Region:Middle East

Author(s):Geetanshi

Product Code:KRAB8330

Pages:96

Published On:October 2025

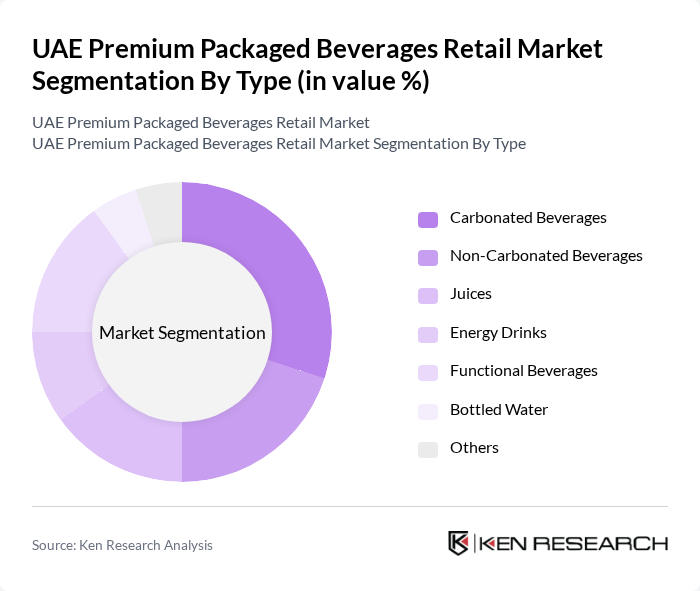

By Type:The market is segmented into various types of beverages, including Carbonated Beverages, Non-Carbonated Beverages, Juices, Energy Drinks, Functional Beverages, Bottled Water, and Others. Among these, Carbonated Beverages and Juices are particularly popular due to their refreshing nature and wide availability. The increasing trend towards health and wellness has also led to a rise in demand for Functional Beverages.

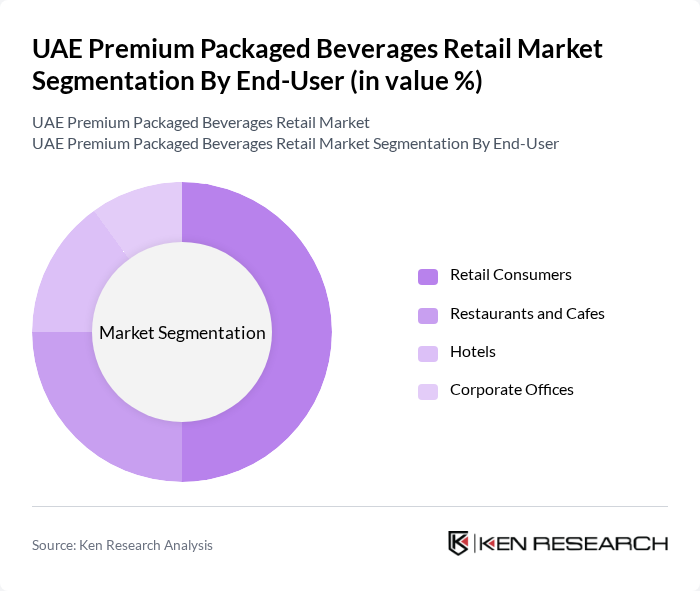

By End-User:The end-user segmentation includes Retail Consumers, Restaurants and Cafes, Hotels, and Corporate Offices. Retail Consumers dominate the market as they account for the majority of sales through various retail channels. The growing trend of dining out and the increasing number of hotels and cafes also contribute significantly to the market.

The UAE Premium Packaged Beverages Retail Market is characterized by a dynamic mix of regional and international players. Leading participants such as Coca-Cola Al Ahlia Beverages, PepsiCo International, Al Ain Water, Nestlé Waters, Red Bull GmbH, Monster Beverage Corporation, Almarai Company, Al Haramain Beverages, Dubai Refreshment PJSC, Emirates Refreshments Company, Al Jazeera International, Al Waha Beverages, Al Fawz Beverages, Al Qusais Beverages, Al Maktoum Beverages contribute to innovation, geographic expansion, and service delivery in this space.

The UAE premium packaged beverages market is poised for significant growth, driven by evolving consumer preferences and economic factors. As health consciousness continues to rise, the demand for organic and functional beverages is expected to increase. Additionally, the expansion of e-commerce platforms will facilitate greater access to premium products. Companies that adapt to these trends and invest in innovative product development will likely capture a larger share of the market, ensuring sustained growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Carbonated Beverages Non-Carbonated Beverages Juices Energy Drinks Functional Beverages Bottled Water Others |

| By End-User | Retail Consumers Restaurants and Cafes Hotels Corporate Offices |

| By Distribution Channel | Supermarkets and Hypermarkets Convenience Stores Online Retail Specialty Stores |

| By Packaging Type | Glass Bottles Plastic Bottles Cans Tetra Packs |

| By Price Range | Premium Mid-Range Economy |

| By Brand Positioning | Luxury Brands Mass Market Brands Niche Brands |

| By Consumer Demographics | Age Group Gender Income Level Lifestyle Preferences |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Beverage Outlets | 150 | Store Managers, Beverage Category Managers |

| Consumer Preferences in Packaged Beverages | 200 | General Consumers, Health-Conscious Shoppers |

| Distribution Channels Analysis | 100 | Logistics Coordinators, Supply Chain Managers |

| Market Trends and Innovations | 80 | Product Development Managers, Marketing Executives |

| Impact of Pricing Strategies | 120 | Pricing Analysts, Retail Strategists |

The UAE Premium Packaged Beverages Retail Market is valued at approximately USD 3.5 billion, reflecting a significant growth trend driven by increasing consumer demand for high-quality beverages and health-conscious choices.