Region:Asia

Author(s):Shubham

Product Code:KRAA6645

Pages:87

Published On:January 2026

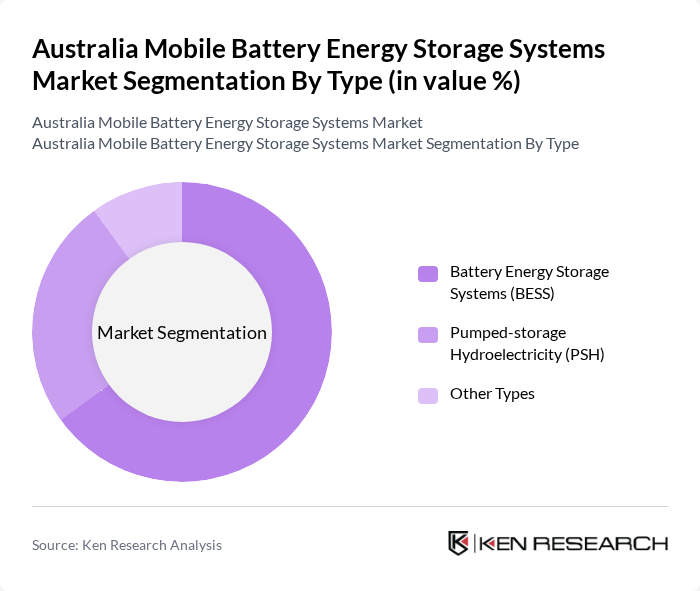

By Type:

The major subsegments under this category include Battery Energy Storage Systems (BESS), Pumped-storage Hydroelectricity (PSH), and Other Types. Among these, Battery Energy Storage Systems (BESS) dominate the market due to their versatility, efficiency, and decreasing costs. The growing adoption of lithium-ion batteries, which are widely used in BESS, has further propelled their market share. The increasing need for renewable energy integration and grid support has made BESS the preferred choice for both residential and commercial applications.

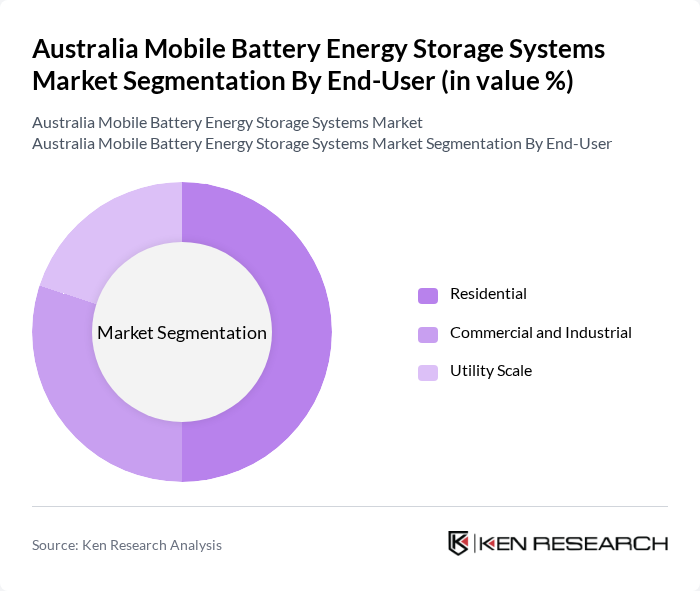

By End-User:

This segmentation includes Residential, Commercial and Industrial, and Utility Scale. The Commercial and Industrial segment is currently leading the market, driven by the increasing adoption of solar systems and the need for energy optimization. Businesses are increasingly investing in battery storage solutions to manage energy costs and enhance their energy security. The Residential segment is also growing rapidly, as consumers seek to optimize energy usage and reduce operational costs through energy storage solutions.

The Australia Mobile Battery Energy Storage Systems Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tesla, Inc., LG Energy Solution Ltd., BYD Company Limited, Panasonic Holdings Corporation, Samsung SDI Co., Ltd., Enphase Energy, Inc., Generac Mobile, Caterpillar Inc., ABB Ltd., EnerSys, Pacific Green Technologies Group, EVO Power Pty Ltd., Century Yuasa Batteries Pty Ltd., GE Vernova Inc., and The AES Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the mobile battery energy storage systems market in Australia appears promising, driven by increasing renewable energy integration and supportive government policies. As technological advancements continue to lower costs and improve efficiency, more consumers are likely to adopt these systems. Additionally, the growing emphasis on sustainability and energy independence will further propel market growth. In the future, the landscape will likely shift towards more decentralized energy solutions, enhancing the role of mobile battery systems in the energy ecosystem.

| Segment | Sub-Segments |

|---|---|

| By Type | Battery Energy Storage Systems (BESS) Pumped-storage Hydroelectricity (PSH) Other Types |

| By End-User | Residential Commercial and Industrial Utility Scale |

| By Region | New South Wales & Australian Capital Territory Victoria & Tasmania Queensland Northern Territory & South Australia Western Australia |

| By Application | Emergency Power Off-Grid Energy Supply Grid-Connected Systems Backup Power Systems |

| By Battery Chemistry | Lithium-ion Batteries Lead-acid Batteries Flow Batteries Others |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Policy Support | Subsidies Tax Exemptions Renewable Energy Certificates (RECs) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Battery Storage Users | 150 | Homeowners, Energy Managers |

| Commercial Battery Storage Solutions | 100 | Facility Managers, Operations Directors |

| Utility-Scale Battery Projects | 80 | Project Managers, Energy Analysts |

| Battery Technology Developers | 70 | R&D Managers, Product Development Engineers |

| Government Policy Makers | 60 | Energy Policy Advisors, Regulatory Officials |

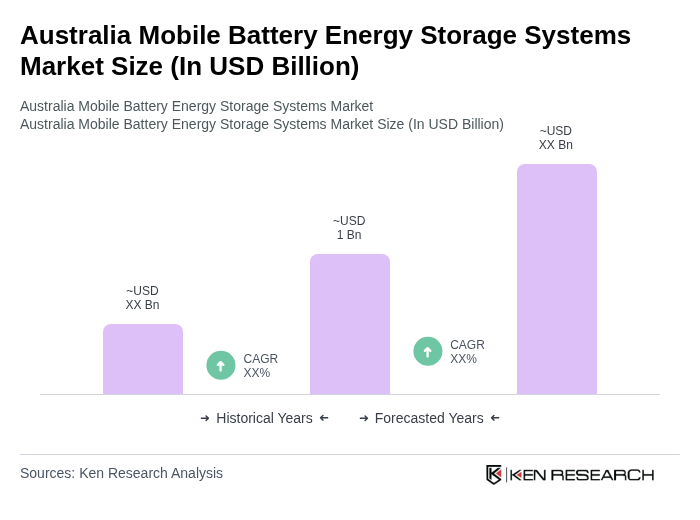

The Australia Mobile Battery Energy Storage Systems market is valued at approximately USD 1 billion, driven by the increasing demand for renewable energy solutions and government incentives promoting energy storage technologies.