Region:Middle East

Author(s):Shubham

Product Code:KRAA6859

Pages:98

Published On:January 2026

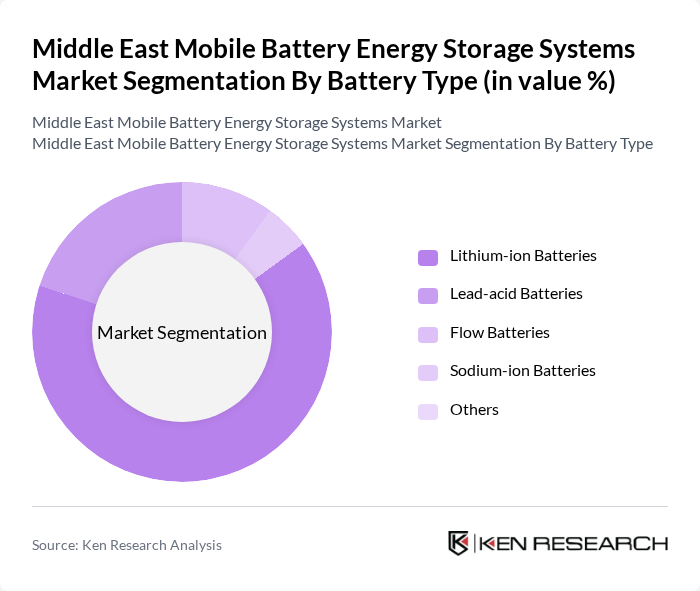

By Battery Type:The battery type segmentation includes various technologies that cater to different applications and performance requirements. Lithium-ion batteries are the most widely used due to their high energy density and efficiency. Lead-acid batteries, while older technology, still find applications in specific sectors due to their lower initial costs. Flow batteries are gaining traction for large-scale applications, while sodium-ion batteries are emerging as a potential alternative. Other battery types also contribute to the market.

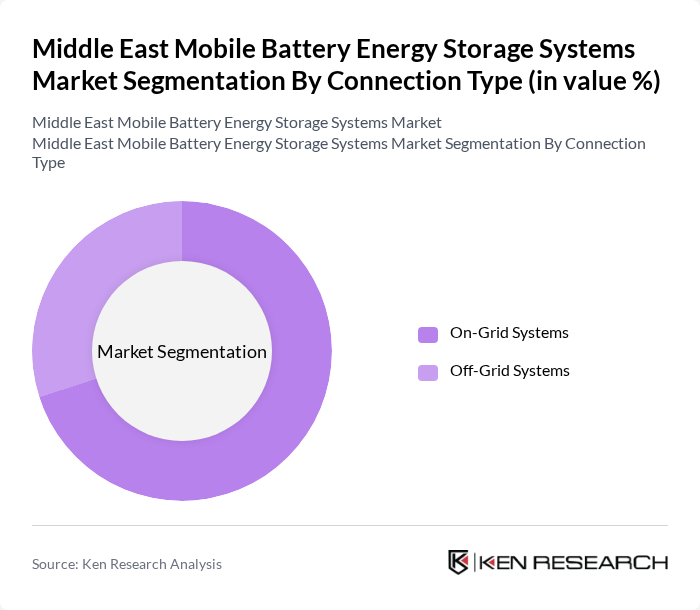

By Connection Type:The connection type segmentation distinguishes between on-grid and off-grid systems. On-grid systems are primarily used in urban areas where energy demand is high and grid connectivity is stable. Off-grid systems are essential in remote areas where grid access is limited, providing energy independence and reliability. The choice between these systems often depends on the specific energy needs and infrastructure availability.

The Middle East Mobile Battery Energy Storage Systems Market is characterized by a dynamic mix of regional and international players. Leading participants such as CATL, BYD Company Limited, Sungrow, Tesla, Inc., LG Energy Solution, Fluence Energy, ACWA Power, Masdar, EDF Renewables, Huawei Digital Power, Dalia Energy, Phinergy, Siemens AG, ABB Ltd., Schneider Electric contribute to innovation, geographic expansion, and service delivery in this space.

The future of the mobile battery energy storage market in the Middle East appears promising, driven by increasing investments in renewable energy and supportive government policies. As the region continues to prioritize sustainability, the integration of advanced technologies such as AI and IoT will enhance energy management capabilities. Furthermore, the expansion of electric vehicle infrastructure will create synergies with energy storage systems, facilitating a more resilient and efficient energy landscape that meets the growing demand for clean energy solutions.

| Segment | Sub-Segments |

|---|---|

| By Battery Type | Lithium-ion Batteries Lead-acid Batteries Flow Batteries Sodium-ion Batteries Others |

| By Connection Type | On-Grid Systems Off-Grid Systems |

| By Component | Battery Packs and Racks Power Conversion System (PCS) Energy Management Software (EMS) Balance-of-Plant and Services |

| By Energy Capacity Range | Below 10 MWh to 100 MWh to 500 MWh Above 500 MWh |

| By End-User Application | Utility-Scale Commercial and Industrial Residential |

| By Geography | Saudi Arabia United Arab Emirates Qatar South Africa Egypt Kenya Rest of Middle East and Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Utility-Scale Battery Storage Projects | 100 | Project Managers, Energy Analysts |

| Commercial Battery Storage Solutions | 80 | Facility Managers, Energy Procurement Officers |

| Residential Energy Storage Systems | 70 | Homeowners, Solar Installation Contractors |

| Battery Technology Suppliers | 60 | Sales Directors, Product Managers |

| Regulatory Bodies and Policy Makers | 50 | Energy Policy Advisors, Regulatory Analysts |

The Middle East Mobile Battery Energy Storage Systems Market is valued at approximately USD 2.4 billion, driven by investments in renewable energy projects and advancements in battery technologies, alongside a growing focus on energy efficiency and sustainability.