Region:Middle East

Author(s):Shubham

Product Code:KRAB8253

Pages:91

Published On:October 2025

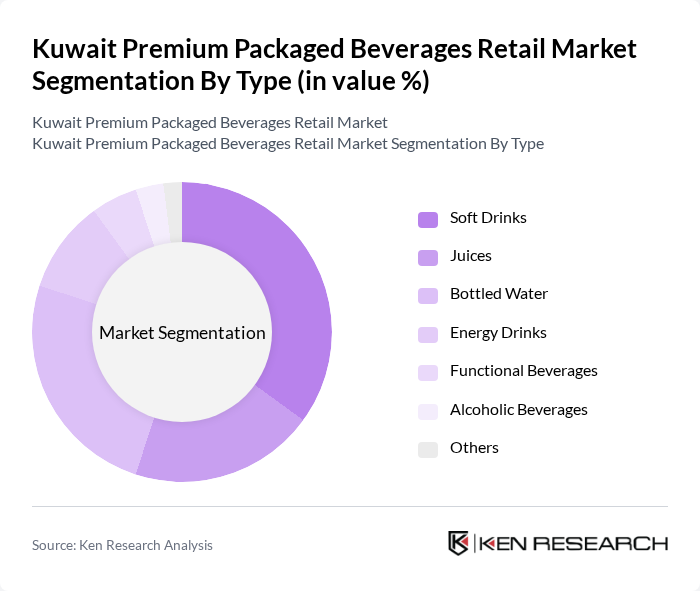

By Type:The market is segmented into various types of beverages, including Soft Drinks, Juices, Bottled Water, Energy Drinks, Functional Beverages, Alcoholic Beverages, and Others. Among these, Soft Drinks and Bottled Water are the leading segments, driven by their widespread consumption and availability in various flavors and packaging options. The increasing health awareness has also led to a rise in demand for Functional Beverages, which are gaining popularity among health-conscious consumers.

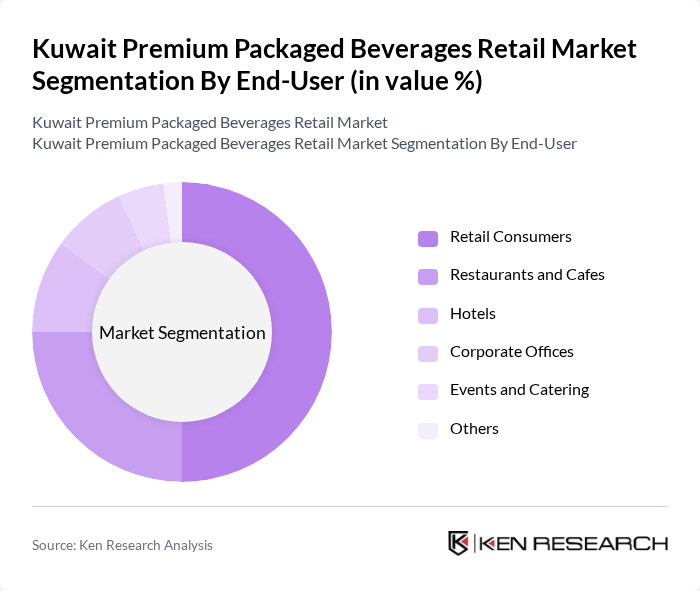

By End-User:The end-user segmentation includes Retail Consumers, Restaurants and Cafes, Hotels, Corporate Offices, Events and Catering, and Others. Retail Consumers dominate the market, driven by the increasing trend of on-the-go consumption and the growing number of retail outlets offering premium beverages. Restaurants and Cafes also play a significant role, as they increasingly focus on offering high-quality beverage options to enhance customer experience.

The Kuwait Premium Packaged Beverages Retail Market is characterized by a dynamic mix of regional and international players. Leading participants such as PepsiCo, Inc., The Coca-Cola Company, Nestlé S.A., Al Ain Water, Americana Group, Almarai Company, Al Watania Agriculture, Al Kout Industrial Projects, Al Jazeera Group, Al Mufeed Group, Al Safi Danone, Al Mulla Group, Al Qatami Group, Al Badr Group, Al Khorafi Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait premium packaged beverages market appears promising, driven by evolving consumer preferences and technological advancements. As health consciousness continues to rise, brands are likely to innovate with functional beverages that offer health benefits. Additionally, the growth of e-commerce is expected to reshape distribution channels, allowing brands to reach a broader audience. Companies that adapt to these trends will likely capture significant market share, ensuring sustained growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Soft Drinks Juices Bottled Water Energy Drinks Functional Beverages Alcoholic Beverages Others |

| By End-User | Retail Consumers Restaurants and Cafes Hotels Corporate Offices Events and Catering Others |

| By Sales Channel | Supermarkets and Hypermarkets Convenience Stores Online Retail Vending Machines Direct Sales Others |

| By Packaging Type | Glass Bottles Plastic Bottles Cans Tetra Packs Others |

| By Price Range | Premium Mid-Range Economy Others |

| By Brand Loyalty | Brand Loyal Consumers Price-Sensitive Consumers Trend-Focused Consumers Others |

| By Distribution Mode | Direct Distribution Indirect Distribution Hybrid Distribution Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Beverage Outlets | 150 | Store Managers, Beverage Category Buyers |

| Consumer Preferences Survey | 200 | General Consumers, Health-Conscious Shoppers |

| Distribution Channel Insights | 100 | Distributors, Logistics Coordinators |

| Market Trend Analysis | 80 | Industry Analysts, Market Researchers |

| Brand Perception Study | 120 | Brand Managers, Marketing Executives |

The Kuwait Premium Packaged Beverages Retail Market is valued at approximately USD 1.2 billion, reflecting a significant growth trend driven by increasing consumer demand for high-quality and health-conscious beverage options.