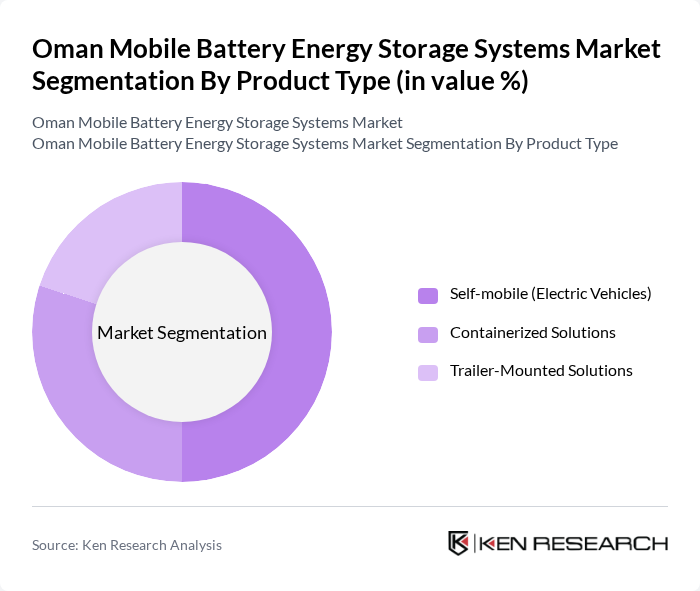

By Product Type:The product type segmentation includes Self-mobile (Electric Vehicles), Containerized Solutions, and Trailer-Mounted Solutions. Self-mobile solutions, particularly electric vehicles, are leading the market due to the increasing adoption of electric mobility and the need for efficient energy storage systems that can be integrated into vehicles. Self-mobile (Electric Vehicles) held a dominant market position globally, capturing more than 44.5% share, reflecting strong consumer preference for sustainable transportation options. The growing consumer preference for sustainable transportation options is driving this trend, making it a significant segment in the mobile battery energy storage market.

Oman Mobile Battery Energy Storage Systems Market Competitive Landscape

The Oman Mobile Battery Energy Storage Systems Market is characterized by a dynamic mix of regional and international players. Leading participants such as CATL, BYD Company Limited, Sungrow Power Supply Co., Ltd., Tesla, Inc., Huawei Digital Power, ACWA Power, Masdar, EDF Renewables, Dalia Energy, Phinergy, Siemens AG, ABB Ltd., Schneider Electric SE, Eaton Corporation, Fluence Energy, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

Oman Mobile Battery Energy Storage Systems Market Industry Analysis

Growth Drivers

- Increasing Demand for Renewable Energy Integration:The Omani government aims to generate 30% of its electricity from renewable sources in the future, translating to approximately 3,000 MW. This ambitious target is driving the need for mobile battery energy storage systems to manage intermittent renewable energy supply effectively. As of the future, the integration of solar and wind energy is expected to increase by 20%, necessitating robust storage solutions to ensure grid stability and reliability.

- Government Initiatives Promoting Energy Storage Solutions:The Omani government has introduced several initiatives, including the National Energy Strategy, which allocates $1 billion for energy storage projects in the future. These initiatives aim to enhance energy security and reduce reliance on fossil fuels. Additionally, the government is providing financial incentives, such as tax exemptions and grants, to encourage investments in battery storage technologies, further stimulating market growth.

- Rising Electricity Costs Driving Consumer Interest:Electricity prices in Oman have increased by 15% over the past two years, prompting consumers to seek cost-effective energy solutions. The average household electricity bill is projected to reach OMR 50 in the future. This rising cost is driving interest in mobile battery energy storage systems, as they offer a way to store energy during off-peak hours and utilize it during peak demand, ultimately reducing overall energy expenses.

Market Challenges

- High Initial Investment Costs:The upfront costs associated with mobile battery energy storage systems can be prohibitive, with average installation costs ranging from OMR 5,000 to OMR 10,000 per unit. This financial barrier limits adoption, particularly among small businesses and residential consumers. As of the future, the average payback period for these systems is estimated at 7-10 years, which may deter potential investors from entering the market.

- Limited Consumer Awareness and Education:A significant challenge in Oman is the lack of consumer awareness regarding the benefits of mobile battery energy storage systems. Surveys indicate that only 30% of consumers are familiar with energy storage technologies. This knowledge gap hinders market growth, as potential users may not understand how these systems can enhance energy efficiency and reduce costs, necessitating targeted educational campaigns to raise awareness.

Oman Mobile Battery Energy Storage Systems Market Future Outlook

The future of the Oman mobile battery energy storage systems market appears promising, driven by increasing investments in renewable energy and supportive government policies. As the country transitions towards a more sustainable energy landscape, the demand for efficient energy storage solutions is expected to rise significantly. Innovations in battery technology and decreasing costs will likely enhance market accessibility, while consumer education initiatives will further stimulate adoption, paving the way for a robust energy storage ecosystem in Oman.

Market Opportunities

- Expansion of Electric Vehicle Market:The electric vehicle (EV) market in Oman is projected to grow by 25% annually, creating a substantial demand for mobile battery storage solutions. This growth presents an opportunity for energy storage systems to support EV charging infrastructure, enhancing grid resilience and promoting sustainable transportation options across the country.

- Development of Smart Grid Technologies:The ongoing development of smart grid technologies in Oman is expected to create new opportunities for mobile battery energy storage systems. By integrating these systems with smart grids, energy efficiency can be optimized, allowing for better demand response and energy management, ultimately leading to a more reliable and sustainable energy network.